Bernanke: Why We Did What We Did

The Federal Reserve cannot solve all the economy’s problems on its own. That will take time and the combined efforts of many...

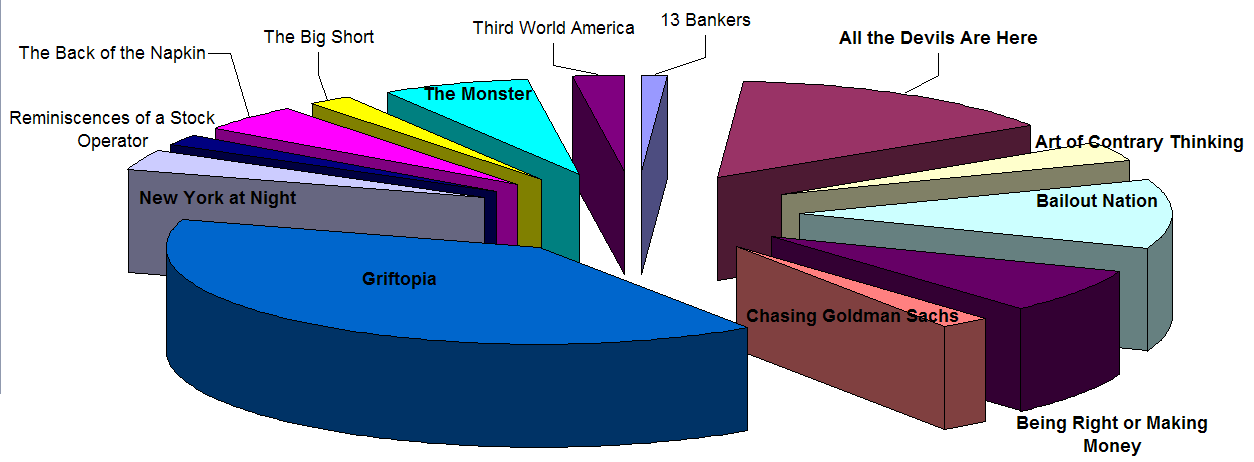

Books Bought By Big Picture Readers (October, 2010)

(Dead tree versions) > I always find it interesting to see what books TBP readers are buying. > Books 13 Bankers (Simon Johnson,...

(Dead tree versions) > I always find it interesting to see what books TBP readers are buying. > Books 13 Bankers (Simon Johnson,...

FOMC STATEMENTS: SIDE-BY-SIDE (11/3 vs 9/21)

November 3 Text vs September 21 Text Fed Side by Side 20101103 From Horowitz & Company

Northern Trust: A Refresher Prior to QE2

Asha Bangalore provides us with a quick refresher course as to the impact of the Fed’s quantitative easing: You can see the full...

Asha Bangalore provides us with a quick refresher course as to the impact of the Fed’s quantitative easing: You can see the full...

The Fed and their doings

In addition to the continued reinvestment of the maturing MBS into US Treasuries, the FOMC decided to buy another $600b of longer term...

QE2 = $600B

Markets all over the map in reaction . . . FOMC Statement: Release Date: November 3, 2010 For immediate release Information received...

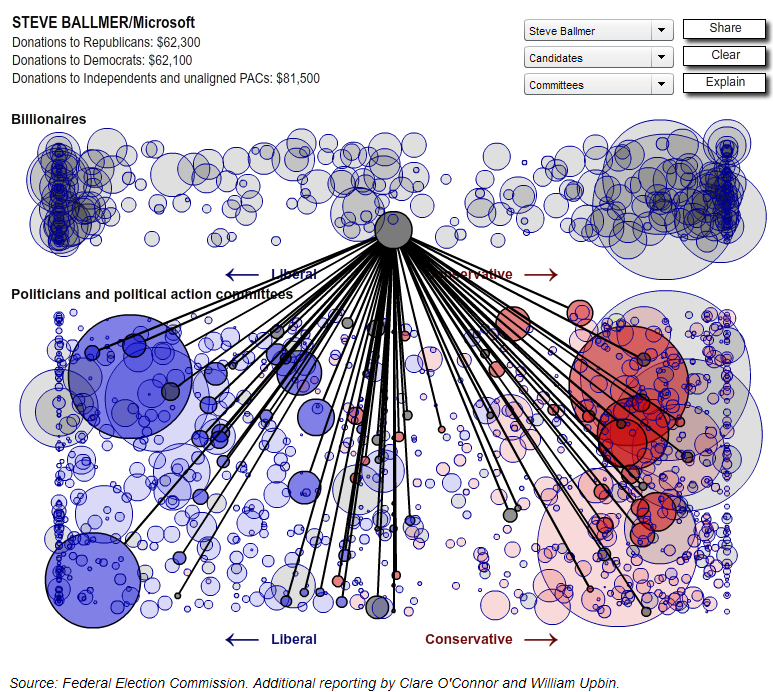

Billionaires’ Favorite Politicians

Fascinating interactive graphic (We love bubbles!) over at Forbes.com: > Hopefully, this will be the last of the political related...

Fascinating interactive graphic (We love bubbles!) over at Forbes.com: > Hopefully, this will be the last of the political related...

Is The Economy Actually Better Than We All Think?

~~~ Dan Gross: 1. Recent History: In the past 20 years, there have been two deficit-reduction deals. But Congressional Republicans...

Mr. Bernanke’s Early Morning Phone Call

Imagine the following phone call that Ben S. Bernanke might have received this morning in the wake of last night’s election...