Imagine the following phone call that Ben S. Bernanke might have received this morning in the wake of last night’s election...

Read More

ADP said 43k private sector jobs were created in Oct, more than twice the expectations of 20k and Sept was revised higher to a loss of...

Read More

Paul Brodsky’s comments delivered to: The BCA Fall Investment Conference The Plaza Grand Ballroom, New York October 25, 2010...

Read More

“He’s the one they call Dr. Feelgood, He’s the one that makes ya feel all right.” Thanks Motley Crue in...

Read More

“We don’t want them to regulate capriciously, arbitrarily, without engaging in a cost-benefit analysis.” – Representative...

Read More

Here is the original: “Fear the Boom and Bust” a Hayek vs. Keynes Rap Anthem.” And the sequel: > > EconStories: On...

Read More

On election night six years ago, I wrote The Tragedy of the Bush Administration. In it, I despaired that: “Once in a generation,...

Read More

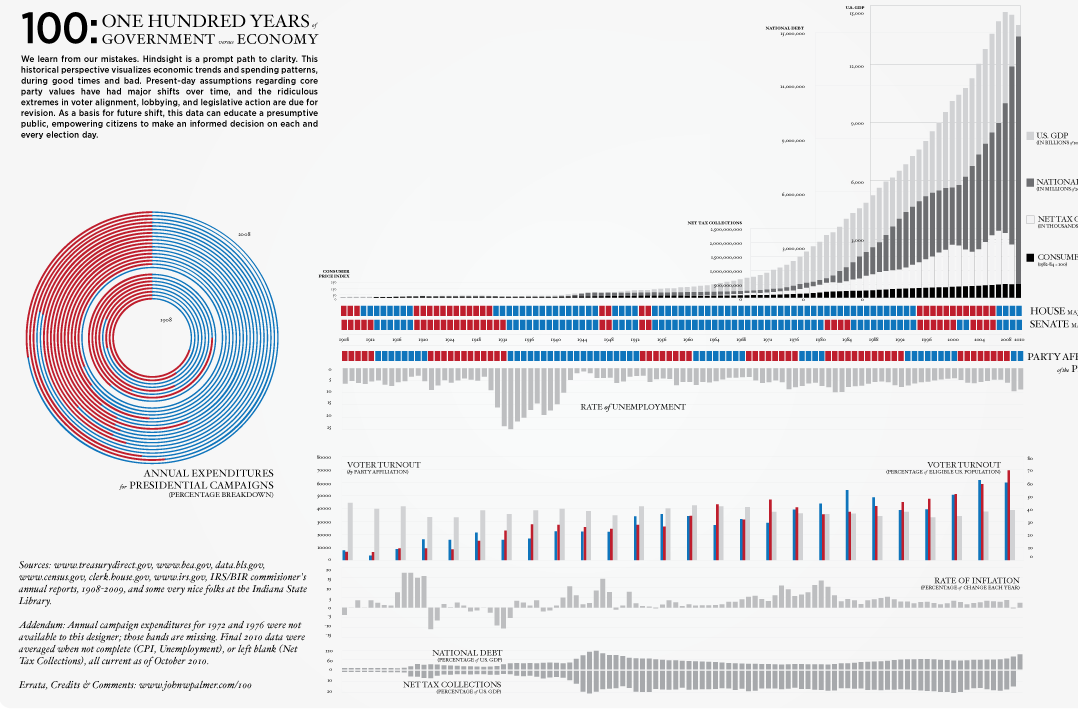

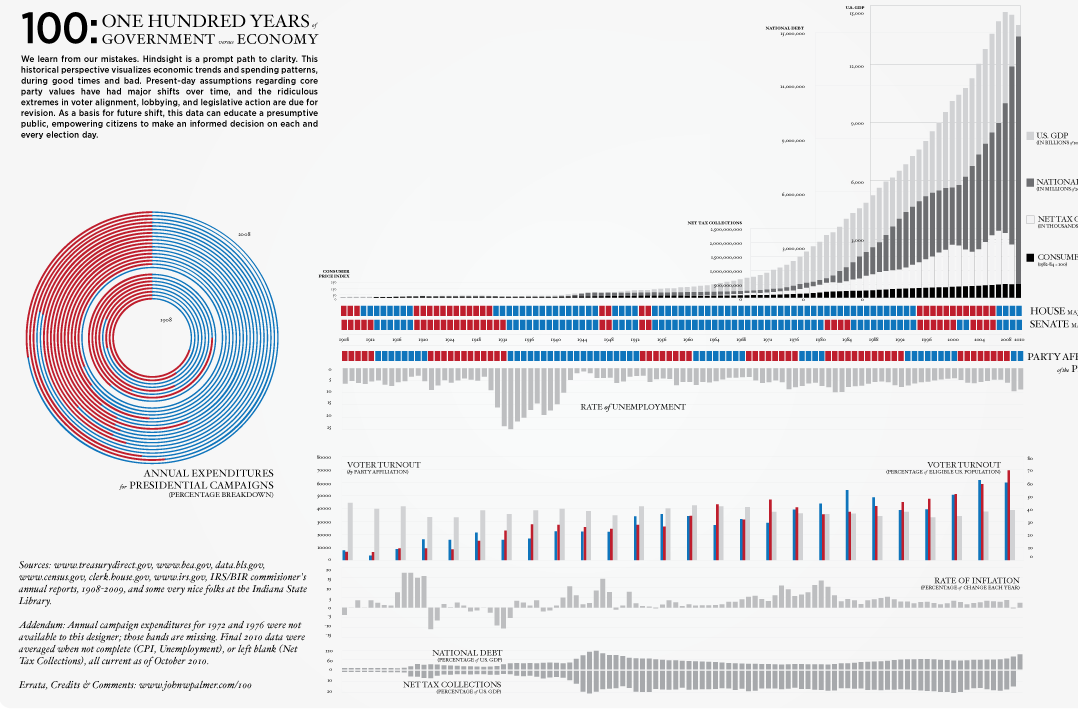

John Palmer has a mad infographic up at johnwpalmer.com: (Full size PDF is here) Special bonus — your cursor is a magnifying glass...

John Palmer has a mad infographic up at johnwpalmer.com: (Full size PDF is here) Special bonus — your cursor is a magnifying glass...

Read More

Be sure to see Miller Tabak’s Chief Economic Strategist’s Dan Greenhaus’ take ont he elections here in the States. His...

Read More

John Palmer has a mad infographic up at johnwpalmer.com: (Full size PDF is here) Special bonus — your cursor is a magnifying glass...

John Palmer has a mad infographic up at johnwpalmer.com: (Full size PDF is here) Special bonus — your cursor is a magnifying glass...