PIG debt trades poorly into their close

Into their close, Greek, Portuguese and Irish debt are all selling off. The Irish 10 yr is now at a new record high above 7% and their 5...

A great pair of really long term charts from Ron Griess of The Charts Store, looking at the long term trend in the Dow: > click for...

A great pair of really long term charts from Ron Griess of The Charts Store, looking at the long term trend in the Dow: > click for...

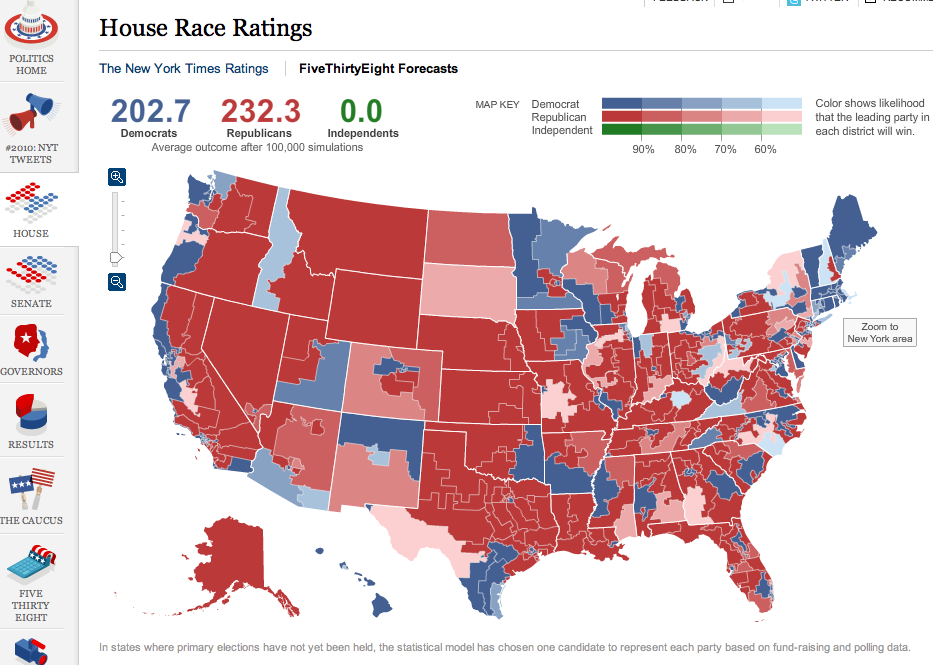

The excellent fivethirtyeight blog — who produced very accurate forecasts for the 2008 elections — crunches the numbers to...

The excellent fivethirtyeight blog — who produced very accurate forecasts for the 2008 elections — crunches the numbers to...

> THE ROAD NOT TAKEN Investment letter – October 16, 2010 IS THE STOCK MARKET A DISCOUNTING MECHANISM PAR EXCELLENCE? Hardly a day...

> THE ROAD NOT TAKEN Investment letter – October 16, 2010 IS THE STOCK MARKET A DISCOUNTING MECHANISM PAR EXCELLENCE? Hardly a day...

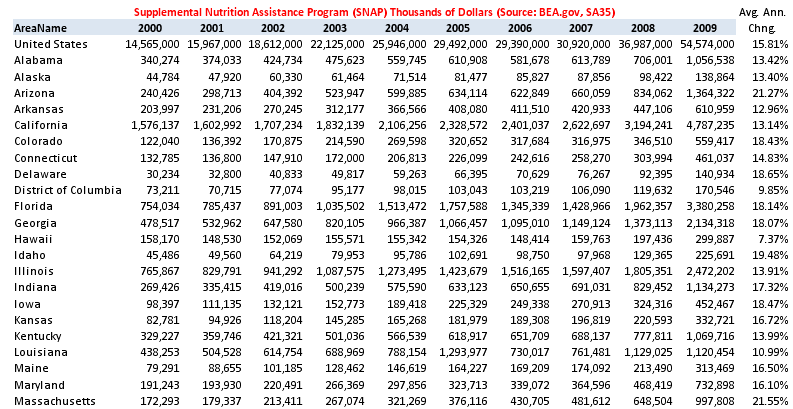

Invictus here, gang, with a little pre-election number crunching. I posted recently on the explosive growth in the use of food stamps,...

Invictus here, gang, with a little pre-election number crunching. I posted recently on the explosive growth in the use of food stamps,...

Get subscriber-only insights and news delivered by Barry every two weeks.