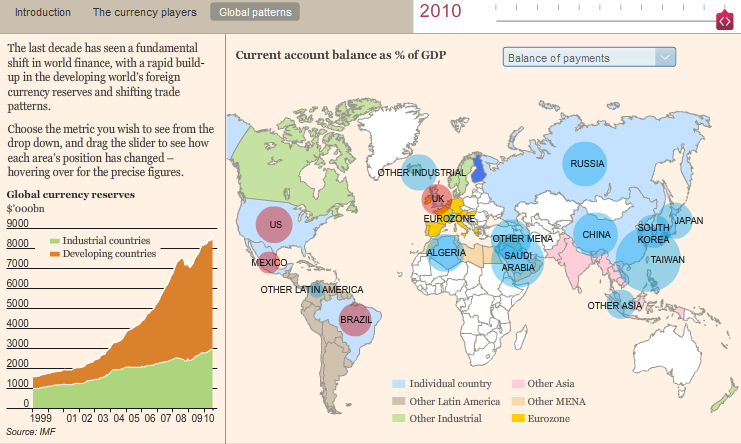

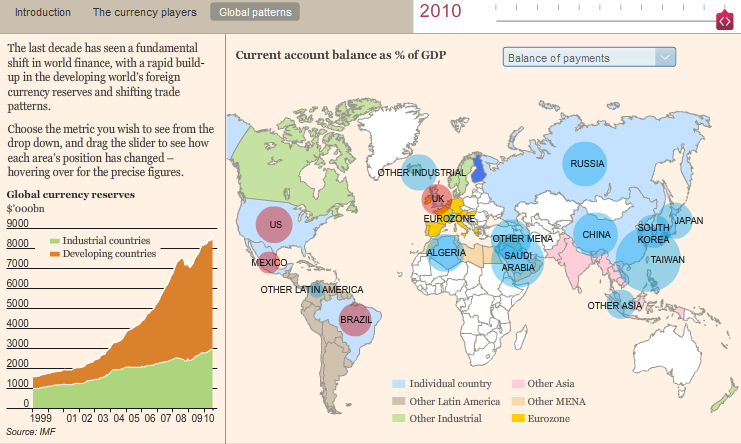

Earlier this month, we showed the Der Spiegel map of currency wars; Today, we have the FT’s interactive take: > click for...

Earlier this month, we showed the Der Spiegel map of currency wars; Today, we have the FT’s interactive take: > click for...

Read More

Earlier this month we noted the stock market gains that occur on days the Federal Reserve conducts Permanent Open Market Operations or...

Earlier this month we noted the stock market gains that occur on days the Federal Reserve conducts Permanent Open Market Operations or...

Read More

The final reading of Oct UoM confidence at 67.7 was a touch below the preliminary figure out a few weeks ago of 67.9, is down from 68.2...

Read More

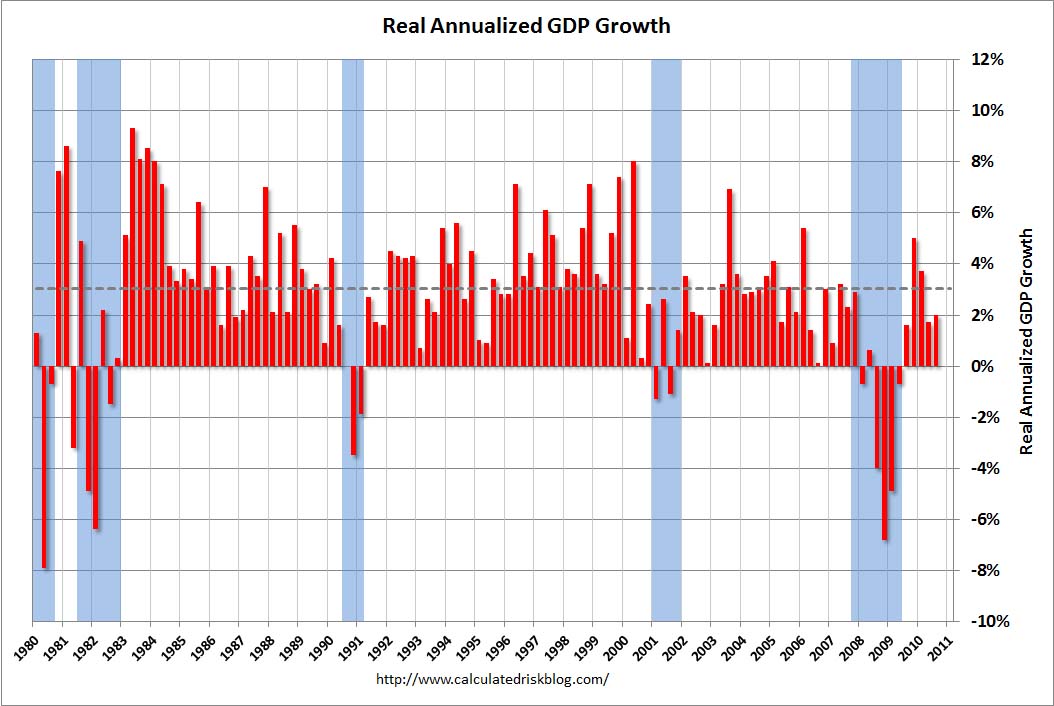

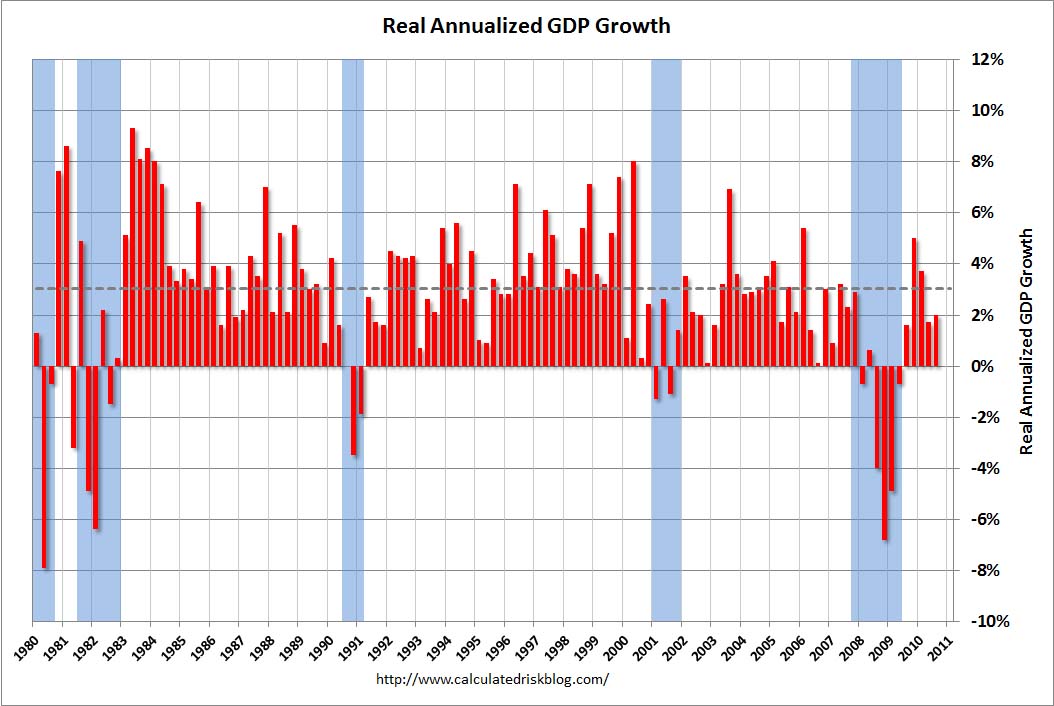

I just got back to the office, and wanted to take a quick look at GDP data, which seems to be dominated by inventory build: “Real...

I just got back to the office, and wanted to take a quick look at GDP data, which seems to be dominated by inventory build: “Real...

Read More

Here is your unicorn chaser for the week: A compilation of awesome people doing incredible things. Music: Mecha Love by Hadouken, out now...

Read More

Here is a job listing that appears to be a job listing for more LPS Foreclosure / Bankruptcy Doc Prep – Short Term Full Job Listing...

Read More

Q3 Real GDP rose by 2%, right in line with expectations but Nominal GDP was better than expected, rising 4.3% vs the estimated gain of...

Read More

Keith Jurow , Ph.D., has been researching and writing about the housing market debacle around the U.S. with an eye for issues that are...

Keith Jurow , Ph.D., has been researching and writing about the housing market debacle around the U.S. with an eye for issues that are...

Read More

Yesterday morning, I had The Misinformation Hour on TV as I got dressed for work. One of the comments that was made — “No...

Read More

Earlier this month, we showed the Der Spiegel map of currency wars; Today, we have the FT’s interactive take: > click for...

Earlier this month, we showed the Der Spiegel map of currency wars; Today, we have the FT’s interactive take: > click for...

Earlier this month, we showed the Der Spiegel map of currency wars; Today, we have the FT’s interactive take: > click for...

Earlier this month, we showed the Der Spiegel map of currency wars; Today, we have the FT’s interactive take: > click for...