Welcome to Crazytown

> From Votesanity.org Several of the candidates running for office next Tuesday are crazy. Most of them are running as Republicans....

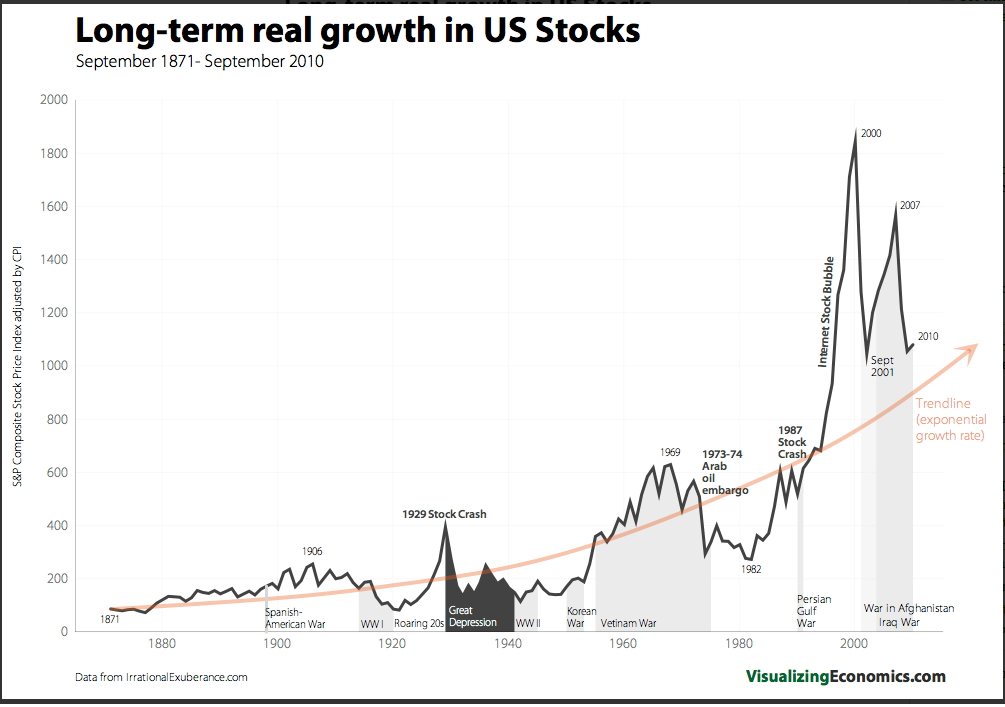

Awesome chart, from Visualizing Economics: > click for larger graphic Source: Visualizing Economics Stock market data from...

Awesome chart, from Visualizing Economics: > click for larger graphic Source: Visualizing Economics Stock market data from...

Get subscriber-only insights and news delivered by Barry every two weeks.