Gotta love Steve Perry leading a packed house @ AT&T Park, San Francisco in ‘Don’t Stop Believing’ during the 8th...

Read More

Source: Banks May Face $97 Billion Loss From Mortgage Mess Kate Kelly CNBC, Wednesday, 27 Oct 2010 | 2:36 PM ET...

Read More

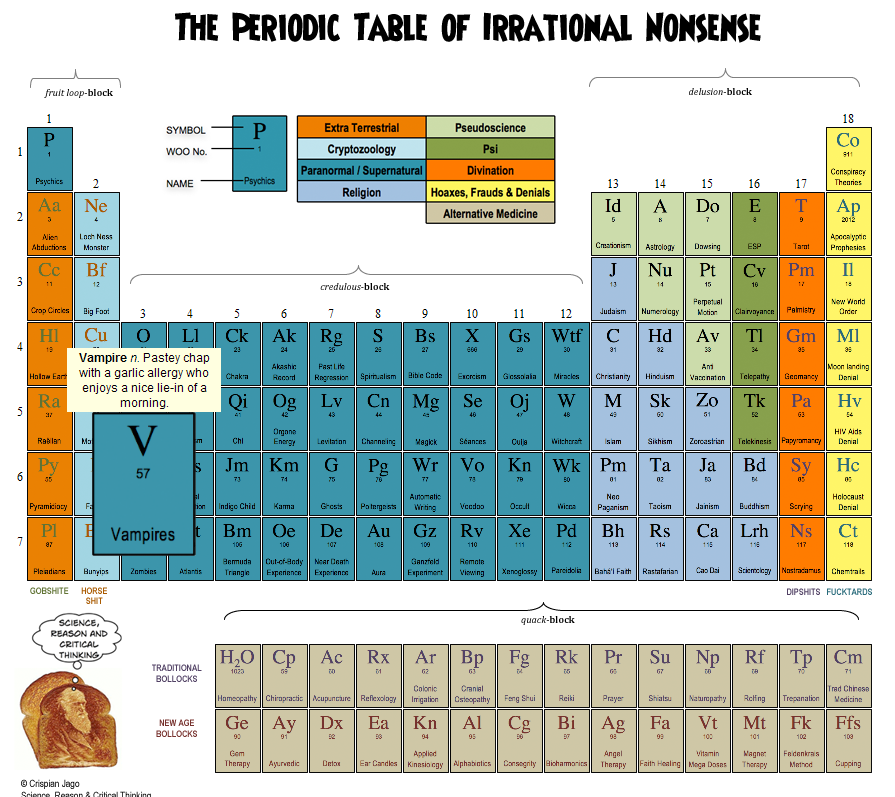

I am a sucker for a good graphic: click for ginormous copy via Mint embedded version after the jump

I am a sucker for a good graphic: click for ginormous copy via Mint embedded version after the jump

Read More

There’s been this meme circulating that 70% of all trading volume on the exchanges is HFT, and that the average holding period for...

Read More

Comment: As we have noted before, the list of those that say QE2 is not necessary, or harmful is long distinguished and impressive....

Read More

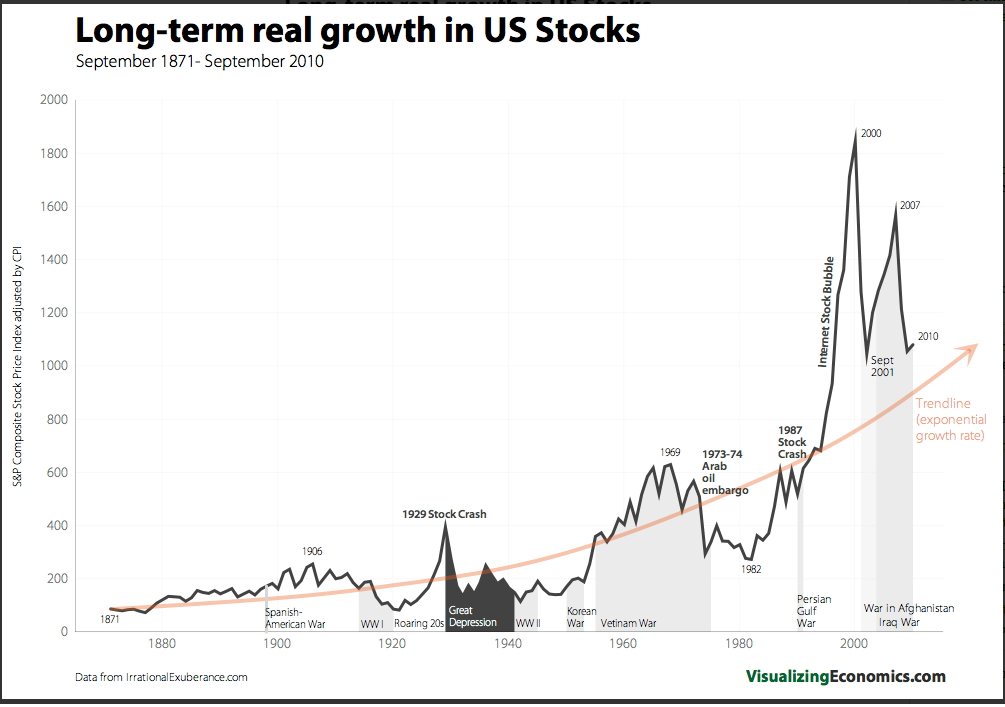

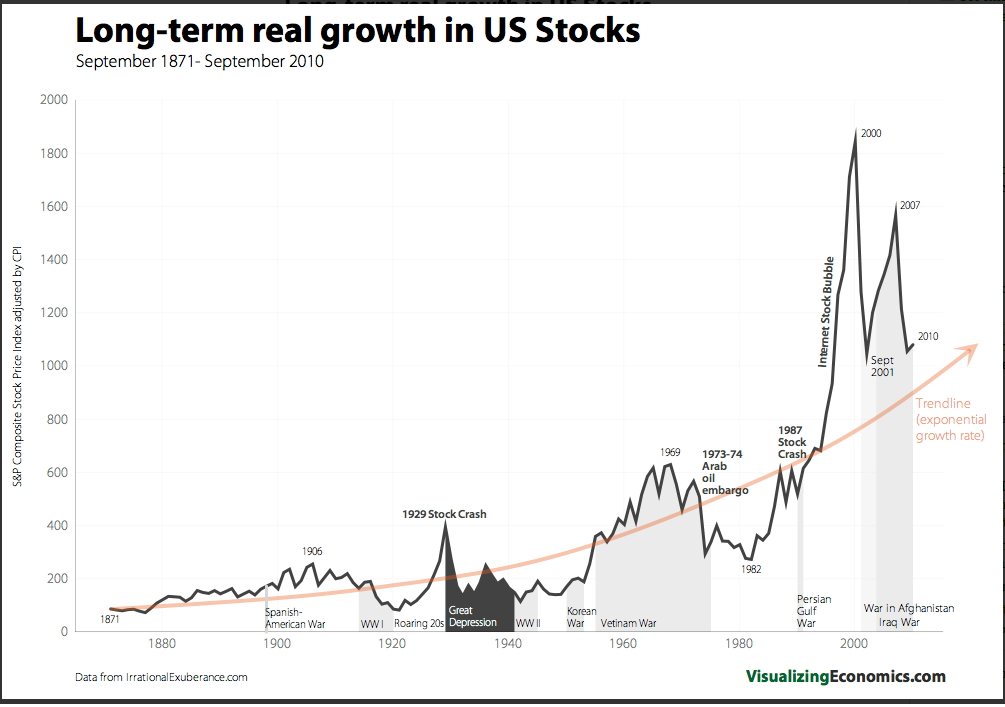

Awesome chart, from Visualizing Economics: > click for larger graphic Source: Visualizing Economics Stock market data from...

Awesome chart, from Visualizing Economics: > click for larger graphic Source: Visualizing Economics Stock market data from...

Read More

click for interactive graphic Hat tip ChartPorn

click for interactive graphic Hat tip ChartPorn

Read More

Initial Jobless Claims totaled 434k, well below expectations of 455k and down from 455k last week. Taking out the July 4th holiday...

Read More

Individual investors are now officially giddy for stocks. As measured by the AAII survey, individual investor bullishness rose to 51.2...

Read More

“It’s an open secret among my brethren that if you get Levine, he’s not going to rule for the investor.”...

Read More

Awesome chart, from Visualizing Economics: > click for larger graphic Source: Visualizing Economics Stock market data from...

Awesome chart, from Visualizing Economics: > click for larger graphic Source: Visualizing Economics Stock market data from...