BofA Hit with Fraudclosure Class Action Suit

Three fascinating Fraudclosure related items: • Law.com: Bank of America Sued in Class Action Over Flouting of Foreclosure Rules Bank...

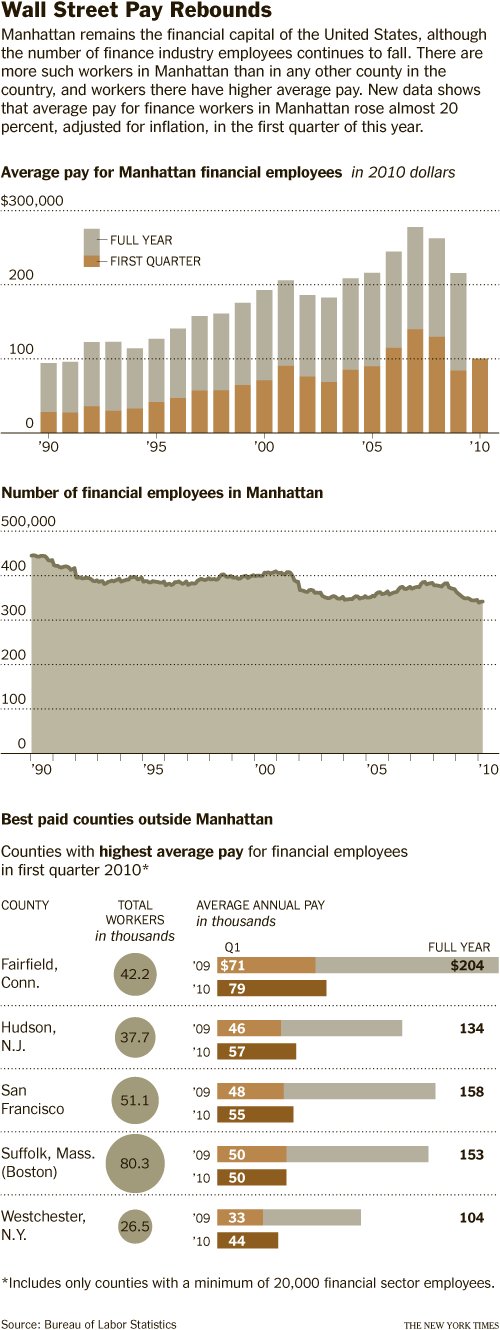

Want to pull down the big bucks? Floyd Norris advises you to get a job on the street of dreams: “Wall Street incomes are surging...

Want to pull down the big bucks? Floyd Norris advises you to get a job on the street of dreams: “Wall Street incomes are surging...

Awesome back of the napkin idea generating flow chart from Frank Chimero: click for ginormous graphic Hat tip Flowing Data

Awesome back of the napkin idea generating flow chart from Frank Chimero: click for ginormous graphic Hat tip Flowing Data

Get subscriber-only insights and news delivered by Barry every two weeks.