‘Should have paid the extra $2 an hour…’

Abelson on robo-signers last week: “Truth is, bankers just can’t stand prosperity, even after their near-death experience of...

> I did an interview with Wally Forbes a few weeks ago — its on Forbes.com, along with specific stock recommendations....

> I did an interview with Wally Forbes a few weeks ago — its on Forbes.com, along with specific stock recommendations....

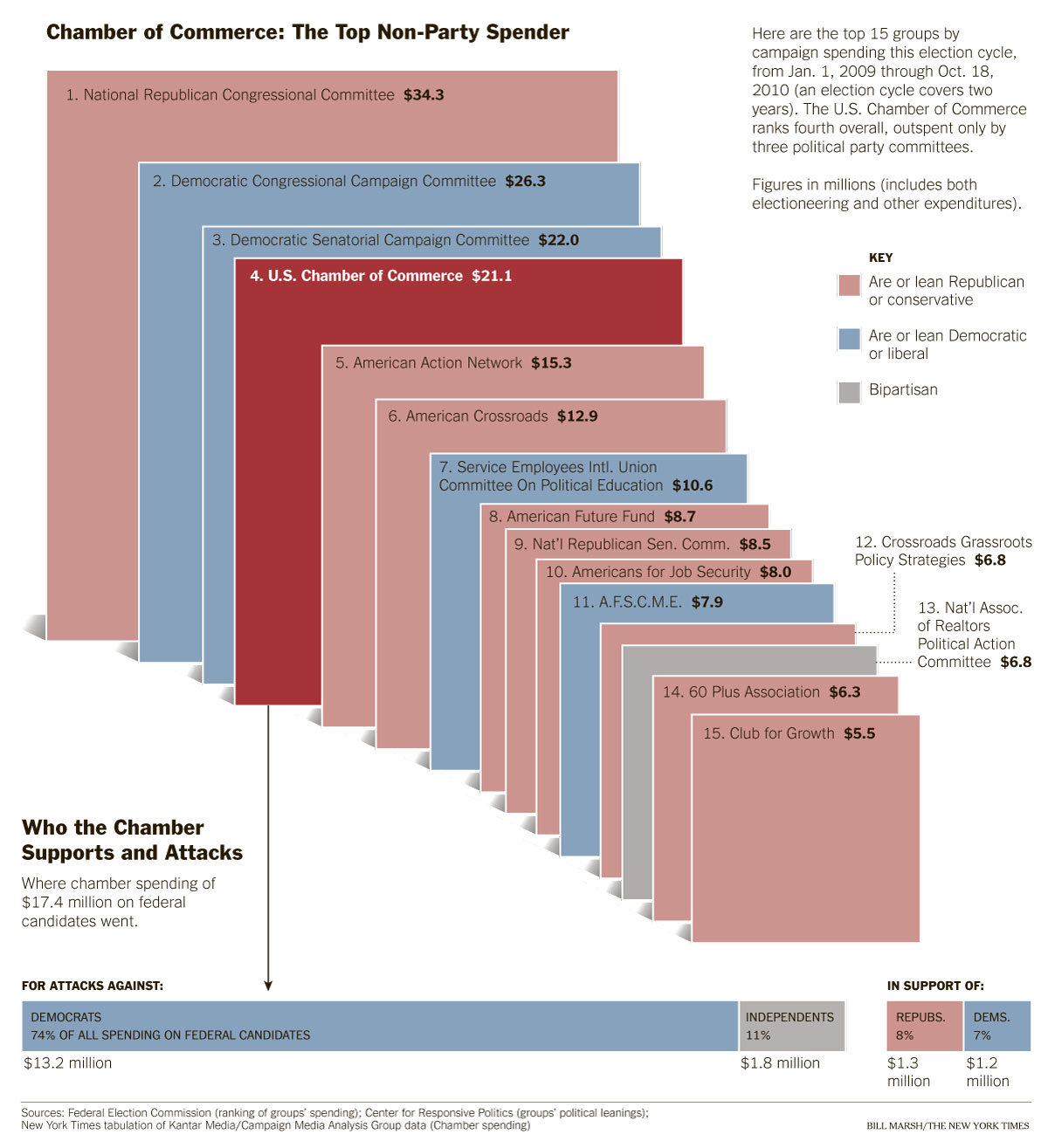

Fantastic chart, very consistent with my view that politics has been utterly corrupted by dirty corporate money. If you want to...

Fantastic chart, very consistent with my view that politics has been utterly corrupted by dirty corporate money. If you want to...

Get subscriber-only insights and news delivered by Barry every two weeks.