Darwin’s Law of Maladaptive Corporate Behavior...

What is more important than survival? On planet Earth, nothing. The most basic rule of life is SURVIVE. The Biological imperative of...

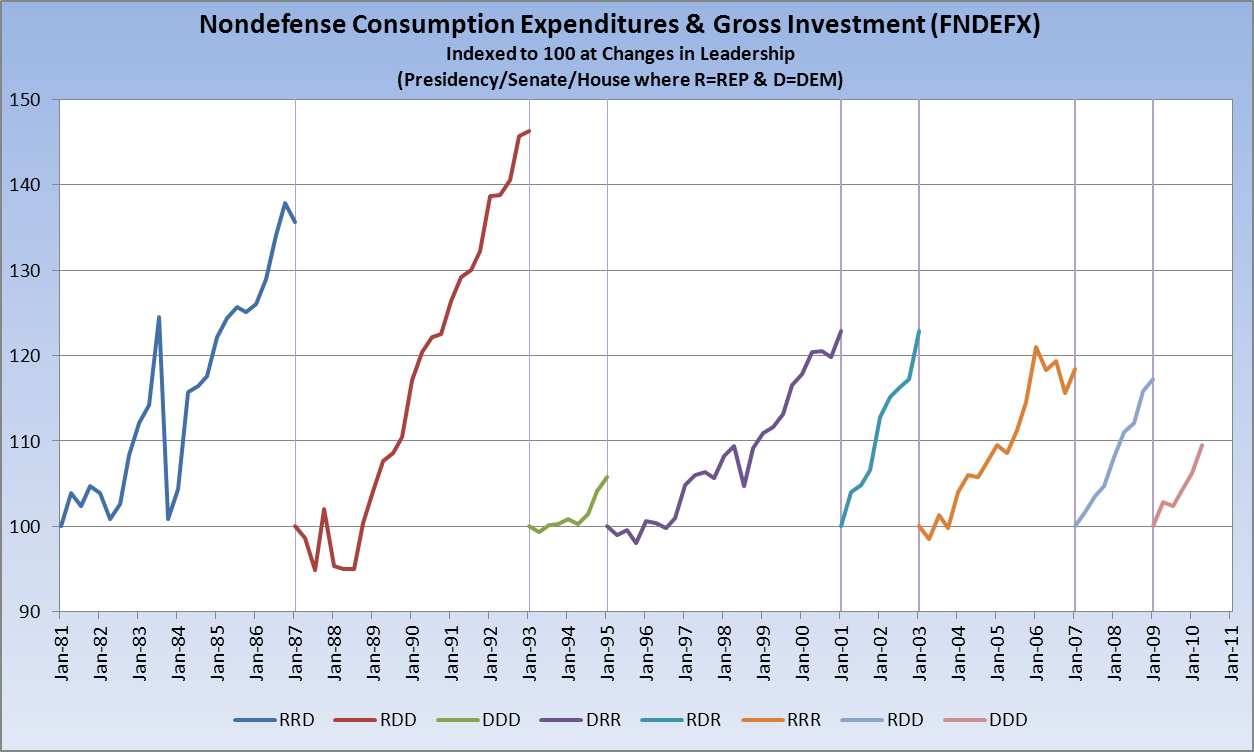

In the comments of my recent Hey, Big Spender post, some readers took me to task because “Congress controls the purse...

In the comments of my recent Hey, Big Spender post, some readers took me to task because “Congress controls the purse...

Many crazy things in the hopper today: • Task force probing whether banks broke federal laws during home seizures: Federal law...

Many crazy things in the hopper today: • Task force probing whether banks broke federal laws during home seizures: Federal law...

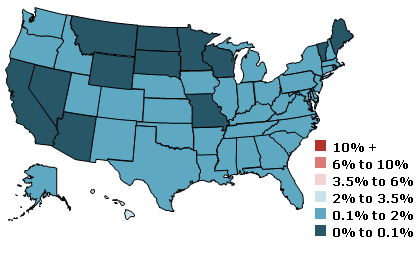

Do underwater homeowners have a zero cost option on future movement of home prices? That seems to be the conclusion of the SF Fed, who...

Do underwater homeowners have a zero cost option on future movement of home prices? That seems to be the conclusion of the SF Fed, who...

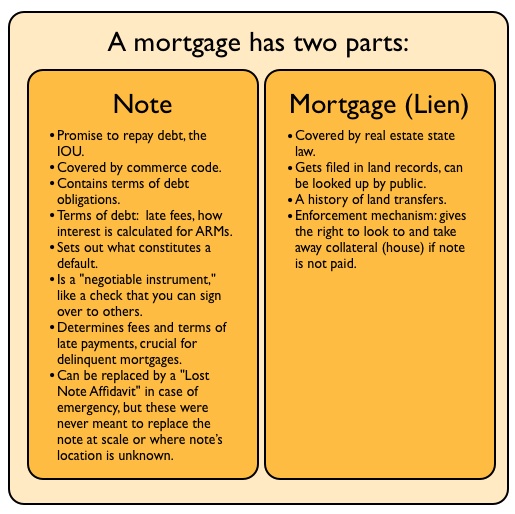

(This is a series giving a basic explanation of the current foreclosure fraud crisis from Mike Konczal; This is Part Two; you should also...

(This is a series giving a basic explanation of the current foreclosure fraud crisis from Mike Konczal; This is Part Two; you should also...

Get subscriber-only insights and news delivered by Barry every two weeks.