In the car on the way home from the studio last night, I had a conversation with a long experienced retail manager at a big shop/bank. He...

In the car on the way home from the studio last night, I had a conversation with a long experienced retail manager at a big shop/bank. He...

Read More

Chris & I appear at the 3 minute mark: Airtime: Mon. Oct. 18 2010 | :43:0 10 ET Discussing whether the banks are headed for disaster...

Read More

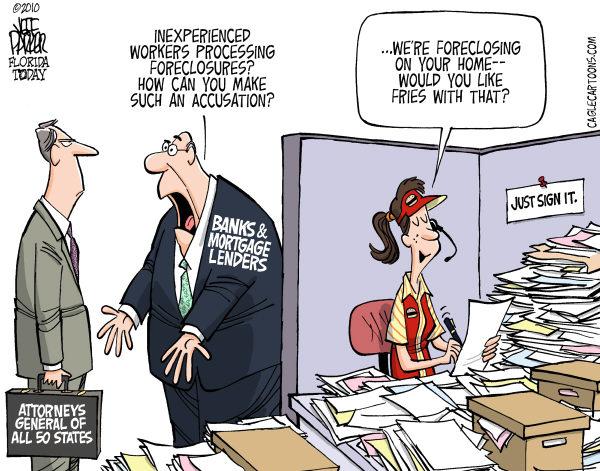

> Back on the Kudlow Report at 7:00 pm this evening with Chris Whalen. We are discussing the hosuing debacle, issues, from MERS to...

> Back on the Kudlow Report at 7:00 pm this evening with Chris Whalen. We are discussing the hosuing debacle, issues, from MERS to...

Read More

This is the first of a 5 part series from Mike Konczal, a former financial engineer, is a fellow with the Roosevelt Institute, who also...

This is the first of a 5 part series from Mike Konczal, a former financial engineer, is a fellow with the Roosevelt Institute, who also...

Read More

Will It Work? How Will We Know?: Josh Rosner from Roosevelt Institute on Vimeo. Hat tip Rorty Bomb

Read More

Goldman Sach’s David Kostin created this chart comparing earnings peaks with market action. In addition to showing how overpriced...

Goldman Sach’s David Kostin created this chart comparing earnings peaks with market action. In addition to showing how overpriced...

Read More

The Oct NAHB home builder index was 16, up 3 pts from Sept, was 2 pts above expectations and is at a 4 month high. To put into...

Read More

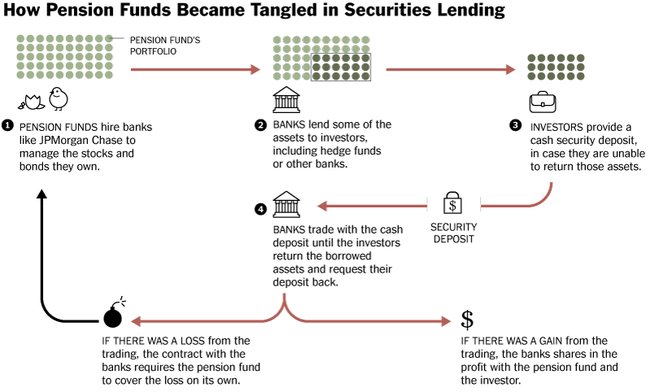

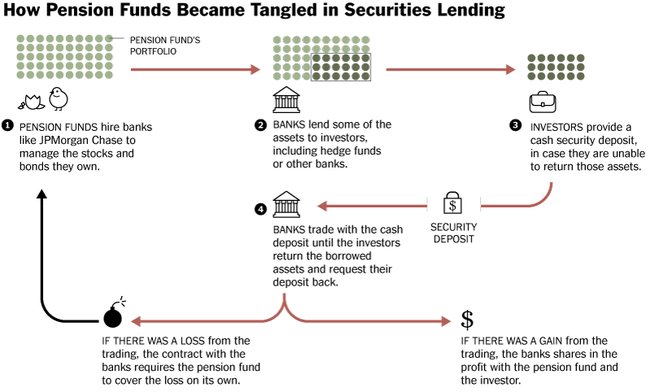

> The MSM article of the day is a NYT takedown of JP Morgan’s raping and pillaging of various cities and pension funds. The...

> The MSM article of the day is a NYT takedown of JP Morgan’s raping and pillaging of various cities and pension funds. The...

Read More

click for ginormous graphic generic via boingboing

click for ginormous graphic generic via boingboing

Read More

In the car on the way home from the studio last night, I had a conversation with a long experienced retail manager at a big shop/bank. He...

In the car on the way home from the studio last night, I had a conversation with a long experienced retail manager at a big shop/bank. He...

In the car on the way home from the studio last night, I had a conversation with a long experienced retail manager at a big shop/bank. He...

In the car on the way home from the studio last night, I had a conversation with a long experienced retail manager at a big shop/bank. He...