> October 14, 2010 Robert S. Mueller III Director Federal Bureau of Investigation 935 Pennsylvania Avenue, NW Washington, DC 20535...

> October 14, 2010 Robert S. Mueller III Director Federal Bureau of Investigation 935 Pennsylvania Avenue, NW Washington, DC 20535...

Read More

To quantify the credit response today to the concerns with large future financial obligations for the banks in dealing with foreclosure...

Read More

Full Deposition of Tammie Lou Kapusta Law Office of David J Stern

Read More

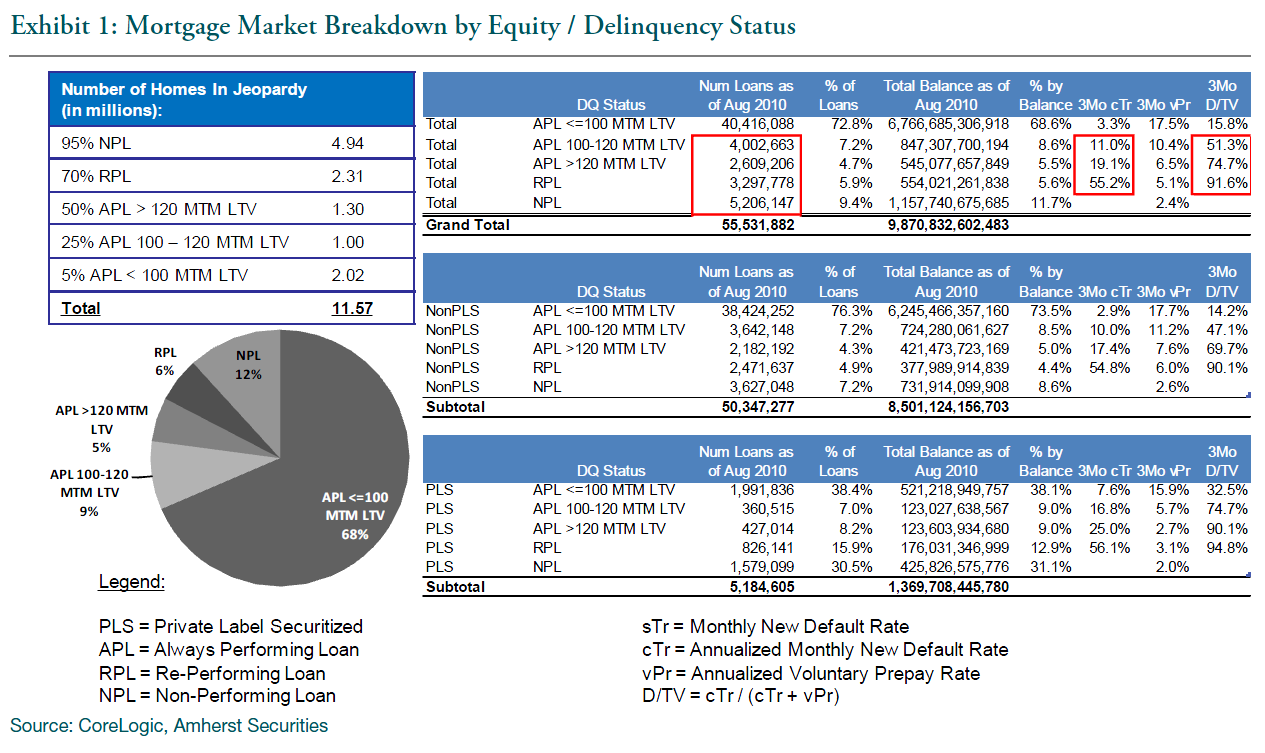

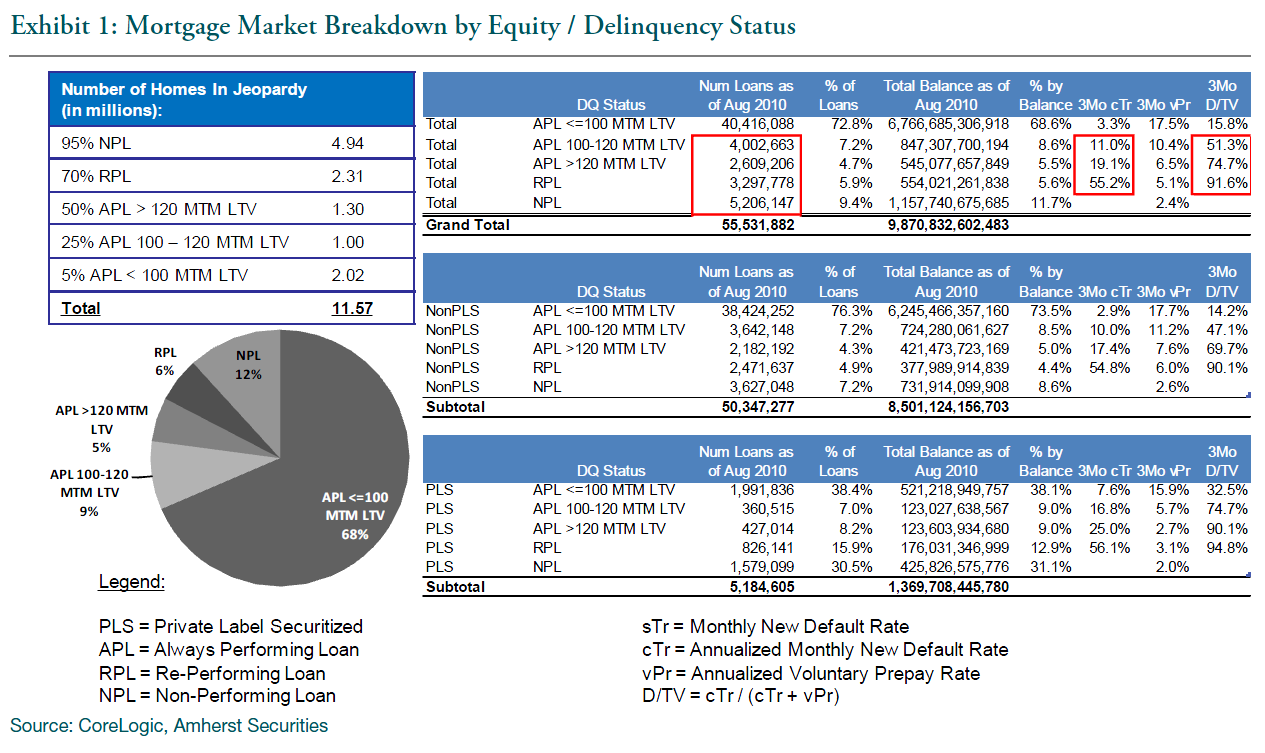

Click for larger graph > Laurie Goodman and the Amherst Securities Group tries to determine the size and scope of the housing problem:...

Click for larger graph > Laurie Goodman and the Amherst Securities Group tries to determine the size and scope of the housing problem:...

Read More

The absurdity of illegal activity, criminal conduct, rampant fraud has reached a point where the nation much declare “No...

The absurdity of illegal activity, criminal conduct, rampant fraud has reached a point where the nation much declare “No...

Read More

Initial Jobless Claims totaled 462k, 17k above expectations and a disappointing reading after last week’s fall to a revised 449k,...

Read More

Yves Smith on Foreclosure Fraud: > click for video You can view the segment here.

Yves Smith on Foreclosure Fraud: > click for video You can view the segment here.

Read More

You may have missed this hard hitting McClatchy article over the weekend. It essentially accuses then Treasury Secretary (and former...

Read More

While Paulson dawdled, GS sold off $30B in subprime, and then went short subprime: click for Video

While Paulson dawdled, GS sold off $30B in subprime, and then went short subprime: click for Video

Read More

FT.com: “Legal documents obtained by the Financial Times suggest that Wells Fargo, the second-largest US mortgage servicer, also...

FT.com: “Legal documents obtained by the Financial Times suggest that Wells Fargo, the second-largest US mortgage servicer, also...

Read More

> October 14, 2010 Robert S. Mueller III Director Federal Bureau of Investigation 935 Pennsylvania Avenue, NW Washington, DC 20535...

> October 14, 2010 Robert S. Mueller III Director Federal Bureau of Investigation 935 Pennsylvania Avenue, NW Washington, DC 20535...

> October 14, 2010 Robert S. Mueller III Director Federal Bureau of Investigation 935 Pennsylvania Avenue, NW Washington, DC 20535...

> October 14, 2010 Robert S. Mueller III Director Federal Bureau of Investigation 935 Pennsylvania Avenue, NW Washington, DC 20535...