After FOMC minutes, China/Japan/earnings/Greece

Following further confirmation from most members of the FOMC in yesterday’s minutes that they will respond to an economy that is...

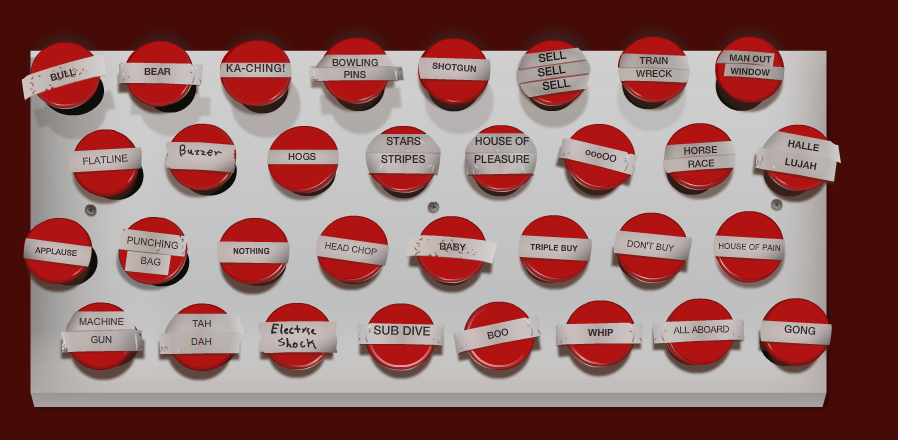

CNBC discovers what the internet was in fact invented for: Goofy amusements: > Cramer’s Soundboard click for interactive site...

CNBC discovers what the internet was in fact invented for: Goofy amusements: > Cramer’s Soundboard click for interactive site...

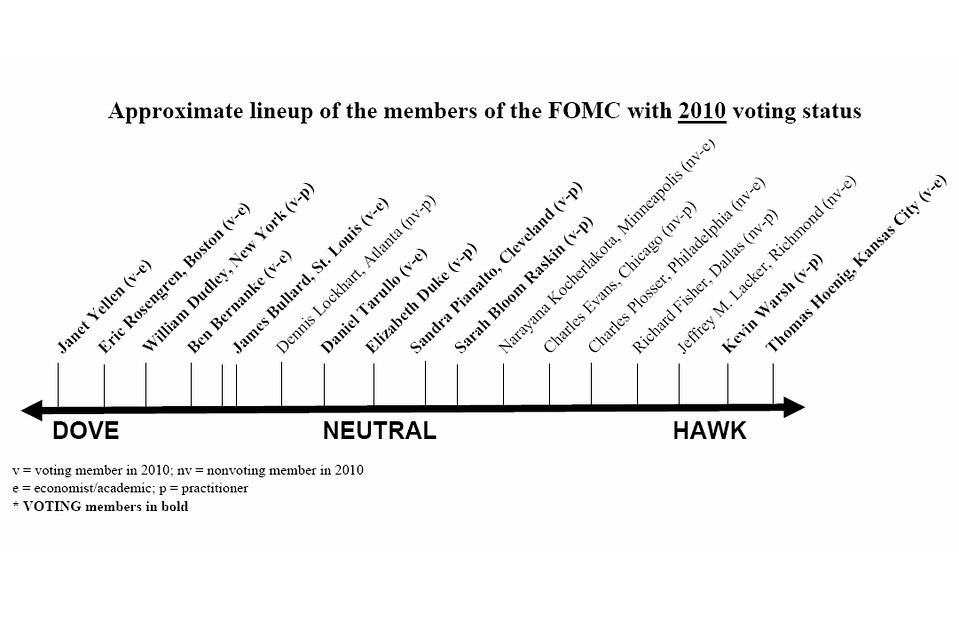

Great chart from MarketBeat regarding where all of the Fed Presidents and Governors are on the Dovish Hawkish scale: > click for...

Great chart from MarketBeat regarding where all of the Fed Presidents and Governors are on the Dovish Hawkish scale: > click for...

Get subscriber-only insights and news delivered by Barry every two weeks.