Earnings time, Fed to take back seat for a few weeks

With Q3 earnings reports upon us in earnest, the market tug of war between the economic reality of sluggish US growth on one side and the...

As long time readers know, I am a big fan of Greg Weldon. This week he has very graciously allowed me to reproduce his client letter from...

As long time readers know, I am a big fan of Greg Weldon. This week he has very graciously allowed me to reproduce his client letter from...

> Tonite I will be on Fast Money on CNBC at 5:15pm discussing the AG stocks, inflation and QE2. I’ll post the video when it goes...

> Tonite I will be on Fast Money on CNBC at 5:15pm discussing the AG stocks, inflation and QE2. I’ll post the video when it goes...

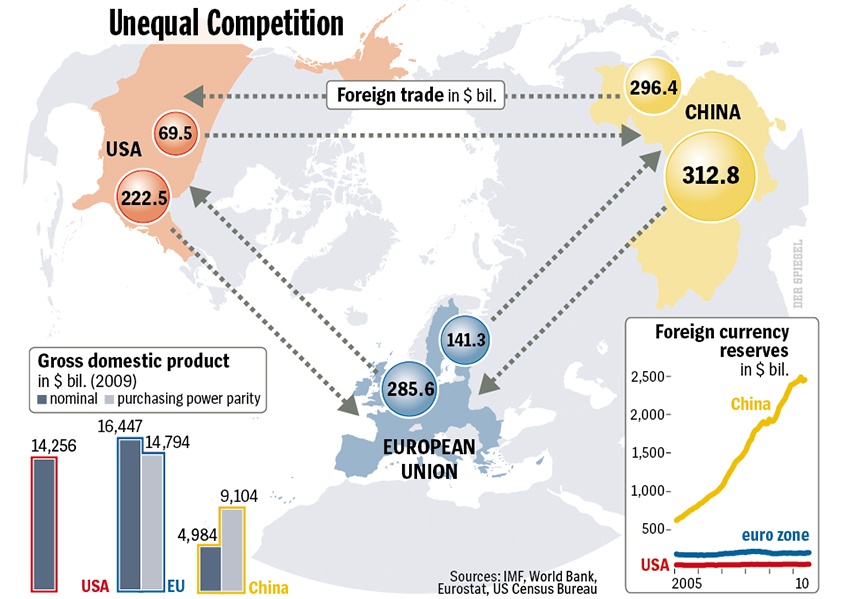

Neat graphic from Der Spiegel: > click for larger graphic > Source: The Specter of Protectionism: World Faces New Wave of Currency...

Neat graphic from Der Spiegel: > click for larger graphic > Source: The Specter of Protectionism: World Faces New Wave of Currency...

Get subscriber-only insights and news delivered by Barry every two weeks.