Succinct summation of week’s events

Succinct summation of week’s events: Positives 1)Private sector job gains about line with expectations 2)Initial Claims fall below...

Bloomberg: Barry Ritholtz, chief executive officer of FusionIQ, a New York research company, and Tobias Levkovich, chief U.S. equity...

Bloomberg: Barry Ritholtz, chief executive officer of FusionIQ, a New York research company, and Tobias Levkovich, chief U.S. equity...

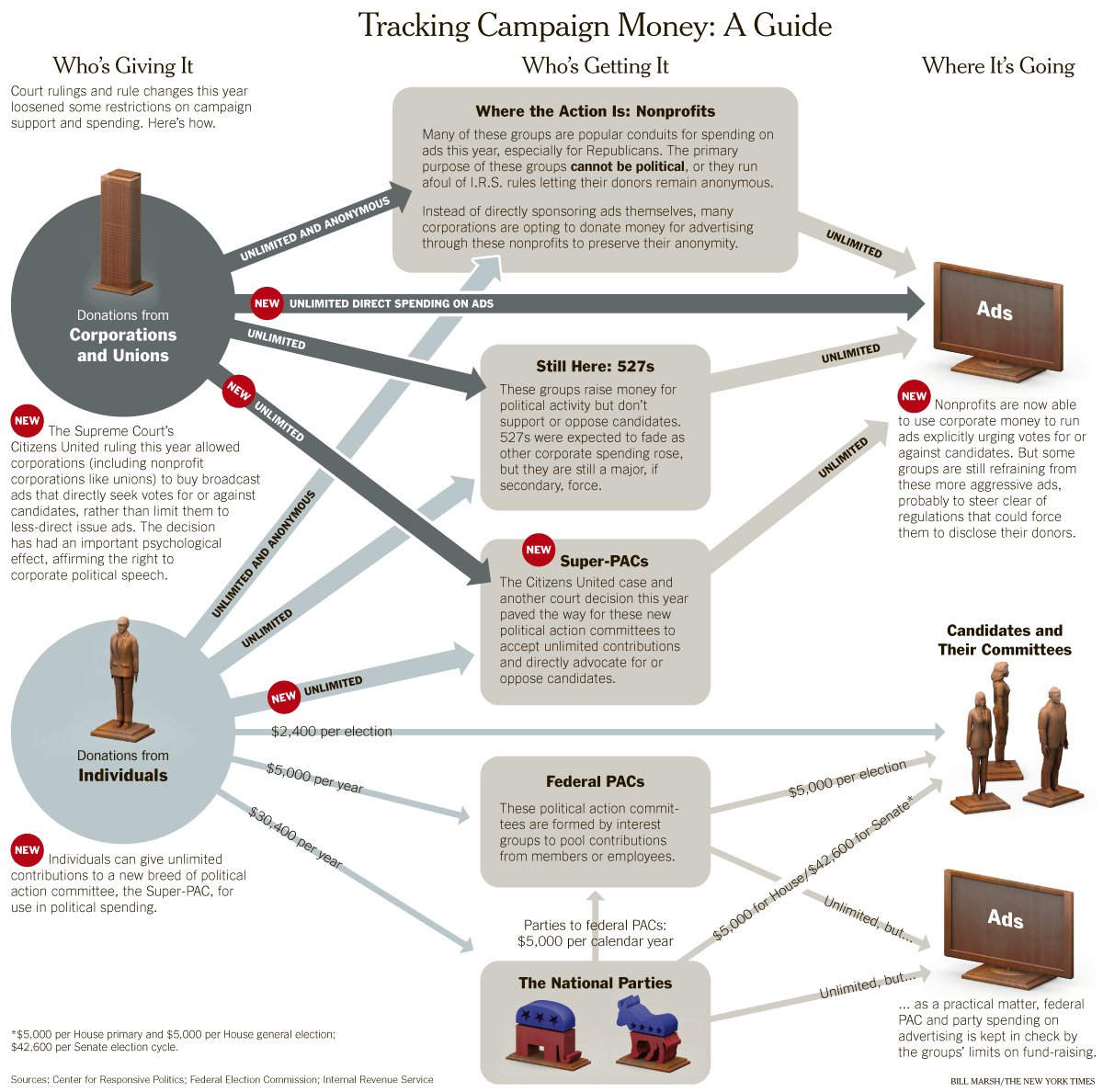

From today’s NYT: The dominant story line of this year’s midterm elections is increasingly becoming the torrents of money, much...

From today’s NYT: The dominant story line of this year’s midterm elections is increasingly becoming the torrents of money, much...

Pretty cool looking, from Automobile mag: BMW’s striking Vision EfficientDynamics concept is headed for production in late 2012 or...

Pretty cool looking, from Automobile mag: BMW’s striking Vision EfficientDynamics concept is headed for production in late 2012 or...

As readers know, I was in Europe a few weeks ago, making a LOT of presentations. My London-based partners seem to feel that an hour or...

As readers know, I was in Europe a few weeks ago, making a LOT of presentations. My London-based partners seem to feel that an hour or...

Get subscriber-only insights and news delivered by Barry every two weeks.