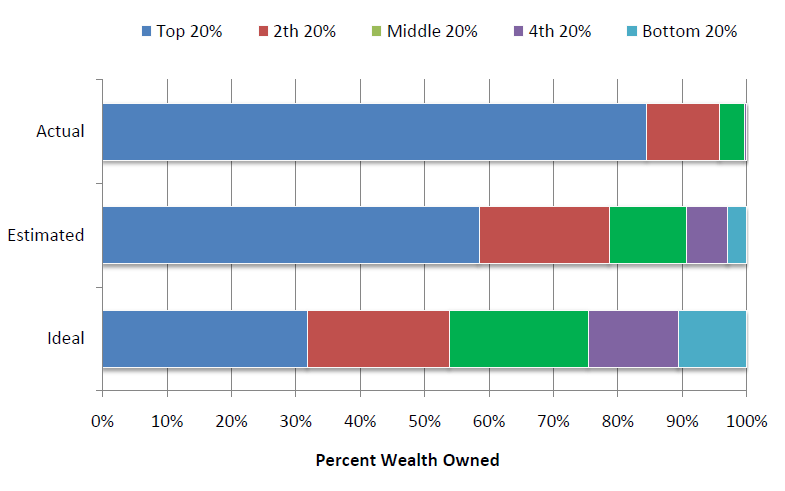

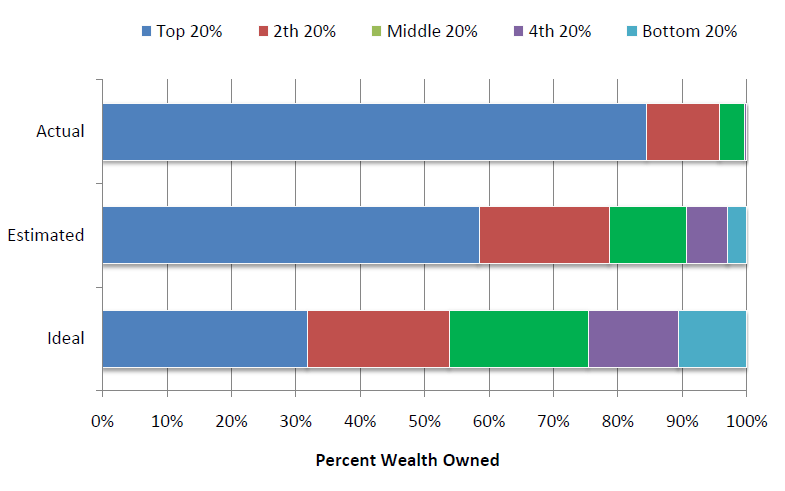

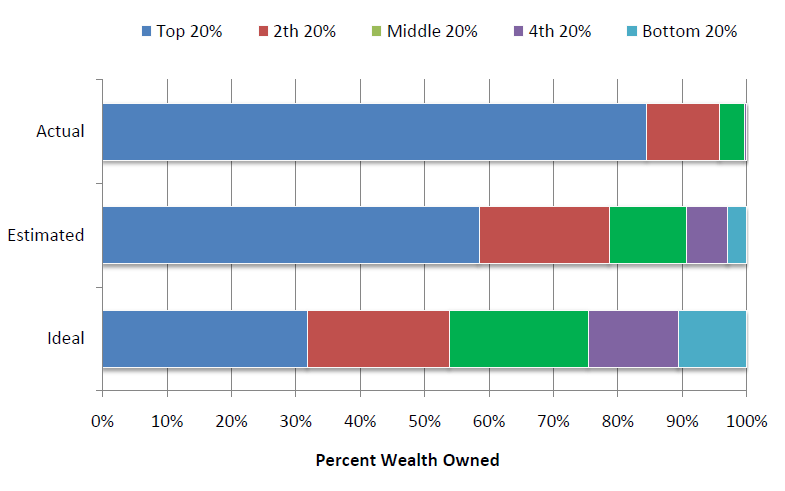

I’ve been meaning to get to this chart for some time, so I am glad Good reminded me to: The actual United States wealth...

I’ve been meaning to get to this chart for some time, so I am glad Good reminded me to: The actual United States wealth...

Read More

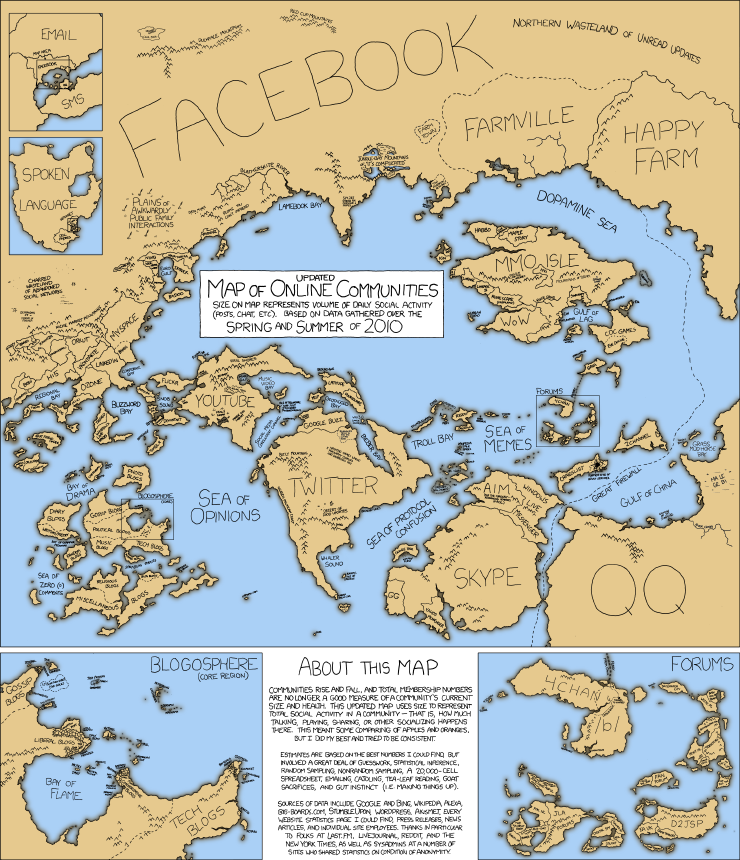

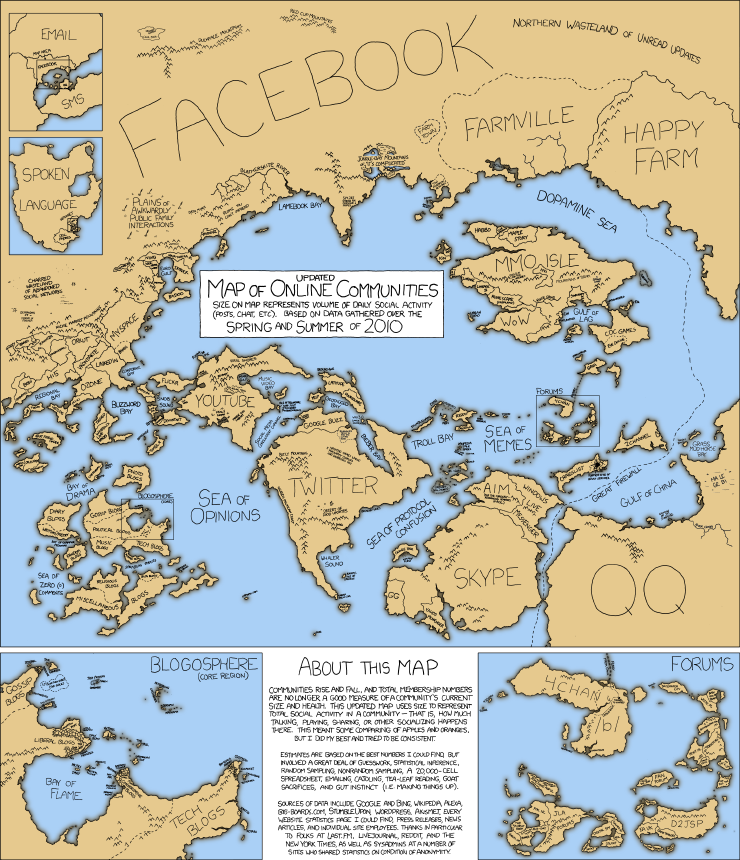

XKCD has updated their map of online communities: > Click for awesomely large graphic

XKCD has updated their map of online communities: > Click for awesomely large graphic

Read More

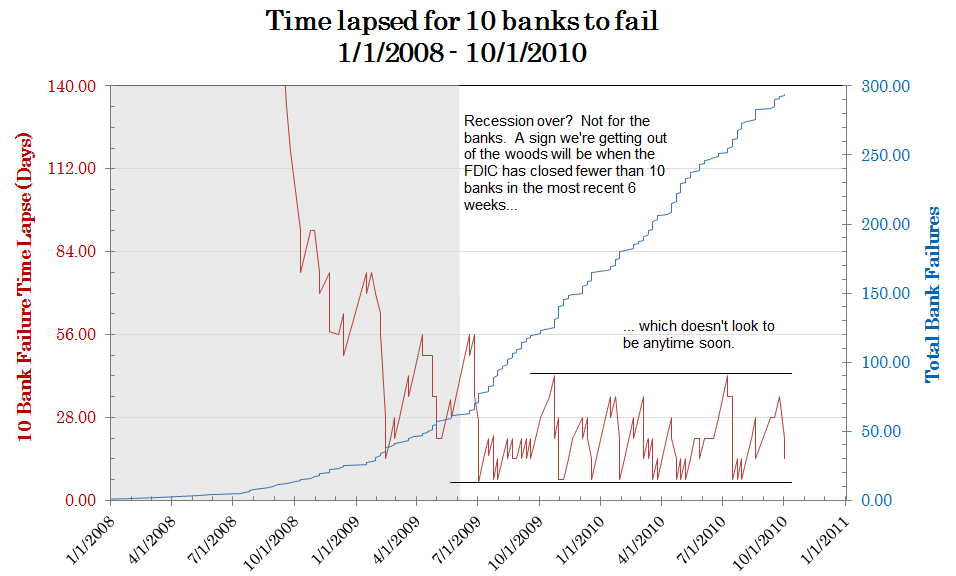

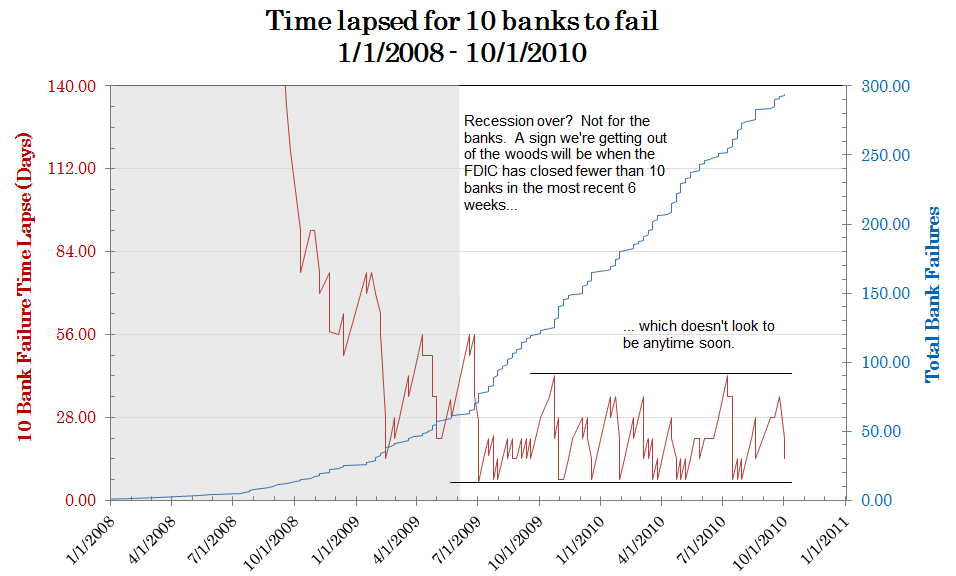

Wesley Allen, a Grad student at Purdue University, sends along these “bank failure plots” that show how long it takes the...

Wesley Allen, a Grad student at Purdue University, sends along these “bank failure plots” that show how long it takes the...

Read More

Frederick Sheehan is the author of Panderer to Power: The Untold Story of How Alan Greenspan Enriched Wall Street and Left a Legacy of...

Read More

My inbox is deluged with rants and demands from people who are insisting that This. Rally. Must. End. NOW! A composite of their emails...

My inbox is deluged with rants and demands from people who are insisting that This. Rally. Must. End. NOW! A composite of their emails...

Read More

Boy, does Tom Toles nail this one: > Hat tip Mike R

Boy, does Tom Toles nail this one: > Hat tip Mike R

Read More

ADP said private sector payrolls fell 39k in Sept and was worse than expectations of a gain of 20k. Aug however was revised up by 20k to...

Read More

David R. Kotok Chairman and Chief Investment Officer Global Musical Chairs October 5, 2010 > The game of musical chairs is played with...

Read More

I’ve been meaning to get to this chart for some time, so I am glad Good reminded me to: The actual United States wealth...

I’ve been meaning to get to this chart for some time, so I am glad Good reminded me to: The actual United States wealth...

I’ve been meaning to get to this chart for some time, so I am glad Good reminded me to: The actual United States wealth...

I’ve been meaning to get to this chart for some time, so I am glad Good reminded me to: The actual United States wealth...