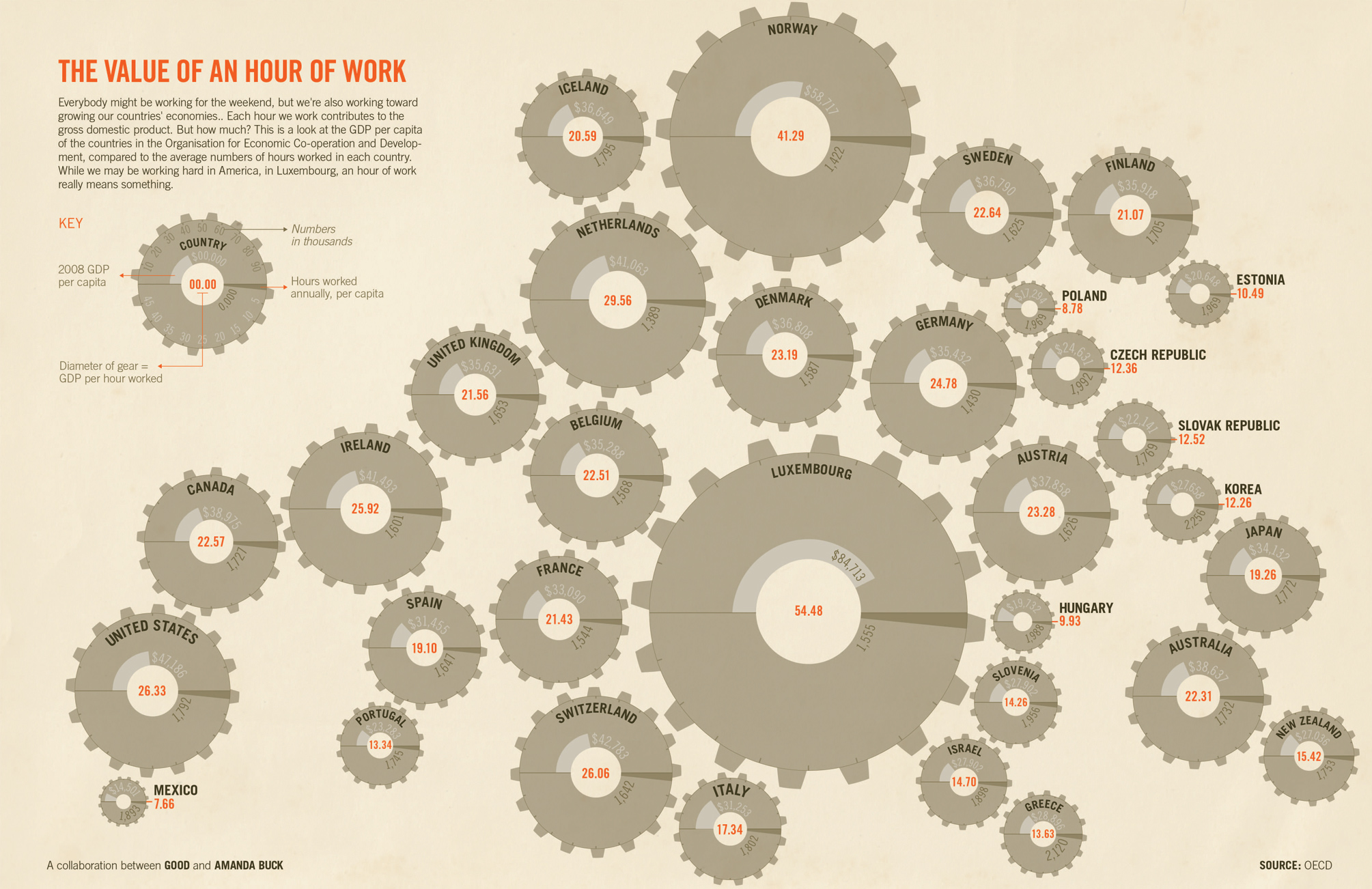

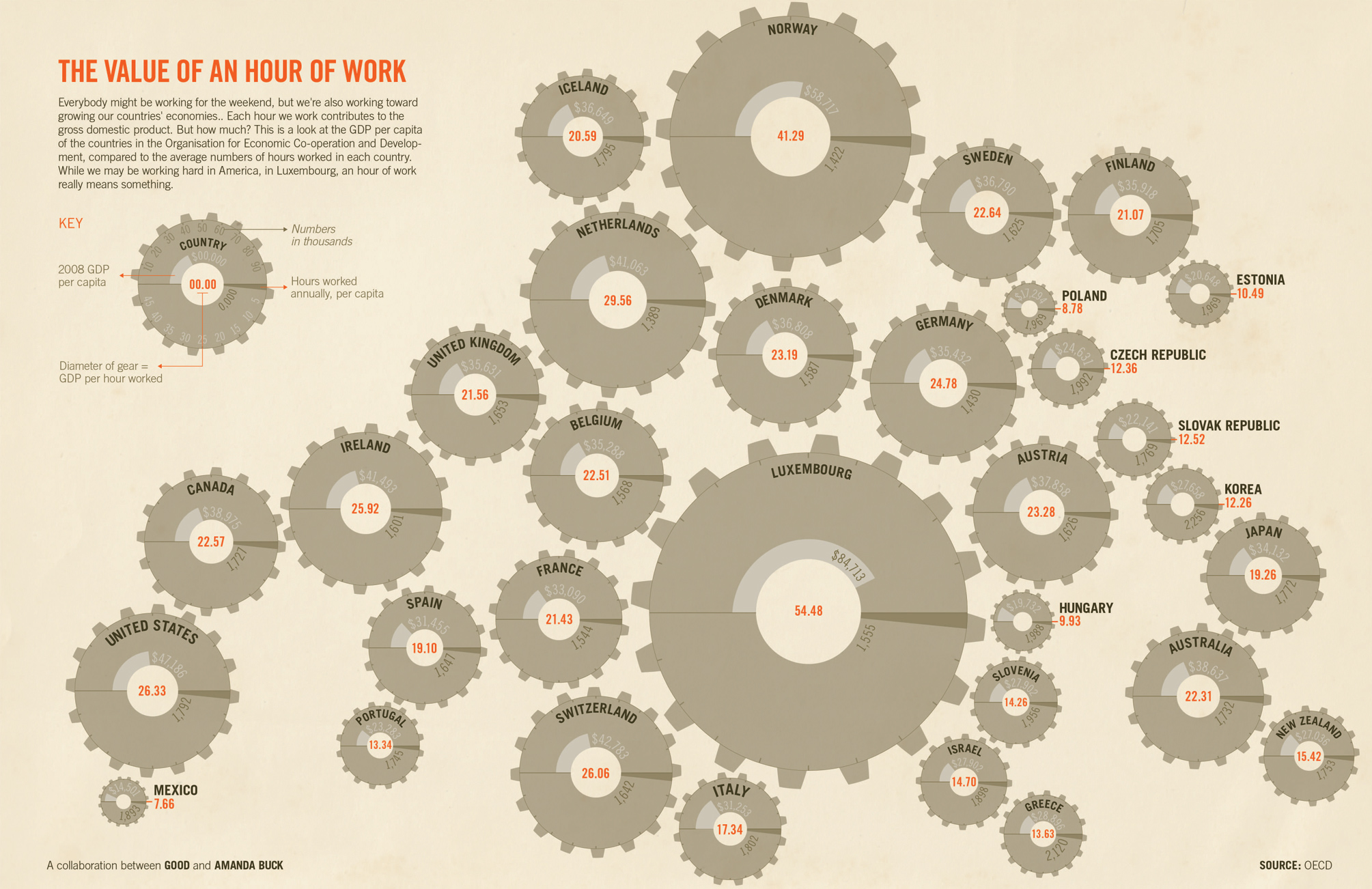

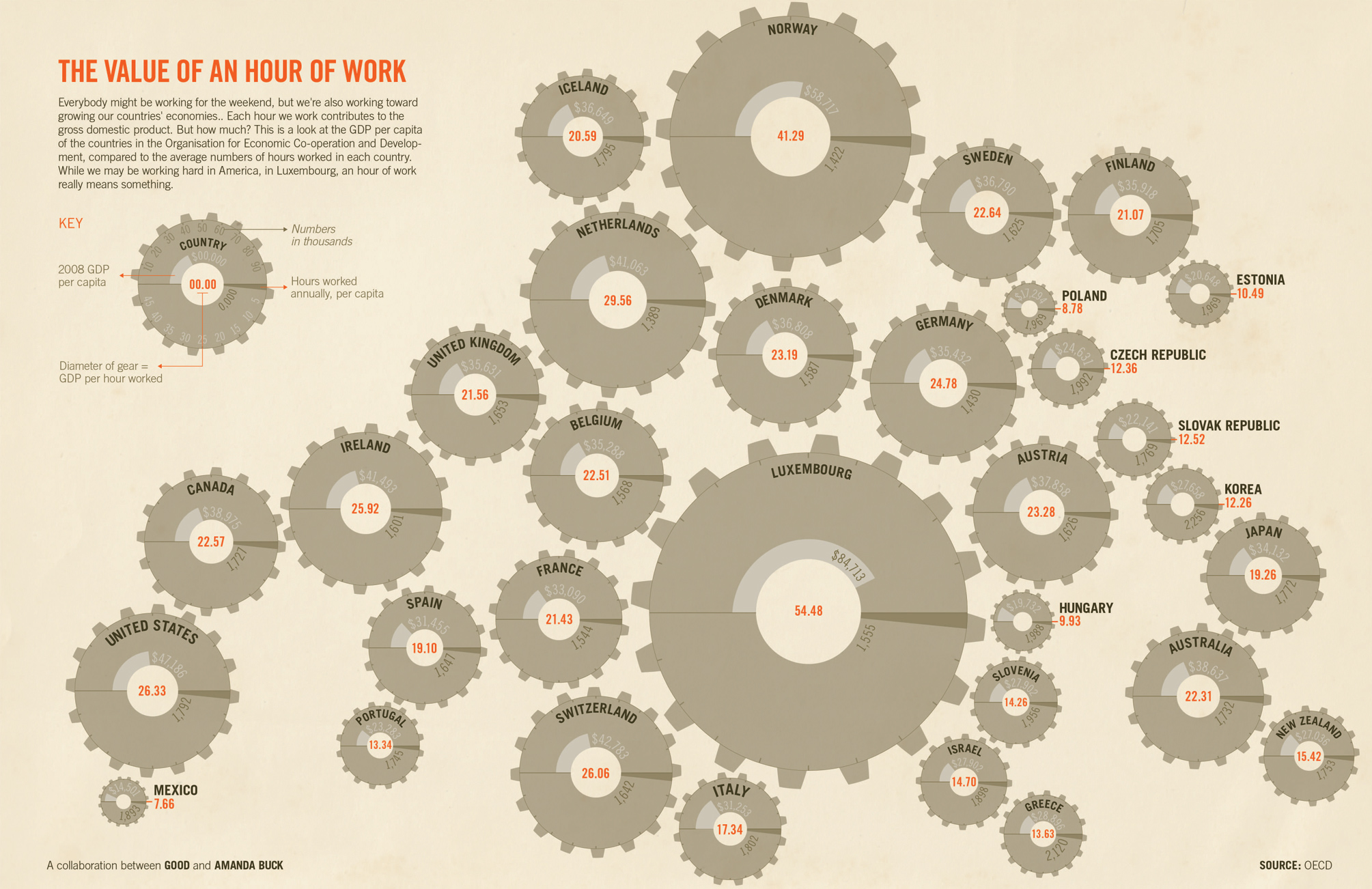

Via Good, we have this digital transparency of the Most Efficient Workforces in the World. Note: I don’t know how the stats were...

Via Good, we have this digital transparency of the Most Efficient Workforces in the World. Note: I don’t know how the stats were...

Read More

Since enough of you emailed me about this Daily beast silliness, I guess I will briefly address it: It is humbling to be acknowledged,...

Since enough of you emailed me about this Daily beast silliness, I guess I will briefly address it: It is humbling to be acknowledged,...

Read More

Evidence of how extraordinary the demand for yield has become, Mexico today plans on selling $500mm of 100 year debt with a coupon of...

Read More

I love this line from Peter Boockvar: “If you live in Japan and thought about selling stuff in the closet on EBAY, hawk it to the...

Read More

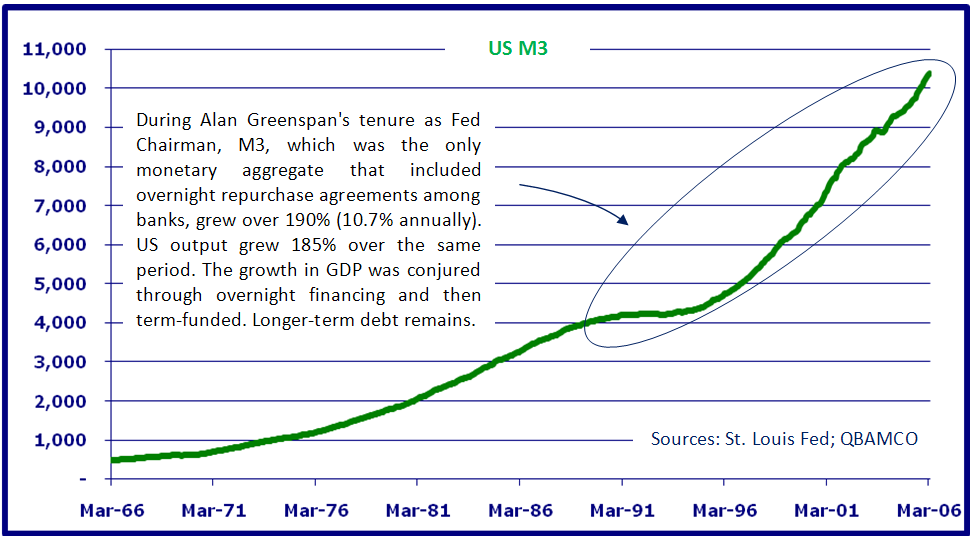

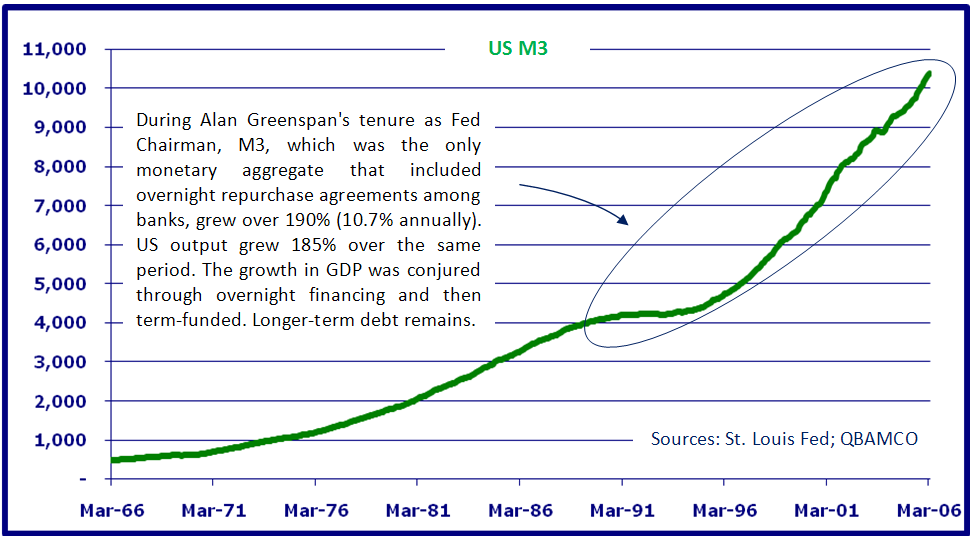

Paul Brodsky & Lee Quaintance run QB Partners, a private macro-oriented investment fund based in New York. ~~~ Who is John Galt? In...

Paul Brodsky & Lee Quaintance run QB Partners, a private macro-oriented investment fund based in New York. ~~~ Who is John Galt? In...

Read More

Terrifi 14 minute interview between CNBC’s Becky Quick talks to FDIC Chairman Sheila Bair about financial regulation. This is the...

Read More

If you have it, the Bank of Japan will buy it. The BoJ cut interest rates from .1% to a range of zero to .1% and announced a 5T yen fund...

Read More

“In the West, this formal property system begins to process assets into capital by describing and organizing the most economically...

“In the West, this formal property system begins to process assets into capital by describing and organizing the most economically...

Read More

Via Good, we have this digital transparency of the Most Efficient Workforces in the World. Note: I don’t know how the stats were...

Via Good, we have this digital transparency of the Most Efficient Workforces in the World. Note: I don’t know how the stats were...

Via Good, we have this digital transparency of the Most Efficient Workforces in the World. Note: I don’t know how the stats were...

Via Good, we have this digital transparency of the Most Efficient Workforces in the World. Note: I don’t know how the stats were...