At this point last year, the FDIC had closed “only” 100 banks. We are on pace to exceed last year’s record setting bank...

At this point last year, the FDIC had closed “only” 100 banks. We are on pace to exceed last year’s record setting bank...

Read More

There is a fun mathematical discussion in the NYT Sports section today worth looking at. It turns out that major league hitters on the...

There is a fun mathematical discussion in the NYT Sports section today worth looking at. It turns out that major league hitters on the...

Read More

Fantastic set of aerial photos from Google Images (by way of Boston.com’s Big Picture), showing Florida’s developmental...

Fantastic set of aerial photos from Google Images (by way of Boston.com’s Big Picture), showing Florida’s developmental...

Read More

MarketBeat (WSJ Blog) – Here’s Why You Should Care about Dividends: ‘Bladder Theory’ A particularly pesky commenter has been...

MarketBeat (WSJ Blog) – Here’s Why You Should Care about Dividends: ‘Bladder Theory’ A particularly pesky commenter has been...

Read More

The law of unintended consequences has made decimalization part of the problem. Once trade execution went from a profitable business to...

The law of unintended consequences has made decimalization part of the problem. Once trade execution went from a profitable business to...

Read More

I’ve been meaning to post something this week on Matt Taibbi’s fantastic new piece on the Tea Party (Tea & Crackers) but...

Read More

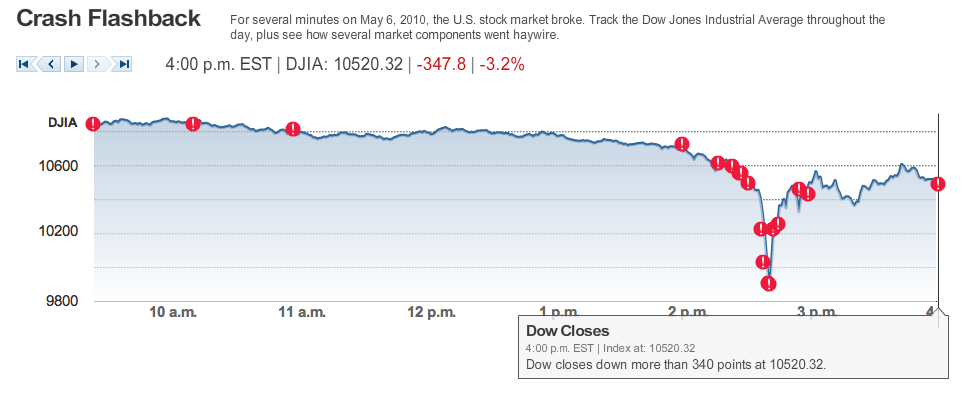

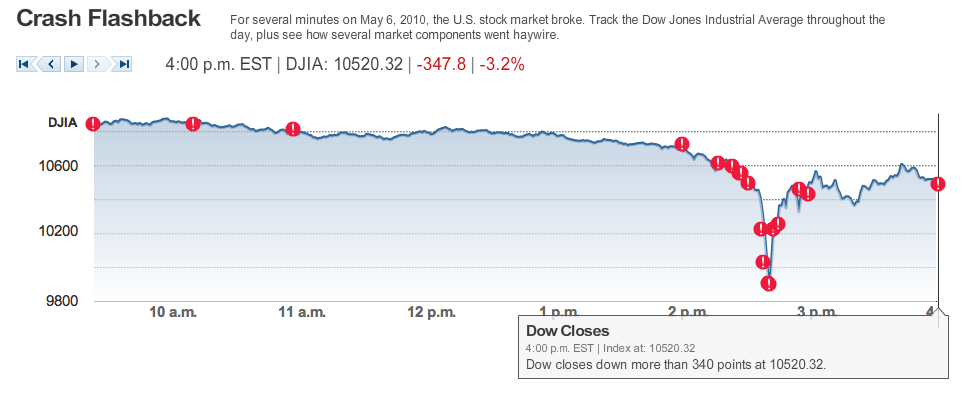

There is a nicely informative interactive graphic that accompanies the WSJ article we discussed earlier, showing most of the major...

There is a nicely informative interactive graphic that accompanies the WSJ article we discussed earlier, showing most of the major...

Read More

Alt. title: Barclay’s Algo + Waddell & Reed Futures Sale = Flash Crash? The 104 page report by the staffs of the U.S. Commodity...

Alt. title: Barclay’s Algo + Waddell & Reed Futures Sale = Flash Crash? The 104 page report by the staffs of the U.S. Commodity...

Read More

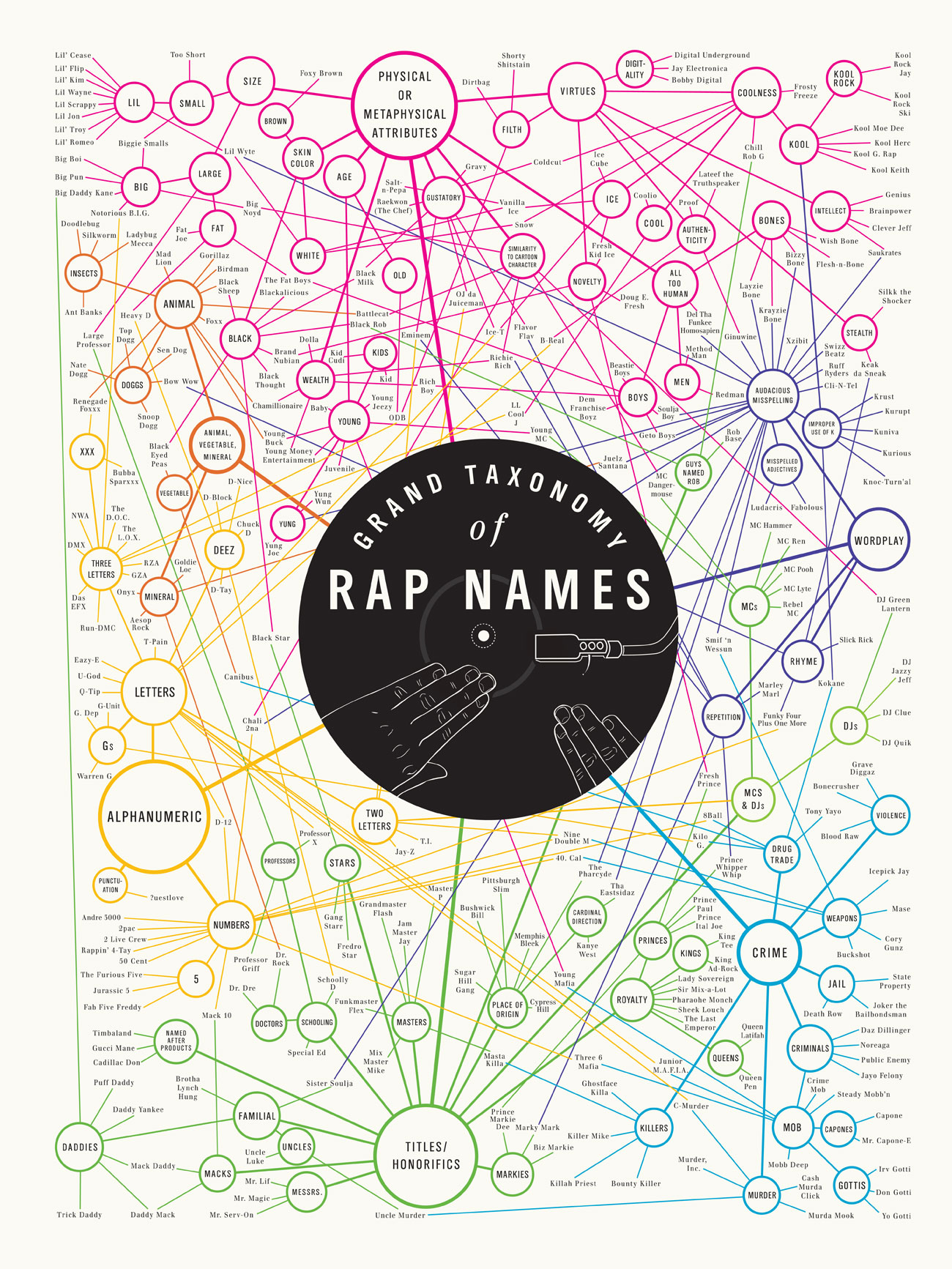

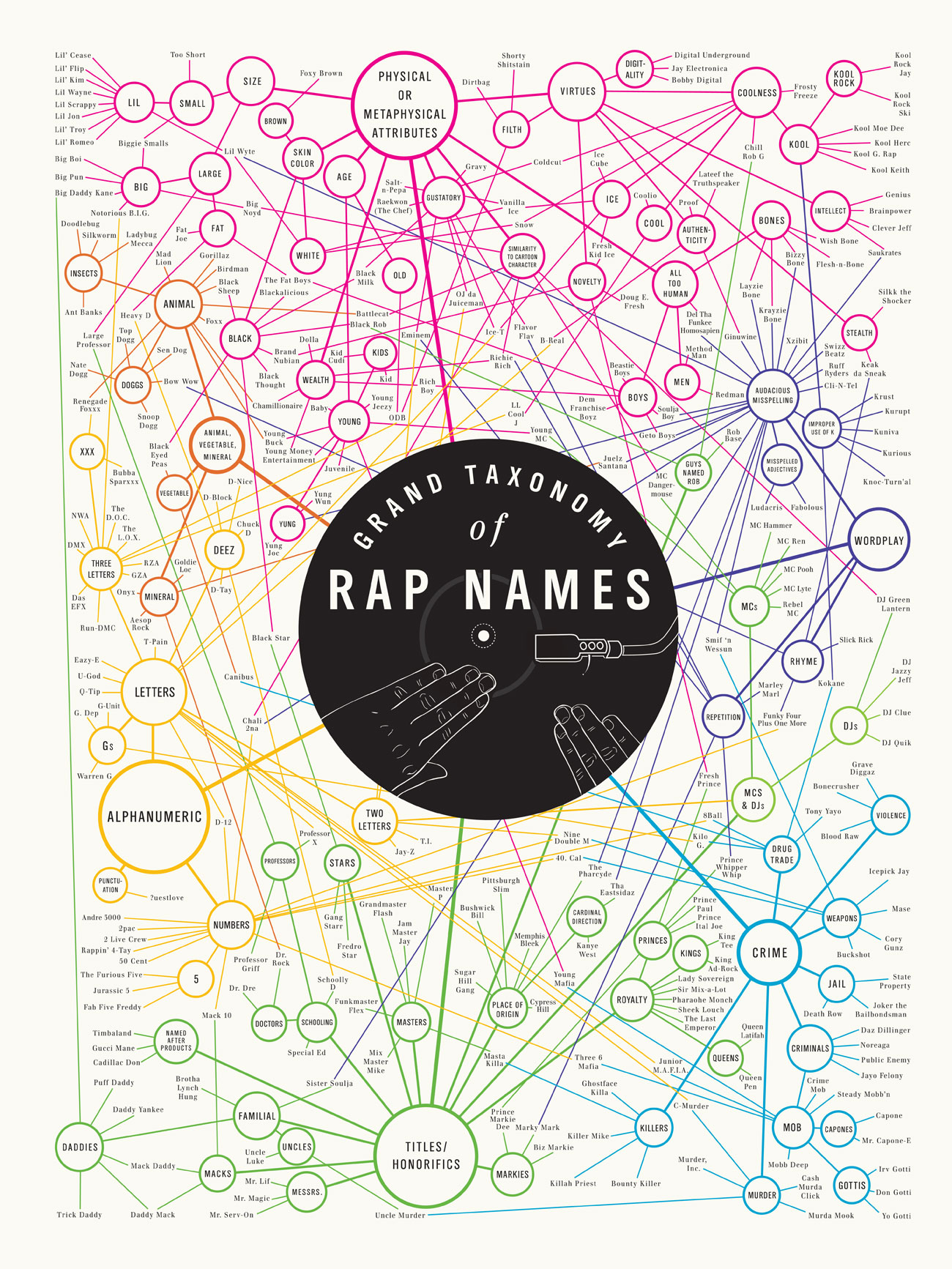

World famous design junkies: Hat tip Josh

World famous design junkies: Hat tip Josh

Read More

At this point last year, the FDIC had closed “only” 100 banks. We are on pace to exceed last year’s record setting bank...

At this point last year, the FDIC had closed “only” 100 banks. We are on pace to exceed last year’s record setting bank...

At this point last year, the FDIC had closed “only” 100 banks. We are on pace to exceed last year’s record setting bank...

At this point last year, the FDIC had closed “only” 100 banks. We are on pace to exceed last year’s record setting bank...