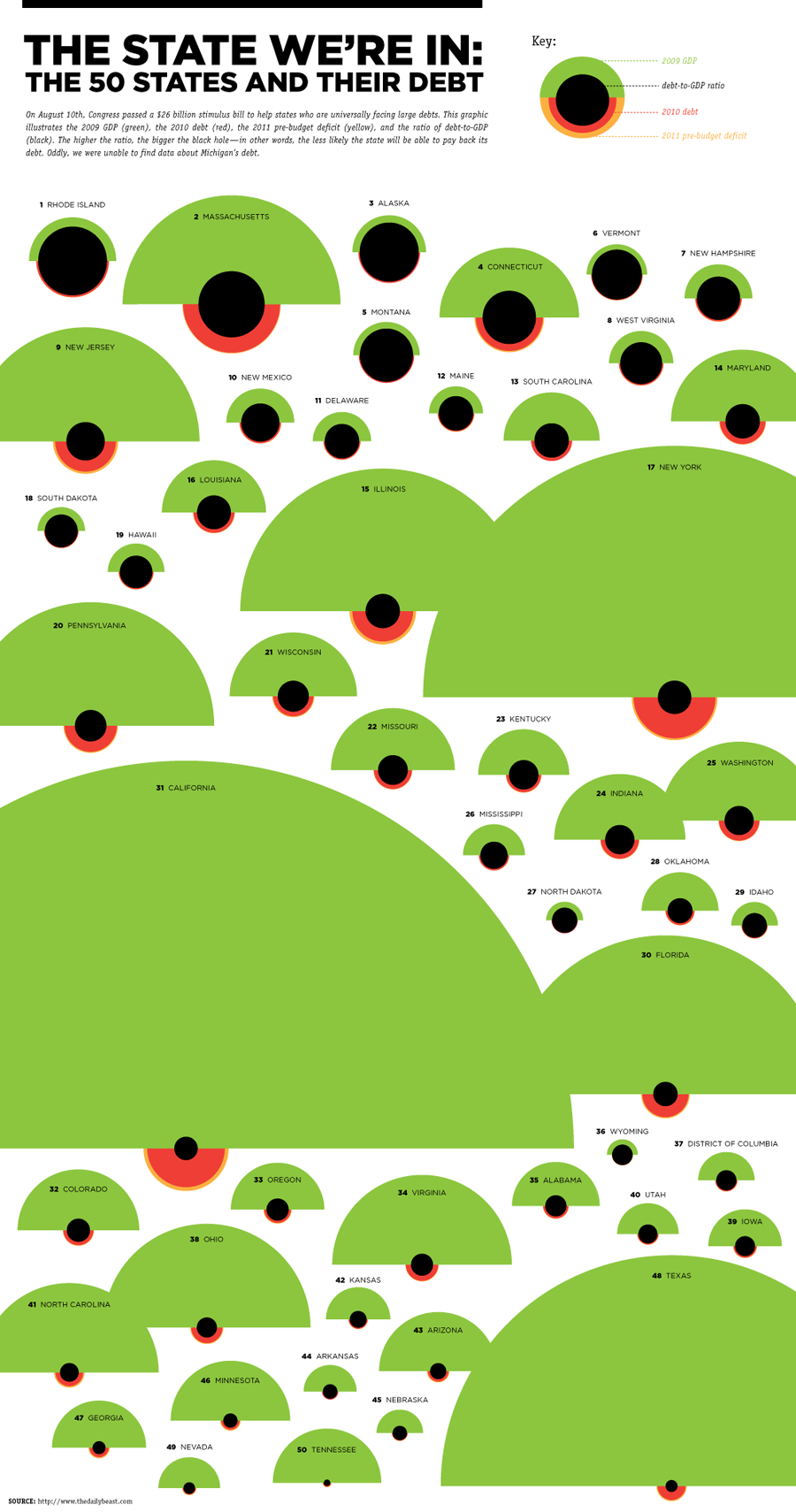

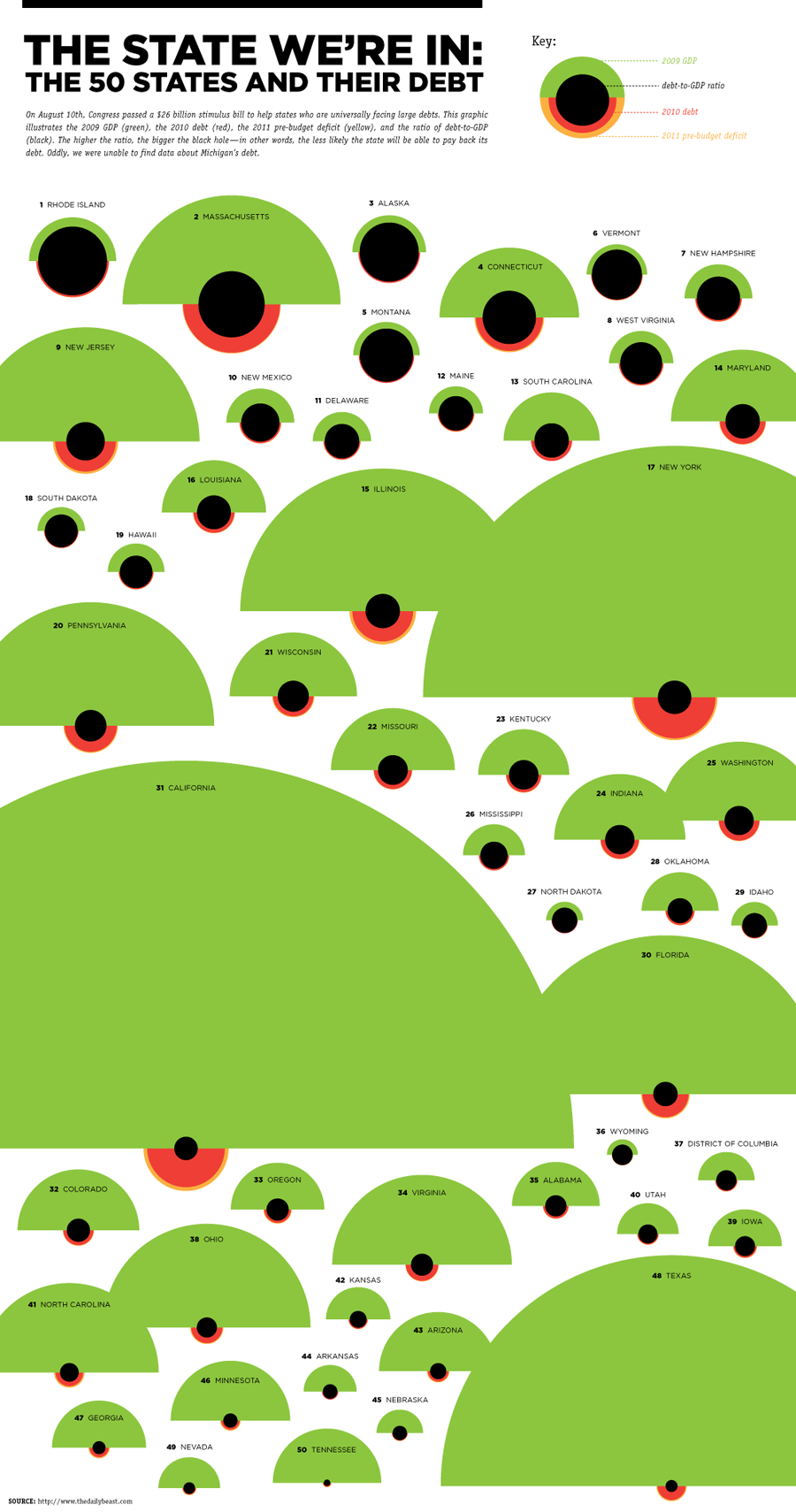

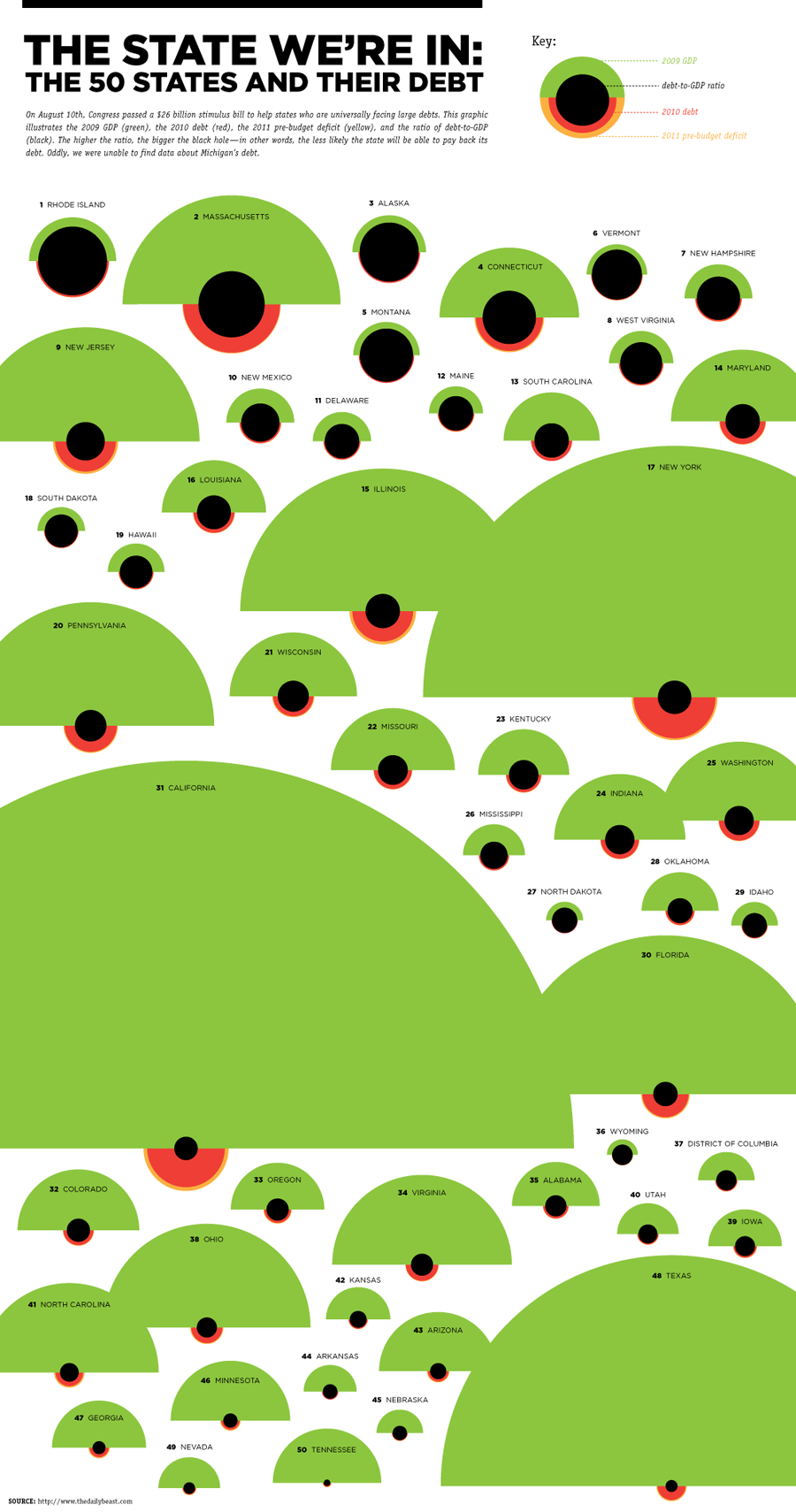

A state-by-state comparison of all 50 states debt load, via Credit Loan: > click for ginormous chart > See also National Debt by...

A state-by-state comparison of all 50 states debt load, via Credit Loan: > click for ginormous chart > See also National Debt by...

Read More

Here is the news release that every Austrian Economist will be forwarding, printing out and framing: > Release Date: October 1, 2010...

Here is the news release that every Austrian Economist will be forwarding, printing out and framing: > Release Date: October 1, 2010...

Read More

Ahhh, the joy of the random click. I don’t know how I stumbled across these here, but who does not enjoy the occasionally snarky...

Read More

James Grant, editor of Grant’s Interest Rate Observer, talks about the overhaul of U.S. financial regulation. Grant also discusses...

Read More

I was about to write on Income and Spending but was sidetracked by this comment from Fed voting member Dudley who said in a speech,...

Read More

by Nomi Prins Big Bailout’s Second Anniversary and Multi-Trillion Dollar Pillage Leftovers It’s been two years since the Emergency...

Read More

The Sept ISM manufacturing index was about in line with expectations at 54.4, down from 56.3 in Aug, off 6 pts from the recent high in...

Read More

~~~ The Atlantic: Since Tim Geithner did not predict the economic crisis, Nassim Taleb has no interest in listening to him talk about it...

Read More

Quote: “. . .we shall urge the greatest of caution upon everyone, everywhere regarding gold. It is not just over-extended to the...

Read More

A state-by-state comparison of all 50 states debt load, via Credit Loan: > click for ginormous chart > See also National Debt by...

A state-by-state comparison of all 50 states debt load, via Credit Loan: > click for ginormous chart > See also National Debt by...

A state-by-state comparison of all 50 states debt load, via Credit Loan: > click for ginormous chart > See also National Debt by...

A state-by-state comparison of all 50 states debt load, via Credit Loan: > click for ginormous chart > See also National Debt by...