Austerity: The History of a Dangerous Idea

WatsonMedia presents Mark Blyth on Austerity from The Global Conversation on Vimeo. From Brown University: With governments...

Doug gives the Themis Boys some props, and he does the same to BATS. Guest Post: The Story of Canada Bill Jones by Doug Clark of BMO The...

Doug gives the Themis Boys some props, and he does the same to BATS. Guest Post: The Story of Canada Bill Jones by Doug Clark of BMO The...

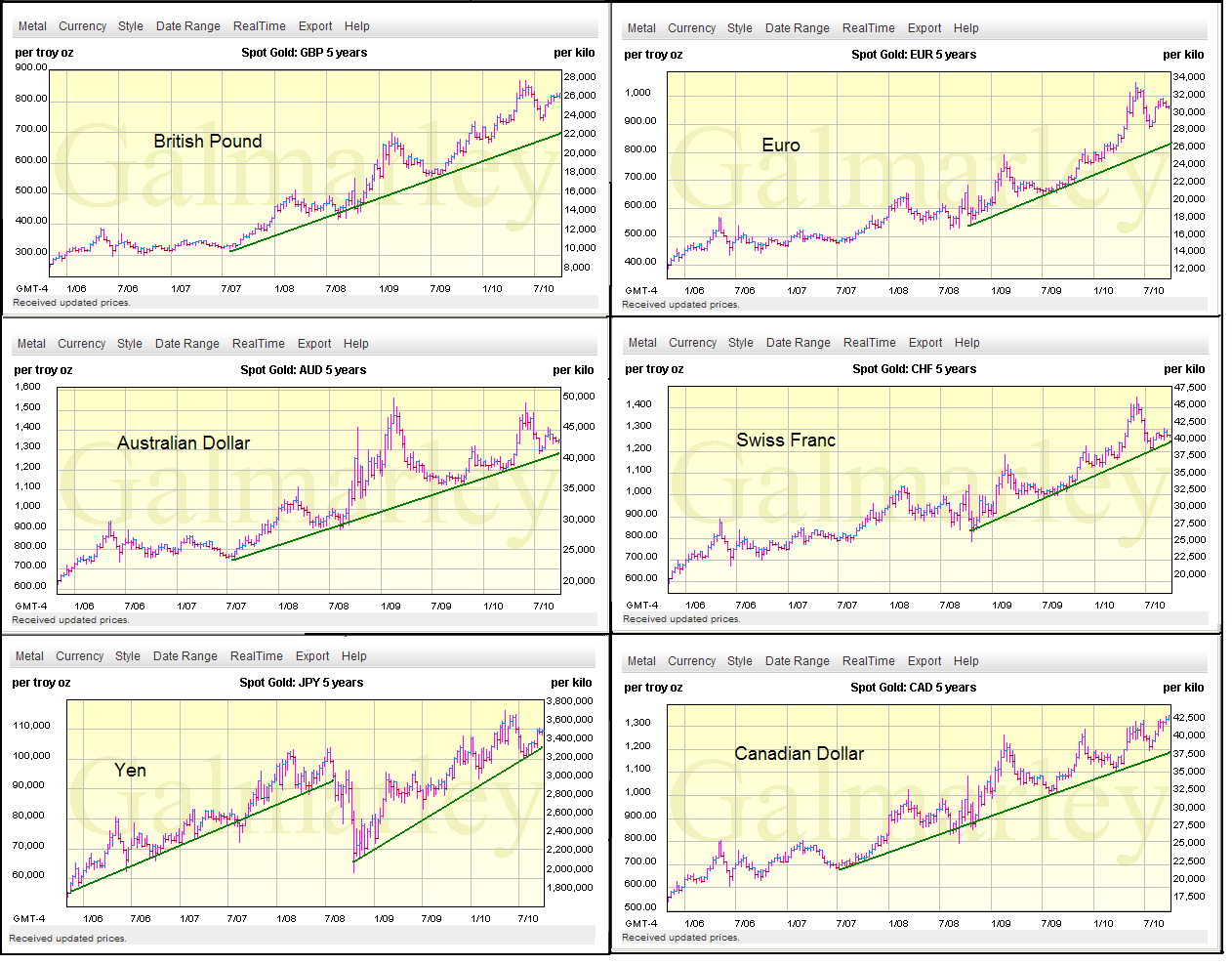

Not so much, according to Jesse’s Café Américain: “But the US dollar is not alone, not the only fiat currency in a bit of a...

Not so much, according to Jesse’s Café Américain: “But the US dollar is not alone, not the only fiat currency in a bit of a...

Get subscriber-only insights and news delivered by Barry every two weeks.