The Amazing Dynamic of the US Treasury Market

Wrapping up the week’s sales, the 7 year auction was good as the yield was right in line with the when issued and the bid to cover...

Doug gives the Themis Boys some props, and he does the same to BATS. Guest Post: The Story of Canada Bill Jones by Doug Clark of BMO The...

Doug gives the Themis Boys some props, and he does the same to BATS. Guest Post: The Story of Canada Bill Jones by Doug Clark of BMO The...

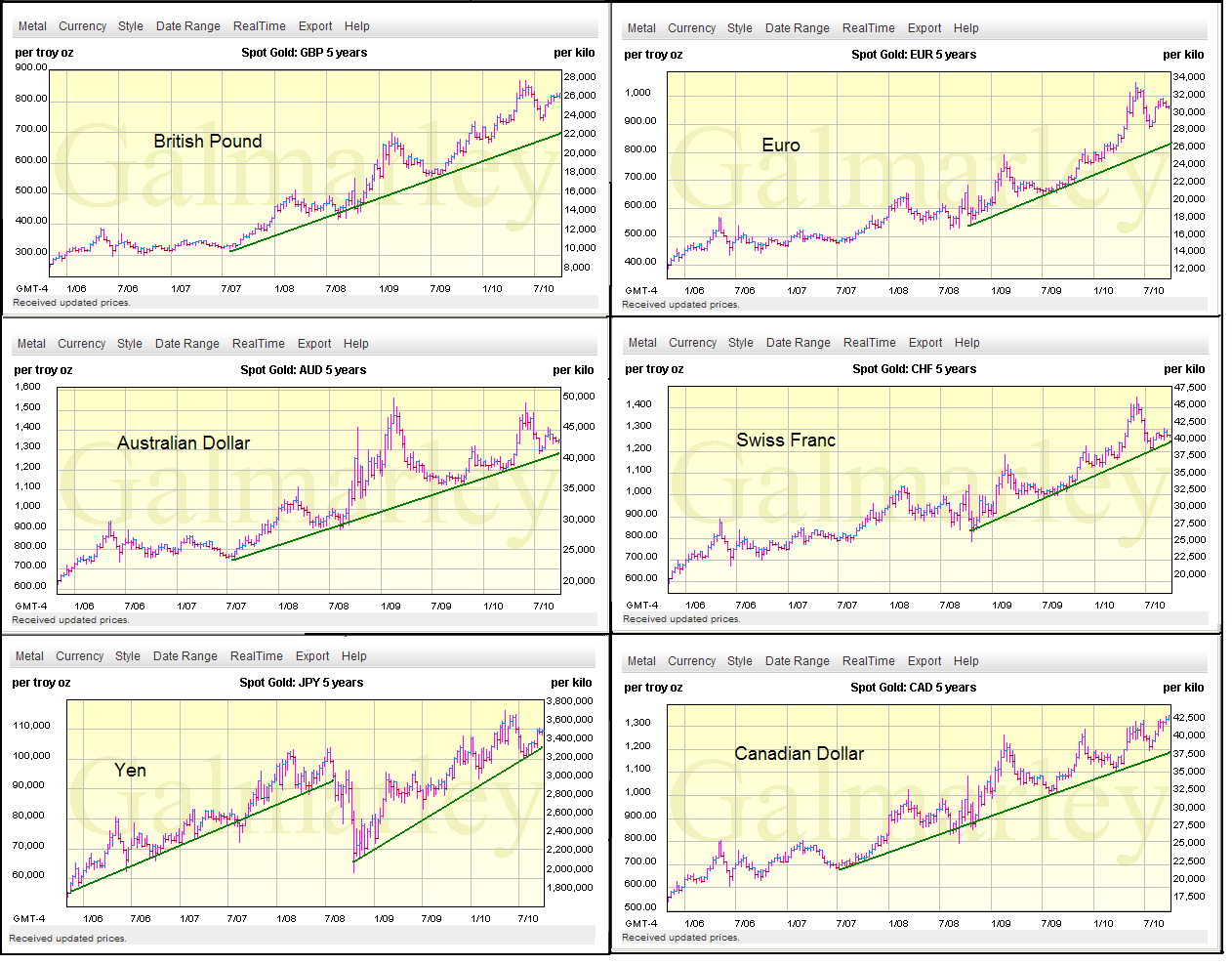

Not so much, according to Jesse’s Café Américain: “But the US dollar is not alone, not the only fiat currency in a bit of a...

Not so much, according to Jesse’s Café Américain: “But the US dollar is not alone, not the only fiat currency in a bit of a...

If you are interested in owning the fastest production car Maserati makes, than its the MC Stradale: > > via Classic Driver

If you are interested in owning the fastest production car Maserati makes, than its the MC Stradale: > > via Classic Driver

Get subscriber-only insights and news delivered by Barry every two weeks.