Fiberglass Freaks’ have available for purchase officially licensed 1966 BATMOBILE Replica $150k. Is the car just a prop? Absolutely...

Fiberglass Freaks’ have available for purchase officially licensed 1966 BATMOBILE Replica $150k. Is the car just a prop? Absolutely...

Read More

Artist Anthony Freda, whose work has been featured here before, writes to say: Barry ‘ Love the left right post, you are indeed...

Artist Anthony Freda, whose work has been featured here before, writes to say: Barry ‘ Love the left right post, you are indeed...

Read More

With the QE, reflation trade back on today (buy gold, sell $’s, buy other commodities and currencies, buy Treasuries, buy stocks),...

Read More

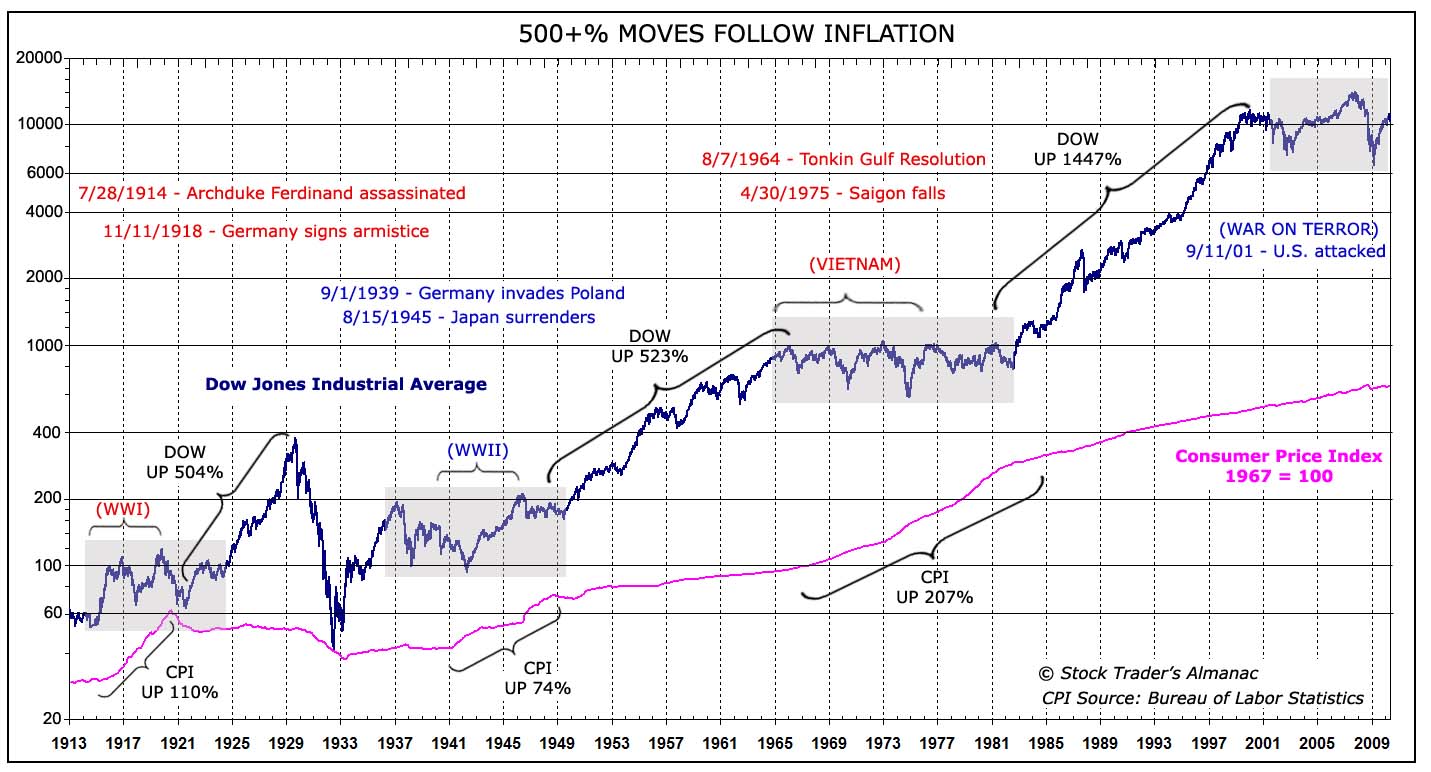

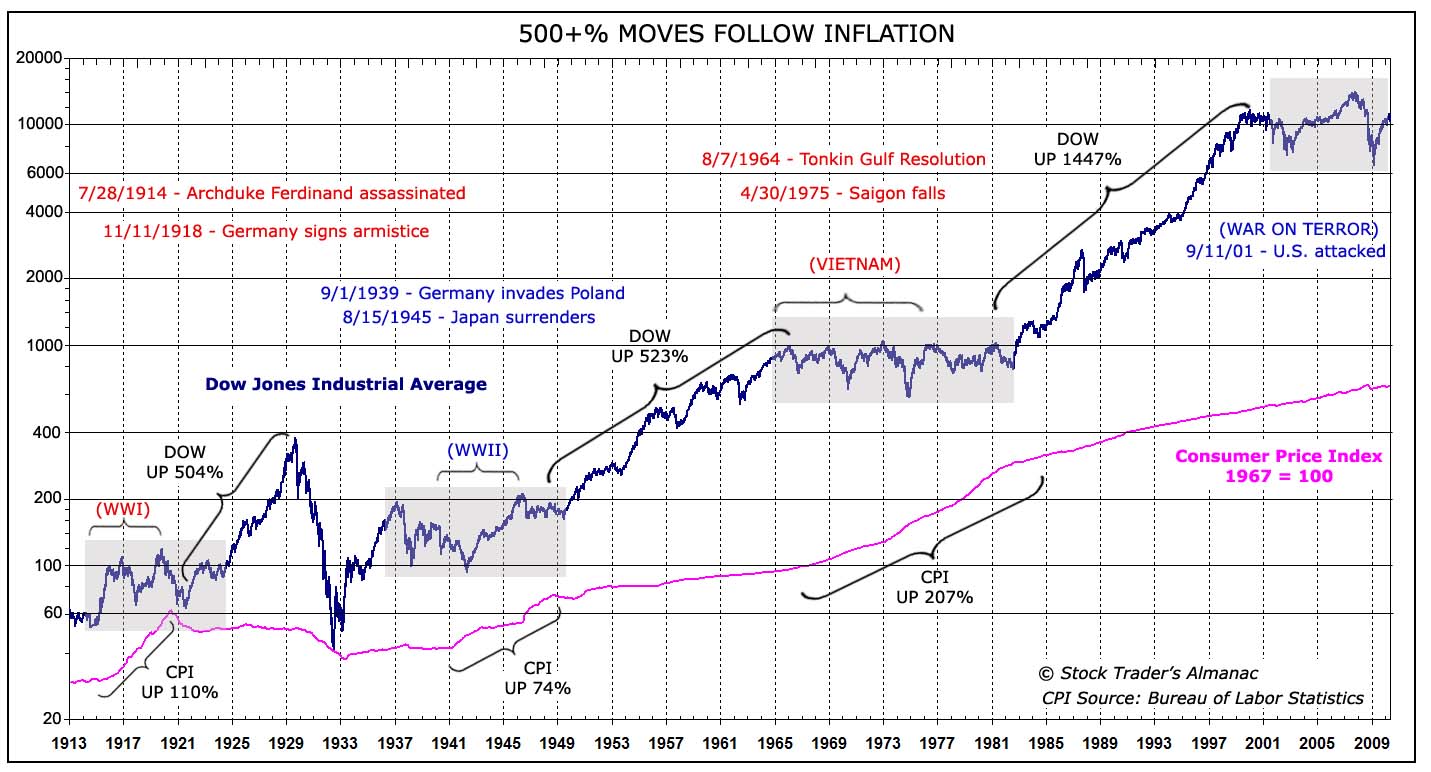

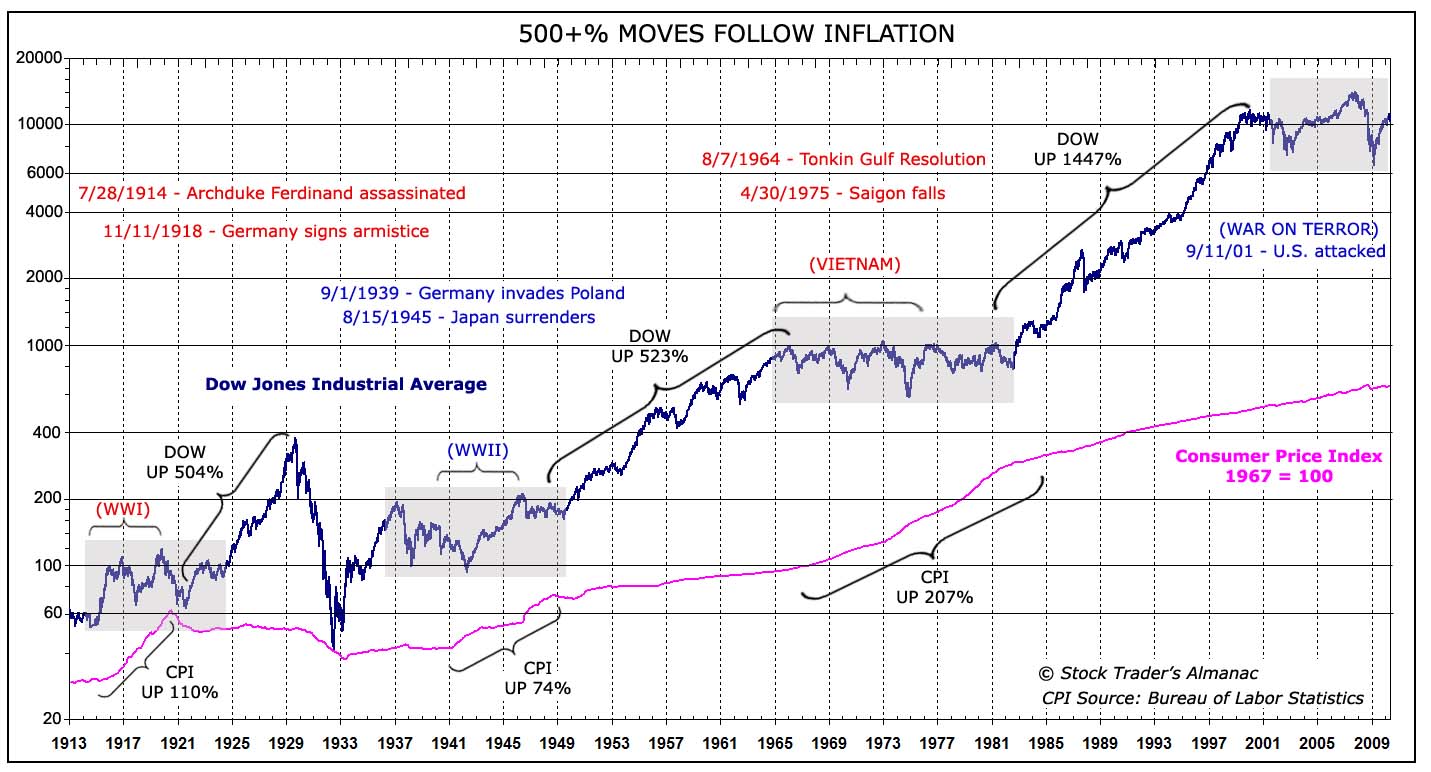

I mentioned this morning that Jeff Hirsch is the anti-Prechter — forecasting a wild $38K Dow in 2025. (Discussed this AM here, with...

I mentioned this morning that Jeff Hirsch is the anti-Prechter — forecasting a wild $38K Dow in 2025. (Discussed this AM here, with...

Read More

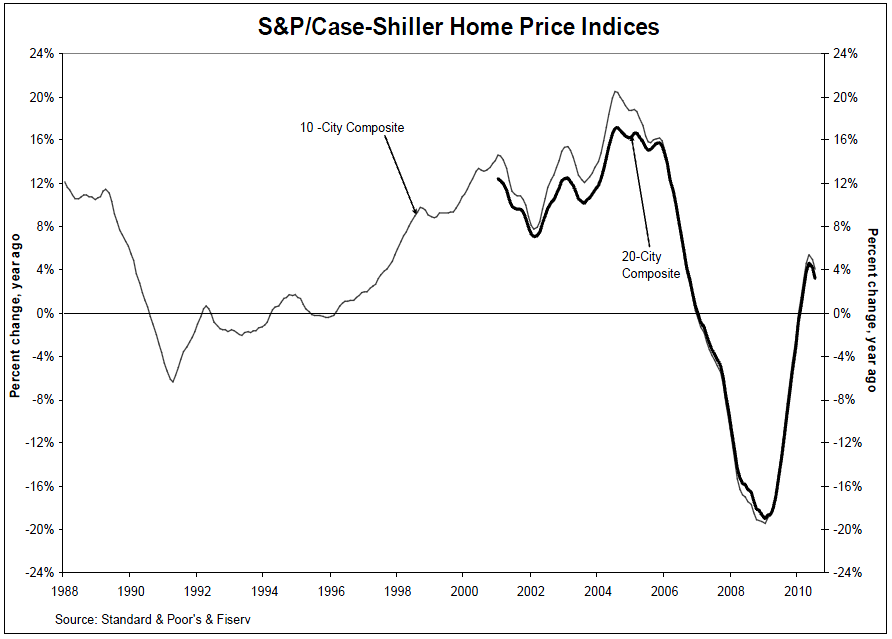

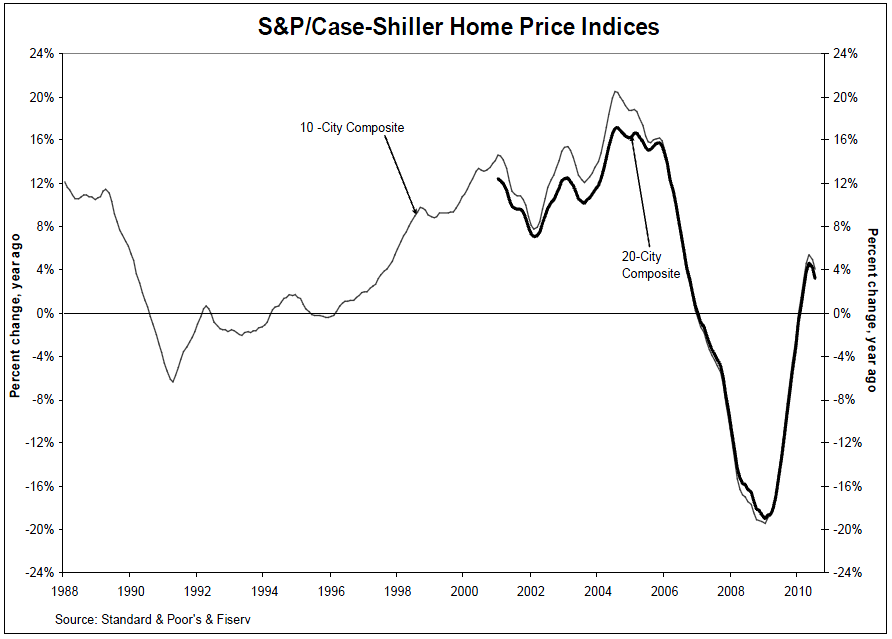

Case Shiller: “Home prices crept forward in July. Ten of the 20 cities saw year-over-year gains and only one – Las Vegas – made a...

Case Shiller: “Home prices crept forward in July. Ten of the 20 cities saw year-over-year gains and only one – Las Vegas – made a...

Read More

Next Super Boom — Dow 38820 By 2025 Stocks Catch Up With Inflation, But First Inflation Catches Up With Government Spending Jeffrey A....

Next Super Boom — Dow 38820 By 2025 Stocks Catch Up With Inflation, But First Inflation Catches Up With Government Spending Jeffrey A....

Read More

The July S&P/CS 20 city home price index fell .13% m/o/m but was up 3.18% y/o/y, both about in line with expectations. The index at...

Read More

Ken Fisher channels my monkey comments to diss PIMCO’s Mohamed El-Erian and their “New Normal” thesis. I disagree with...

Read More

Soleil: Perspective Vince Farrell Soleil Securities Corporation Chief Investment Officer Phone: 212.380.4909 vfarrell-at-soleilgroup.com...

Read More

As the Fed continues to debate what form, if necessary, their next round of QE will take as evidenced by today’s WSJ article, the...

Read More

Fiberglass Freaks’ have available for purchase officially licensed 1966 BATMOBILE Replica $150k. Is the car just a prop? Absolutely...

Fiberglass Freaks’ have available for purchase officially licensed 1966 BATMOBILE Replica $150k. Is the car just a prop? Absolutely...

Fiberglass Freaks’ have available for purchase officially licensed 1966 BATMOBILE Replica $150k. Is the car just a prop? Absolutely...

Fiberglass Freaks’ have available for purchase officially licensed 1966 BATMOBILE Replica $150k. Is the car just a prop? Absolutely...