Historical Recession Duration

For some perspective on the Great Recession, the chart of the day (below) illustrates the duration of all US recessions since 1900. There...

For some perspective on the Great Recession, the chart of the day (below) illustrates the duration of all US recessions since 1900. There...

Implications of the Financial Crisis for Economics

Chairman Ben S. Bernanke At the Conference Co-sponsored by the Center for Economic Policy Studies and the Bendheim Center for Finance,...

Steven Johnson: Where Good Ideas Come From

I love that he lifted RSI’s animated approach: Beginning with Charles Darwin’s first encounter with the teeming ecosystem of...

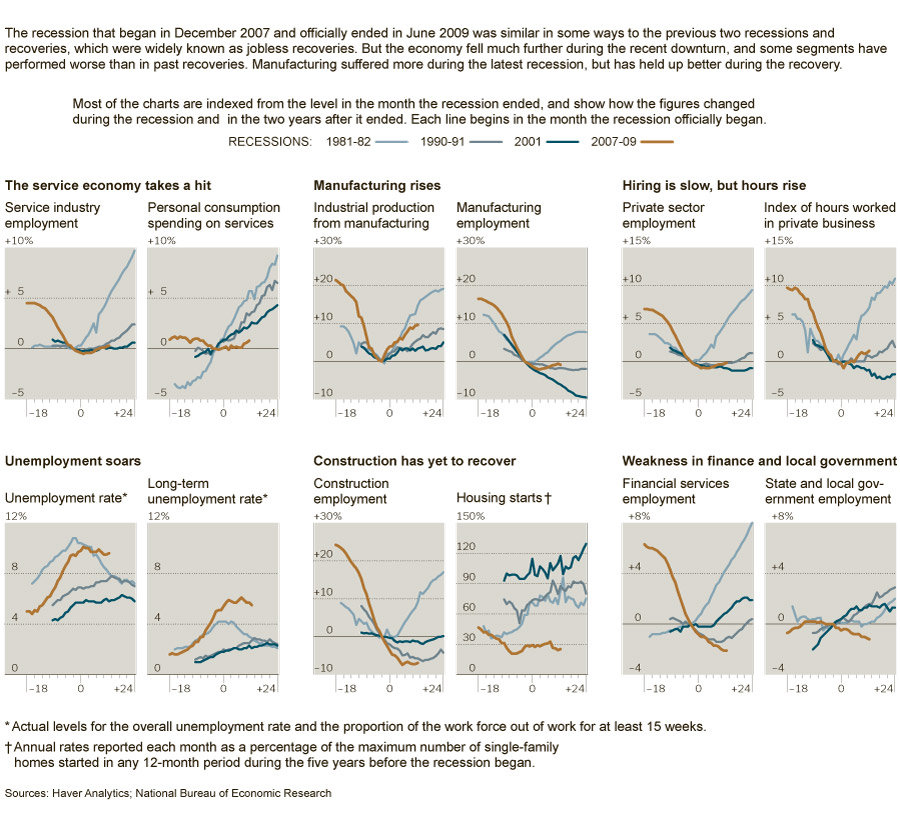

4 Recessions (and Recoveries)

click for ginormous graphic > Floyd Norris takes a closer look at the current post-recession recovery, compared to prior recoveries....

click for ginormous graphic > Floyd Norris takes a closer look at the current post-recession recovery, compared to prior recoveries....

Hedge Fund Titan David Tepper

Why making the call to buy financials in 2009 was easy and other market insights, with David Tepper, president & founder of...

Friday Nite Jazz Rock: 5 Best Unknown/Unheard...

Two months ago, I asked a simple question: What are the 5 best unknown, unheard Rock albums ? The question generated 100s of comments...

Two months ago, I asked a simple question: What are the 5 best unknown, unheard Rock albums ? The question generated 100s of comments...

Succinct summation of week’s events

Succinct summation of week’s events: Positives 1) Durable goods core cap ex better than expected 2) Multi family starts highest...

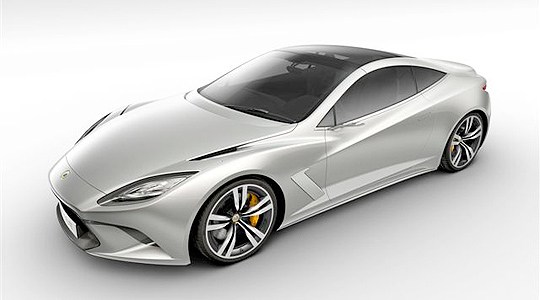

New Lotus Elite

Nice! The rear-wheel-drive 2+2 prototype has a 5.0-litre front-mid-mounted V8 engine delivering 611bhp and 720Nm of torque, which should...

Nice! The rear-wheel-drive 2+2 prototype has a 5.0-litre front-mid-mounted V8 engine delivering 611bhp and 720Nm of torque, which should...

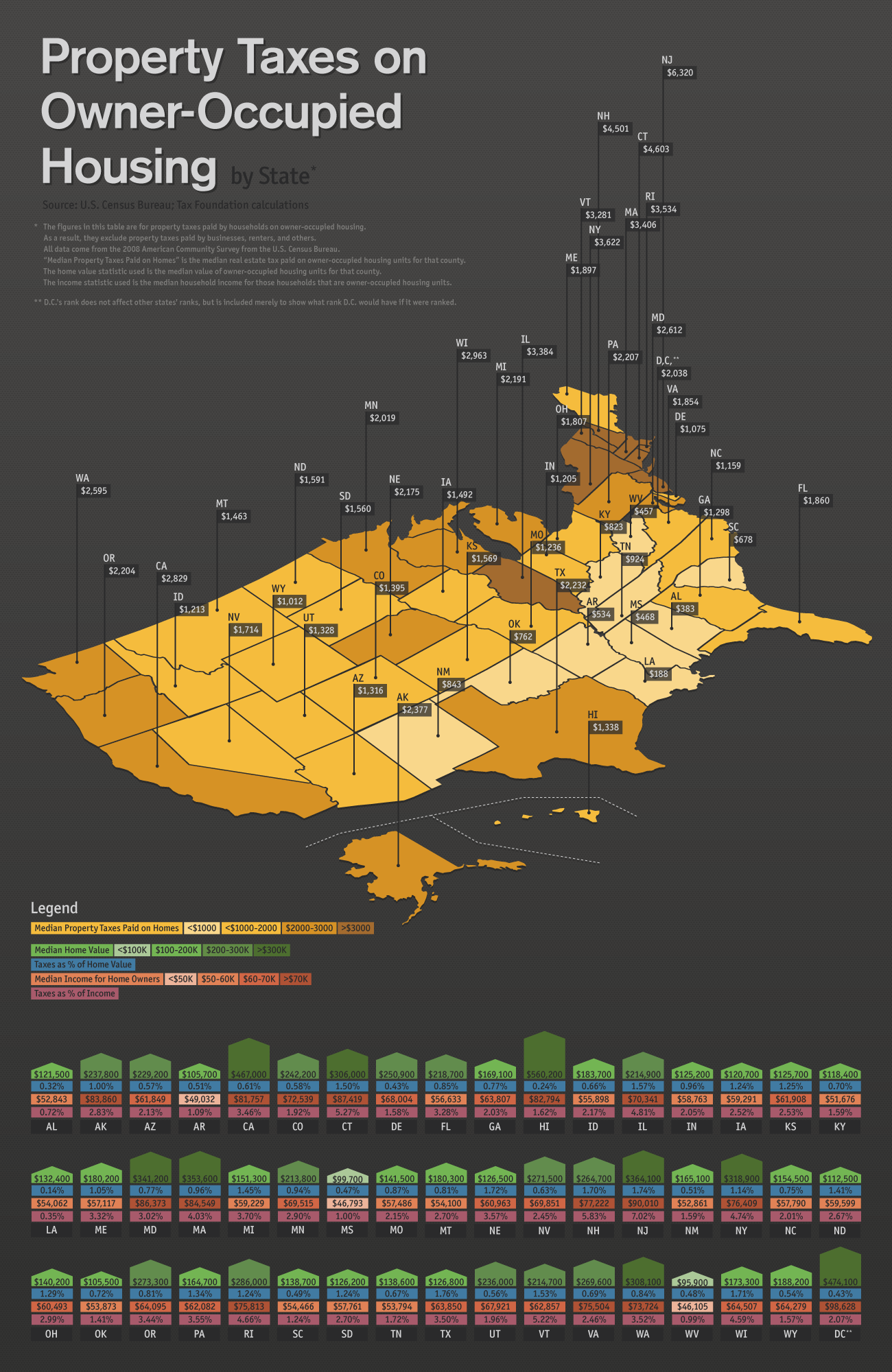

Property Taxes in America

Median household property tax by Credit Loan. The median reflects the mix of houses, local school districts, government spending,...

Median household property tax by Credit Loan. The median reflects the mix of houses, local school districts, government spending,...