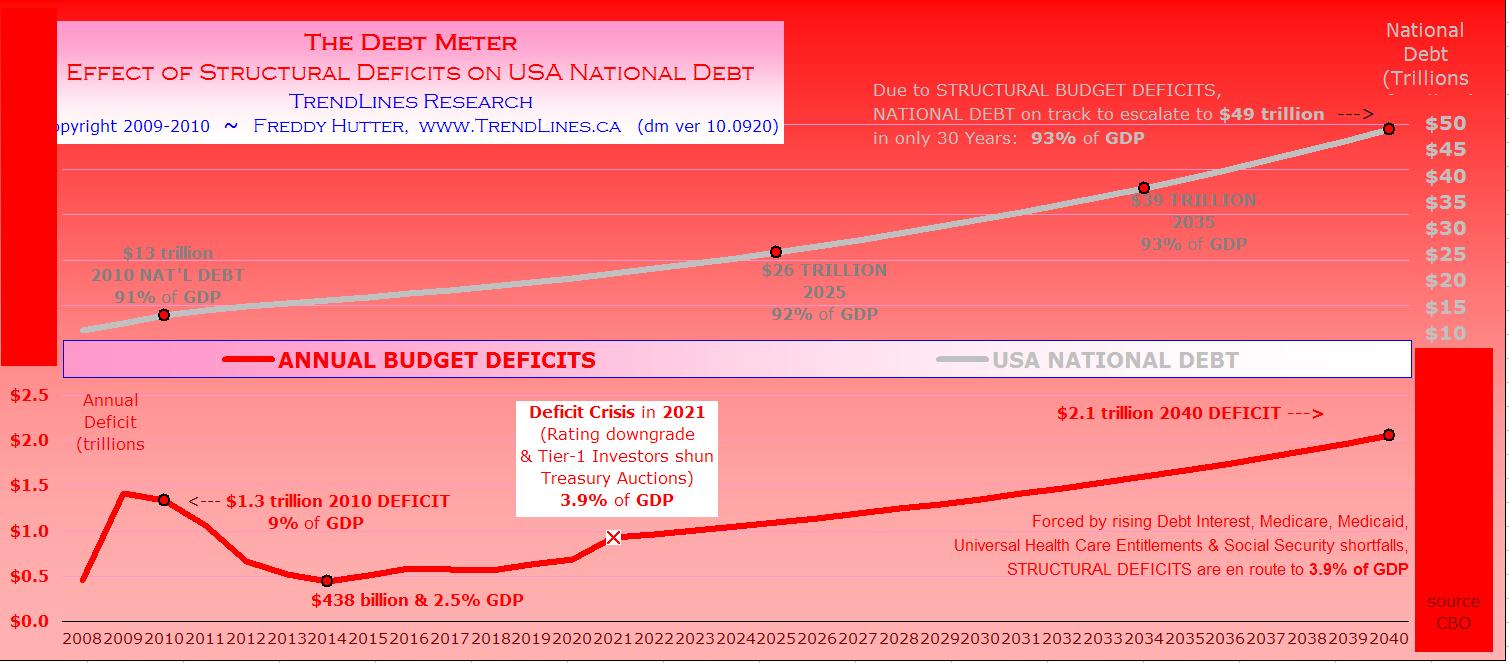

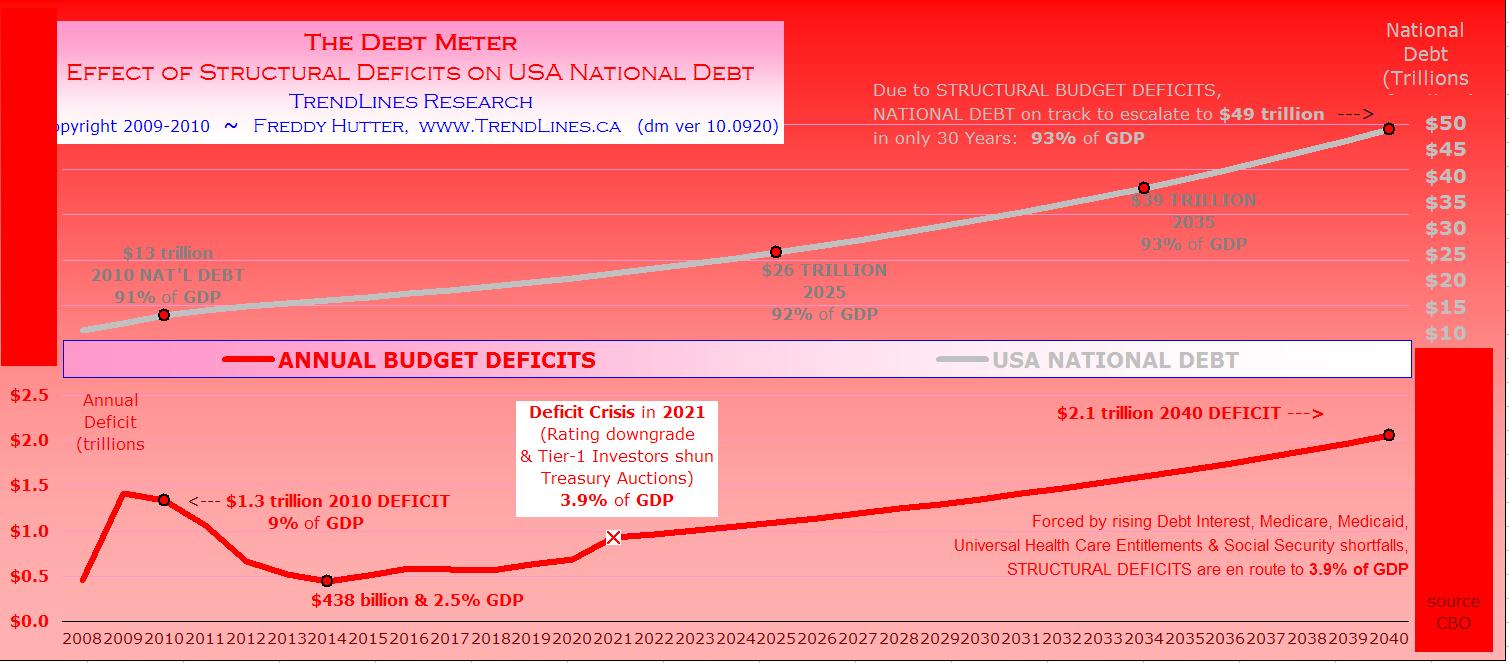

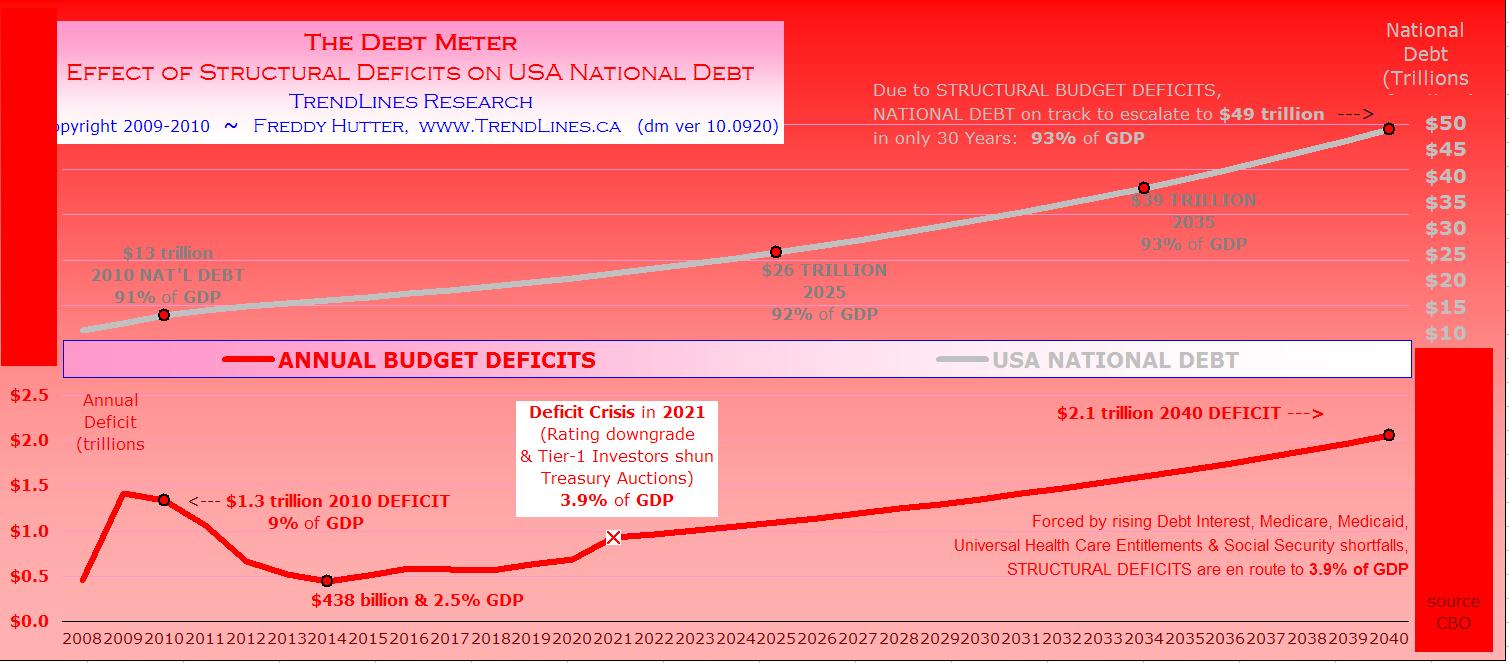

Terrific charts via Freddy Hutter of Trendlines Research, showing long term structural deficits. > Effect of Structural Deficits on...

Terrific charts via Freddy Hutter of Trendlines Research, showing long term structural deficits. > Effect of Structural Deficits on...

Read More

Visit msnbc.com for breaking news, world news, and news about the economy

Read More

Joseph Saluzzi (jsaluzzi-at-ThemisTrading.com) and Sal L. Arnuk (sarnuk-at-ThemisTrading.com) are co-heads of the equity trading desk at...

Read More

I’ve previously mentioned the Dollar Redesign project from Richard Smith. Every now and again, a new design catches my eye. Dowling...

I’ve previously mentioned the Dollar Redesign project from Richard Smith. Every now and again, a new design catches my eye. Dowling...

Read More

Aug New Home sales, a measure of contract signings now 4 months removed from the home buying tax credit, was 7k units below expectations...

Read More

Apropos of our earlier Volcker discussion, consider this classic an indictment of the Business Schools Tall Paul referenced: > Via...

Apropos of our earlier Volcker discussion, consider this classic an indictment of the Business Schools Tall Paul referenced: > Via...

Read More

Insight on her appointment to the new consumer protection agency, with Elizabeth Warren, assistant to President Obama. She seems so...

Read More

I’ve been talking about the rise in commodity prices for a while now (CRB raw industrials sub index was up yesterday for the 8th...

Read More

Peter T Treadway, PhD Historical Analytics LLC www.thedismaloptimist.com September 23, 2010 > The legendary Muhammad Ali developed a...

Read More

“Normal distribution curves — if I would submit to you — do not exist in financial markets. Its not that they are fat tails,...

Read More

Terrific charts via Freddy Hutter of Trendlines Research, showing long term structural deficits. > Effect of Structural Deficits on...

Terrific charts via Freddy Hutter of Trendlines Research, showing long term structural deficits. > Effect of Structural Deficits on...

Terrific charts via Freddy Hutter of Trendlines Research, showing long term structural deficits. > Effect of Structural Deficits on...

Terrific charts via Freddy Hutter of Trendlines Research, showing long term structural deficits. > Effect of Structural Deficits on...