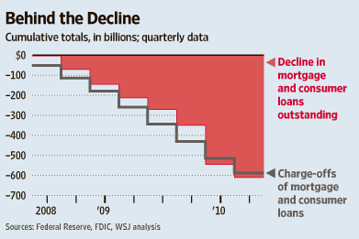

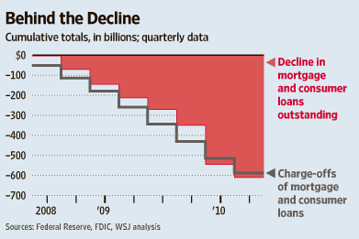

Real Time Economics references the Fed’s Z.1 Flow of Funds Accounts released Friday. What some economists have been assuming was...

Real Time Economics references the Fed’s Z.1 Flow of Funds Accounts released Friday. What some economists have been assuming was...

Read More

The Sept NAHB home builder sentiment index was unchanged at 13 holding at the lowest since March ’09 but was 1 pt below...

Read More

The NBER has officially dated the end of the Great Recession June 2009: The Business Cycle Dating Committee of the National Bureau of...

The NBER has officially dated the end of the Great Recession June 2009: The Business Cycle Dating Committee of the National Bureau of...

Read More

There was a ton of data released last week, some of which we only get quarterly or annually. It would be virtually impossible to...

There was a ton of data released last week, some of which we only get quarterly or annually. It would be virtually impossible to...

Read More

David R. Kotok Chairman and Chief Investment Officer P. T. F. S. D. September 19, 2010 > For the last two years, American investors...

Read More

With Obama’s town hall talk today and the FOMC meeting Tues, we will hear again that from both a fiscal and monetary policy view,...

Read More

I wanted to share an interesting email exchange from this weekend. “R” writes: “You occasionally shred an argument with...

Read More

“In some ways Herbert Hoover got a bad rap,” says David Stockman in an interview with WSJ’s Alan Murray. The Former...

Read More

Congratulations to the 6 newest members of the FDIC class of 2010 bank closings! > Charts courtesy of Ron Griess of The Chart Store

Congratulations to the 6 newest members of the FDIC class of 2010 bank closings! > Charts courtesy of Ron Griess of The Chart Store

Read More

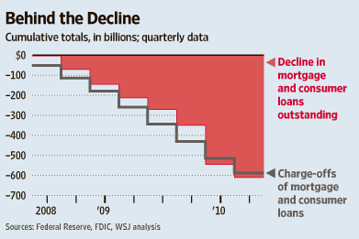

Real Time Economics references the Fed’s Z.1 Flow of Funds Accounts released Friday. What some economists have been assuming was...

Real Time Economics references the Fed’s Z.1 Flow of Funds Accounts released Friday. What some economists have been assuming was...

Real Time Economics references the Fed’s Z.1 Flow of Funds Accounts released Friday. What some economists have been assuming was...

Real Time Economics references the Fed’s Z.1 Flow of Funds Accounts released Friday. What some economists have been assuming was...