P.R.I.N.T. Money

Parody of the Free Credit Report.com “New Car” ad featuring U.S. financial heads Ben Bernanke, Hank Paulson, and Timothy...

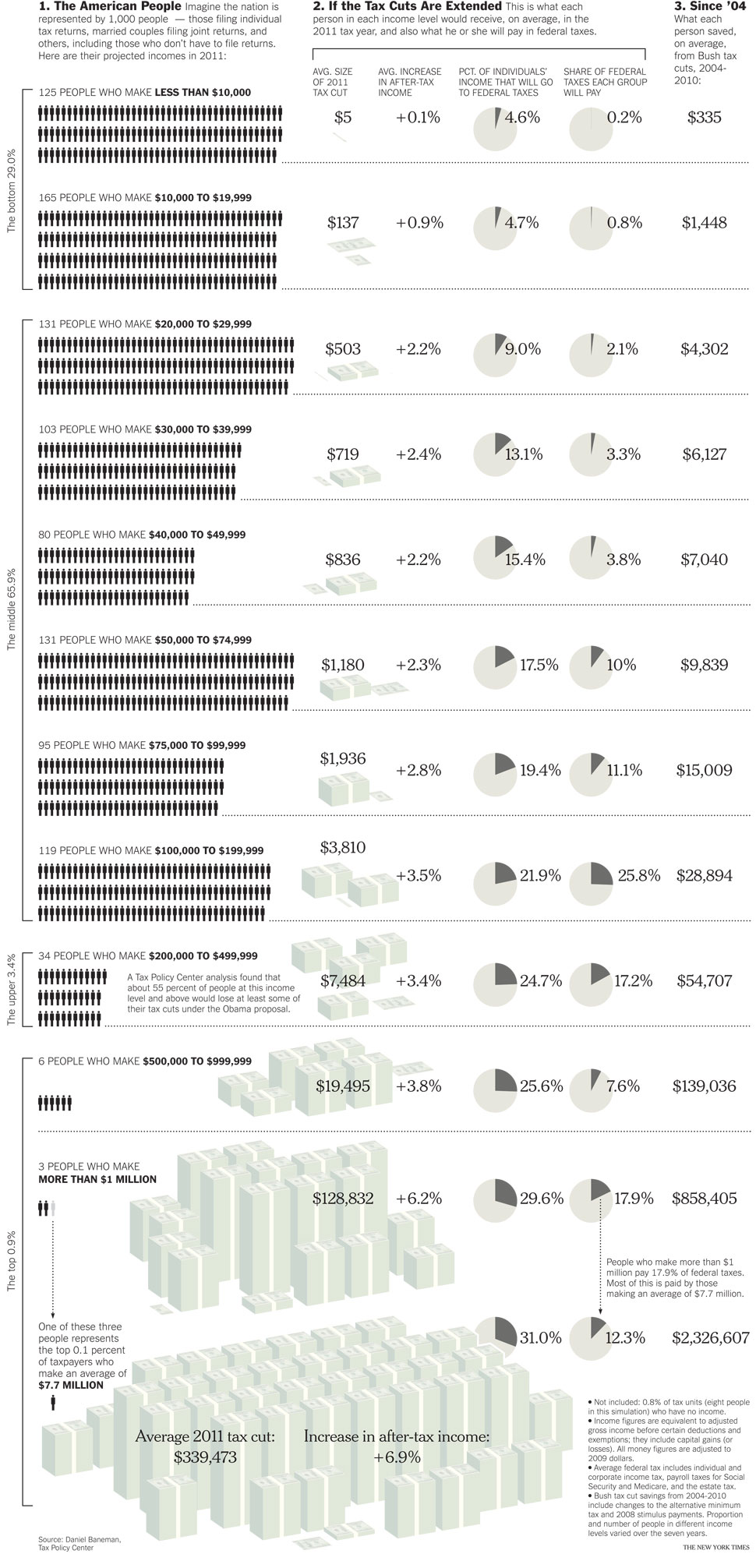

The NYTimes graphic department has your Sunday morning chart porn regarding the extension of tax cuts. Its an illustration fueled by data...

The NYTimes graphic department has your Sunday morning chart porn regarding the extension of tax cuts. Its an illustration fueled by data...

The Chances of a Double Dip September 17, 2010 Dr. Gary Shilling > Dr. Gary Shilling graciously agreed to condense his September...

The Chances of a Double Dip September 17, 2010 Dr. Gary Shilling > Dr. Gary Shilling graciously agreed to condense his September...

Get subscriber-only insights and news delivered by Barry every two weeks.