Post-Crisis Aftershocks

Nothing in the financial reform bill can prevent another housing bubble, Robert Shiller, a Yale economics professor and co-creator of the...

WhatTF is going on with our weather? NYC got hit with 5 micro tornadoes — upturning trees, moving cars, disrupting rail and...

WhatTF is going on with our weather? NYC got hit with 5 micro tornadoes — upturning trees, moving cars, disrupting rail and...

> Back on the Kudlow Report at 7:00 pm this evening to discuss RE, mortgage mods, prices, foreclosures, and maybe even some housing....

> Back on the Kudlow Report at 7:00 pm this evening to discuss RE, mortgage mods, prices, foreclosures, and maybe even some housing....

BNN speaks to Diane Brady. senior editor, Bloomberg BusinessWeek, and Barry Ritholtz, CE and director of equity research, Fusion IQ. >...

BNN speaks to Diane Brady. senior editor, Bloomberg BusinessWeek, and Barry Ritholtz, CE and director of equity research, Fusion IQ. >...

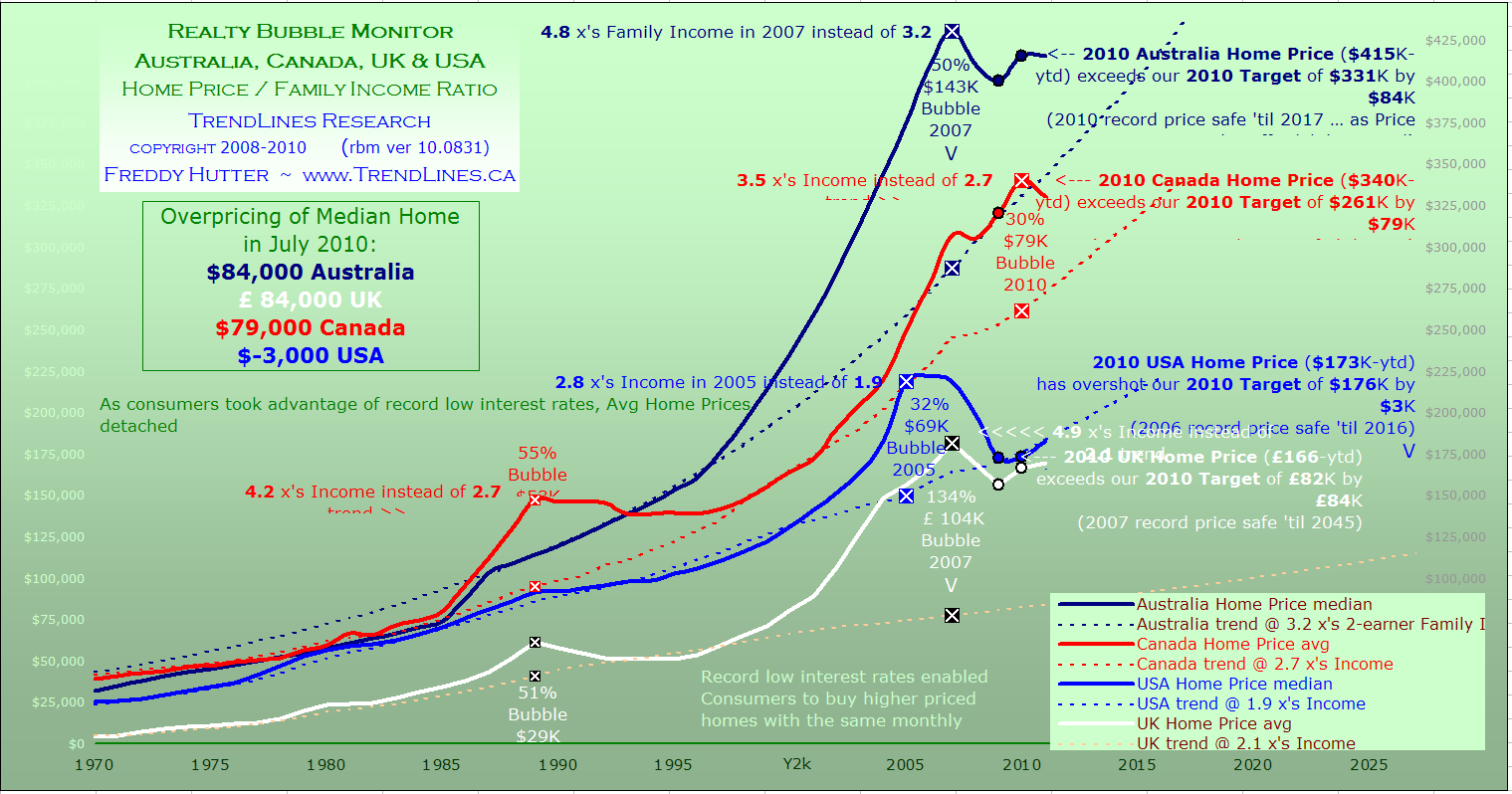

Terrific pair of long term housing charts, via Freddy Hunter of Realty Bubble Monitor. > Home Price / Family Income Ratio: Overpricing...

Terrific pair of long term housing charts, via Freddy Hunter of Realty Bubble Monitor. > Home Price / Family Income Ratio: Overpricing...

Get subscriber-only insights and news delivered by Barry every two weeks.