The higher they go, the more they love ’em

As we all know, stock prices are the only thing where the higher they go, the more people want to buy and the lower they go, the more...

Cassandra Does Tokyo is a former hedge fund manager and ex NY Trader, who is now living abroad. ~~~ ETFs clearly can provide some...

Cassandra Does Tokyo is a former hedge fund manager and ex NY Trader, who is now living abroad. ~~~ ETFs clearly can provide some...

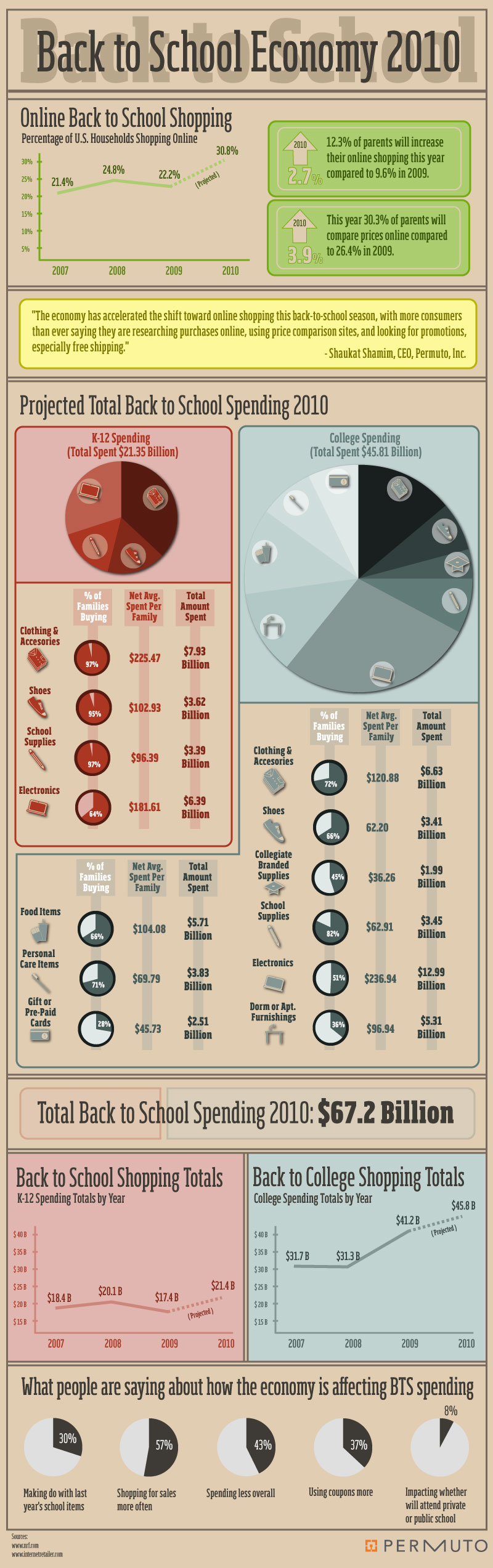

Permuto: Second only to Christmas, back to school is the most important indicator of the annual retail climate, revealing whether or not...

Permuto: Second only to Christmas, back to school is the most important indicator of the annual retail climate, revealing whether or not...

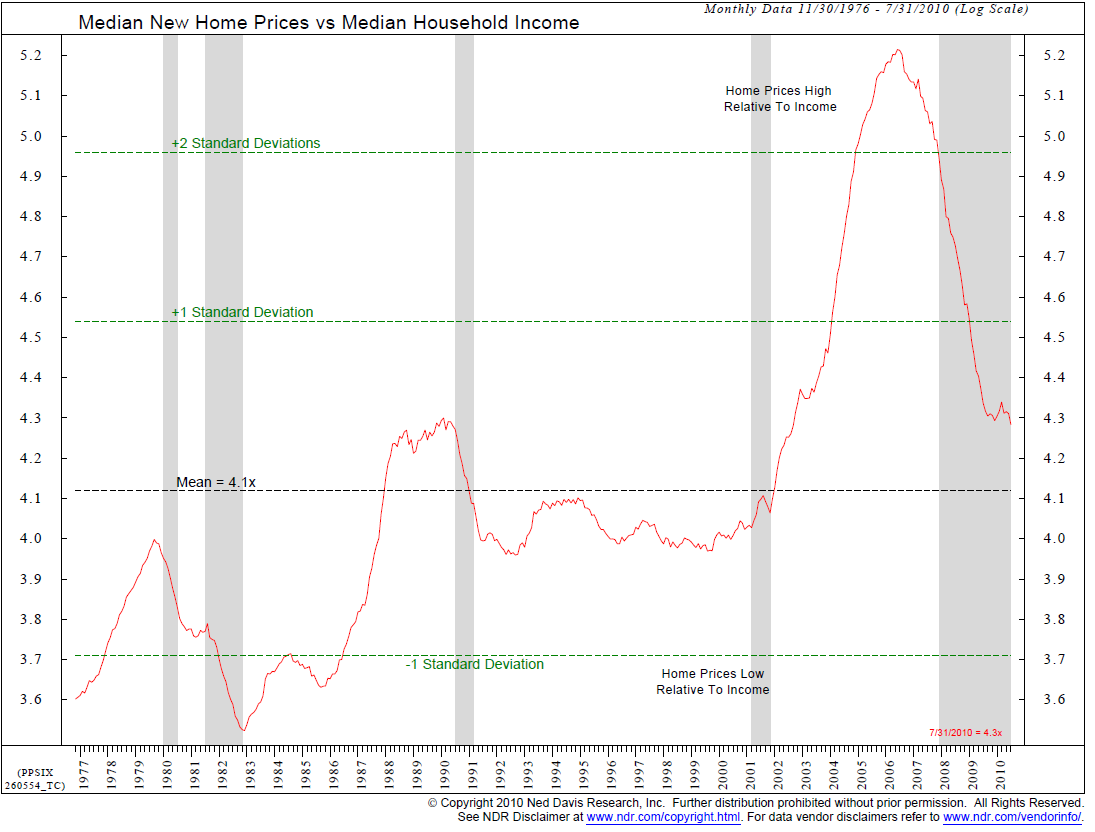

As mentioned earlier this morning, courtesy of Ned Davis Research are these two updated charts, as of the end of Q2. (Click thru...

As mentioned earlier this morning, courtesy of Ned Davis Research are these two updated charts, as of the end of Q2. (Click thru...

I love this Hoodie with a huge open palm on the front with a zipper running between the middle and ring finger — unzip it, and . ....

I love this Hoodie with a huge open palm on the front with a zipper running between the middle and ring finger — unzip it, and . ....

Get subscriber-only insights and news delivered by Barry every two weeks.