Japan takes on daily $4T market

What’s the best quote to describe Japan’s decision to intervene in the FX market to weaken the Yen, “Desperate times...

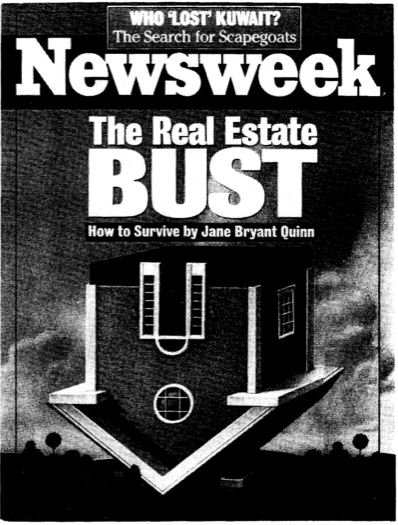

As a follow up to yesterday’s look at Time magazine’s Housing covers, Paul Macrae Montgomery of Universal Economics was kind...

As a follow up to yesterday’s look at Time magazine’s Housing covers, Paul Macrae Montgomery of Universal Economics was kind...

Jeff Hirsch is editor-in-chief of The Stock Trader’s Almanac, Commodity Trader’s Almanac, and Almanac Investor eNewsletter....

Jeff Hirsch is editor-in-chief of The Stock Trader’s Almanac, Commodity Trader’s Almanac, and Almanac Investor eNewsletter....

I have a commentary on the Time Magazine article coming this week — I find it is both inaccurate and misleading — but...

I have a commentary on the Time Magazine article coming this week — I find it is both inaccurate and misleading — but...

Get subscriber-only insights and news delivered by Barry every two weeks.