FINRA Censures “Illicit Equities Trading Strategy”...

Interesting development on the high frequency trader issue: FINRA, the self regulatory arm of the financial services industry, sanctioned...

One of my favorite analysts is Albert Edwards of Societe Generale in London. Acerbic, witty and brilliant. Emphasis on brilliant. The...

One of my favorite analysts is Albert Edwards of Societe Generale in London. Acerbic, witty and brilliant. Emphasis on brilliant. The...

> If you are anywhere near a radio this mornings, I will be the morning guest on “Bloomberg Surveillance,” with hosts Tom Keene...

> If you are anywhere near a radio this mornings, I will be the morning guest on “Bloomberg Surveillance,” with hosts Tom Keene...

> I will be swinging by Dylan’s place this afternoon about 4:20pm to discuss the stimulus, tax cuts and infrastructure spending....

> I will be swinging by Dylan’s place this afternoon about 4:20pm to discuss the stimulus, tax cuts and infrastructure spending....

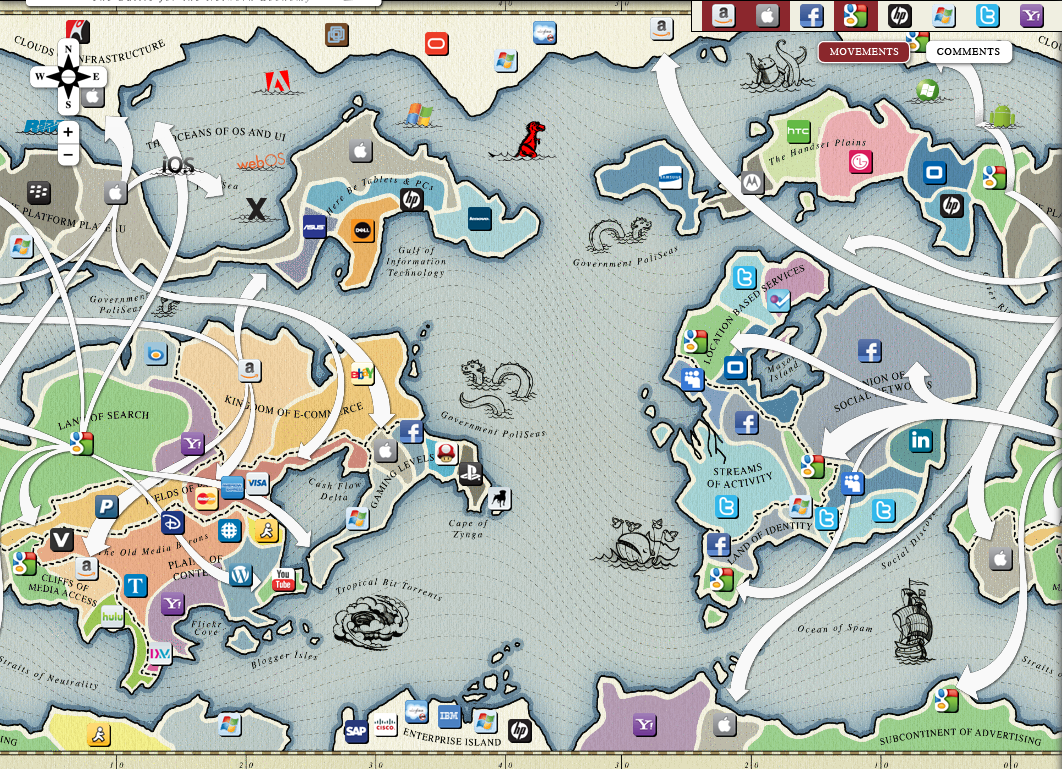

Cool interactive map showing “how a handful of major actors in the Internet Economy are moving from their bases of power into other...

Cool interactive map showing “how a handful of major actors in the Internet Economy are moving from their bases of power into other...

Get subscriber-only insights and news delivered by Barry every two weeks.