Less Cash, More Equity

I have a quote in today’s Ahead of the Tape column in the WSJ regarding the improving tenor in the markets post-August: “The...

> Martin Wolf, who has been more right during the period leading up to the crisis, and thereafter, than anyone else I can think of,...

> Martin Wolf, who has been more right during the period leading up to the crisis, and thereafter, than anyone else I can think of,...

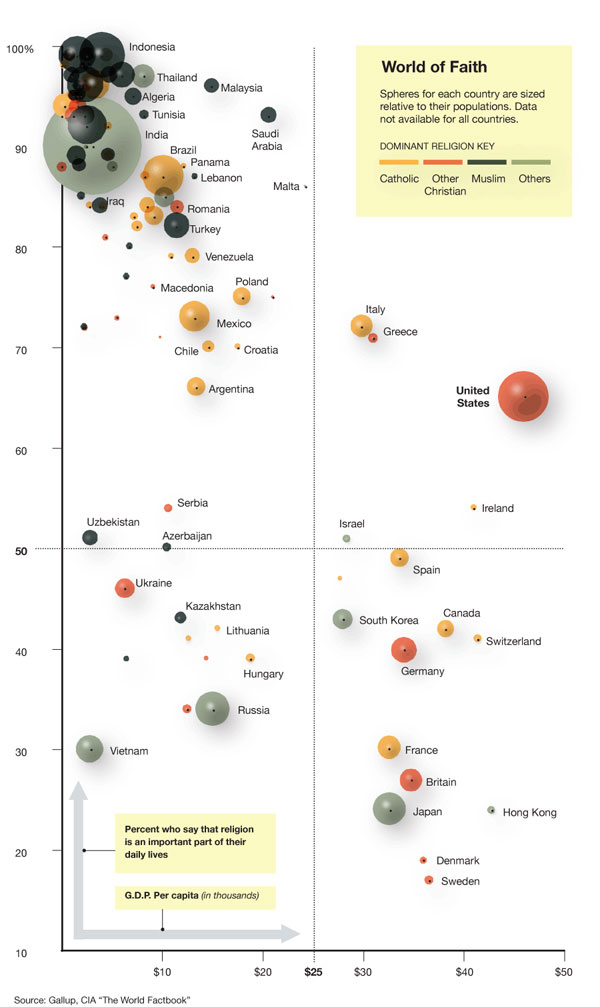

Religion has a surprisingly high correlation with poverty, according to a Gallup survey conducted in more than 100 countries. The more...

Religion has a surprisingly high correlation with poverty, according to a Gallup survey conducted in more than 100 countries. The more...

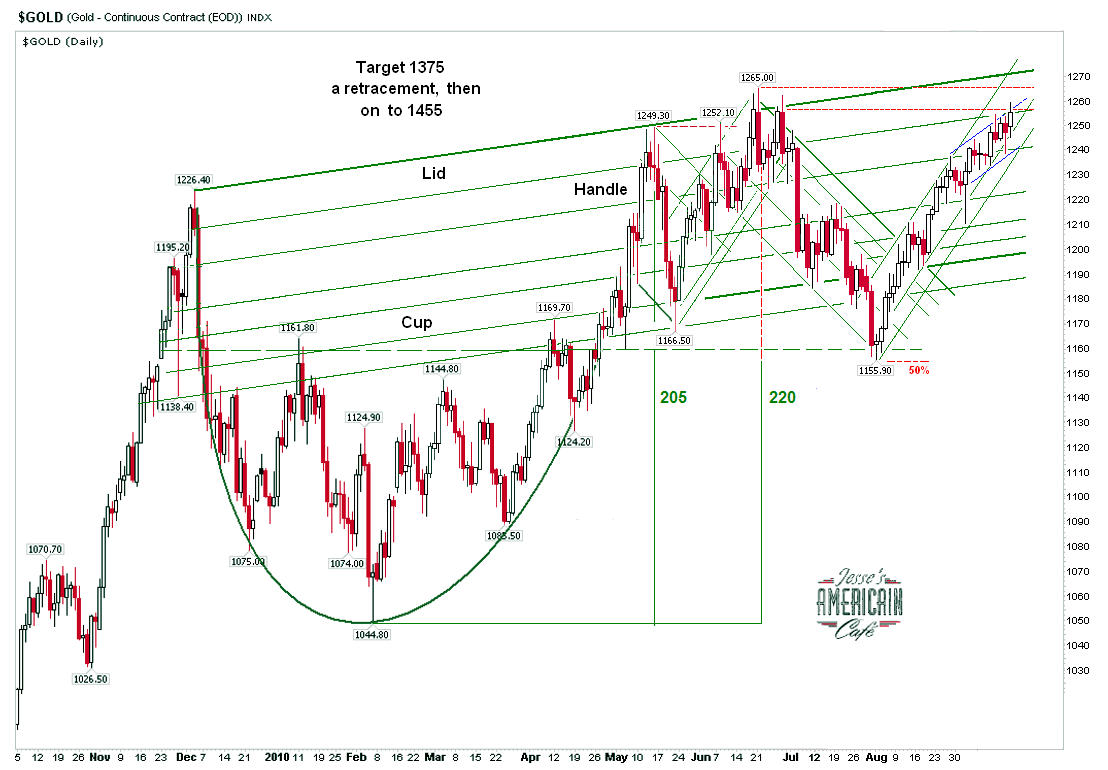

Interesting chart forwarded to me by GW — I am not sure precisely what to make of this: > click for larger graph Source: Gold Daily

Interesting chart forwarded to me by GW — I am not sure precisely what to make of this: > click for larger graph Source: Gold Daily

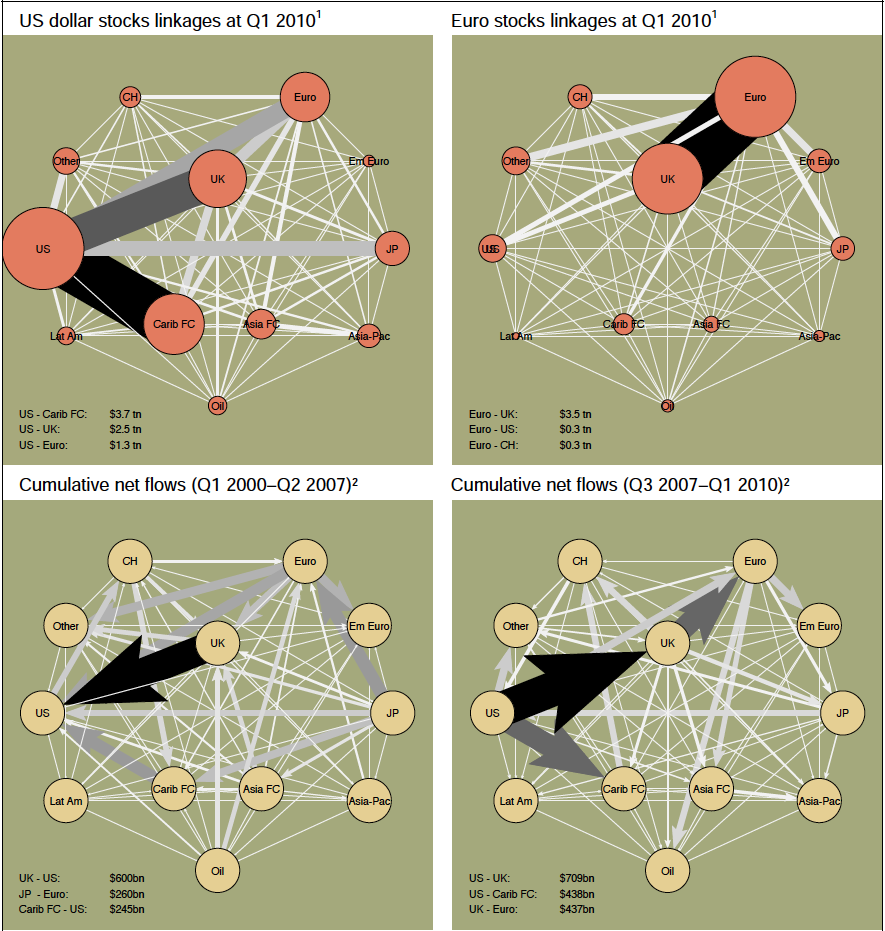

Fascinating chart in the BIS Quarterly Review that helps to explain how any banking crisis can go viral, infecting the entire globe: >...

Fascinating chart in the BIS Quarterly Review that helps to explain how any banking crisis can go viral, infecting the entire globe: >...

Get subscriber-only insights and news delivered by Barry every two weeks.