Today’s chart porn is a quick look at major world indices since January 2000, via the always excellent D-Short. > click for...

Today’s chart porn is a quick look at major world indices since January 2000, via the always excellent D-Short. > click for...

Read More

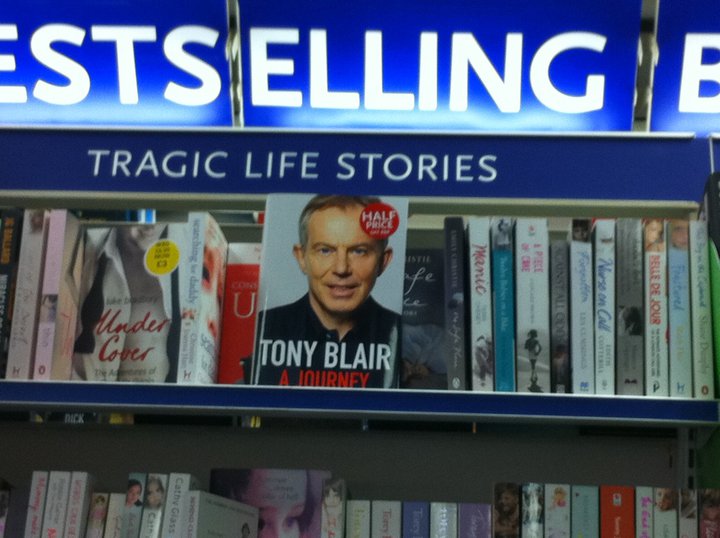

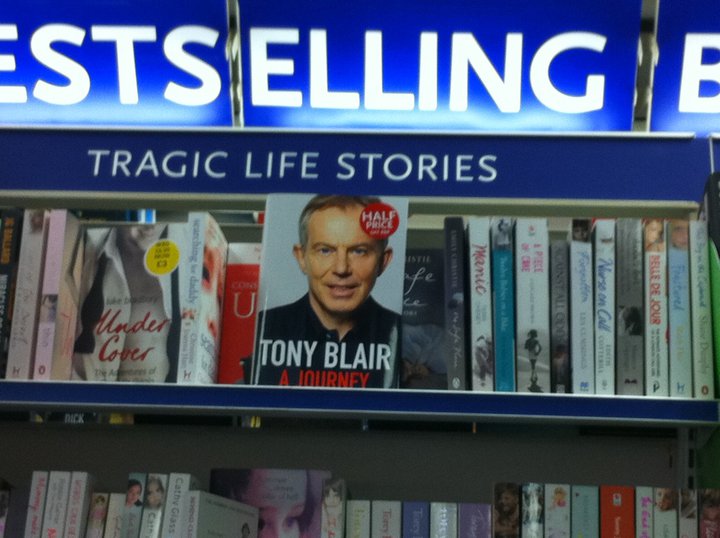

I am trying (as a stateside NYer) to wrap my head around these (hilarious) photos from a Facebook group called Subversively. Apparently,...

I am trying (as a stateside NYer) to wrap my head around these (hilarious) photos from a Facebook group called Subversively. Apparently,...

Read More

Fantastic bike: > from Rhinebeck Grand National Meet: Newly restored bike owned by Frank Westfall of Syracuse, NY. Originally built by...

Fantastic bike: > from Rhinebeck Grand National Meet: Newly restored bike owned by Frank Westfall of Syracuse, NY. Originally built by...

Read More

Using the generic futures contract on Bloomberg, gold is rallying to match its all time record high at $1,257ish. With very little...

Read More

Robert Shiller, Professor of Economics at Yale University, sits down with Simon Constable to discuss the sharp falloff in home sales, the...

Read More

Amongst the items coming out of the FCIC hearings last week were new docs that revealed exactly how over-reliant LEH was on daily, short...

Read More

Using the generic futures contract on Bloomberg, gold is rallying to match its all time record high at $1,257ish. With very little...

Read More

Following last week’s beat the economic #, (as opposed to great data) pre holiday, beginning of the month stock market rally, the...

Read More

Following last week’s beat the economic #, (as opposed to great data) pre holiday, beginning of the month stock market rally, the...

Read More

Earlier this month, Jeff Miller posted an interesting discussion about The Fly on the Wall litigation (lower court decision here;...

Read More

Today’s chart porn is a quick look at major world indices since January 2000, via the always excellent D-Short. > click for...

Today’s chart porn is a quick look at major world indices since January 2000, via the always excellent D-Short. > click for...

Today’s chart porn is a quick look at major world indices since January 2000, via the always excellent D-Short. > click for...

Today’s chart porn is a quick look at major world indices since January 2000, via the always excellent D-Short. > click for...