This song has been stuck in my head for weeks now: “(Do The) Push and Pull (Part 1)” is a 1970 single by Rufus Thomas. This...

Read More

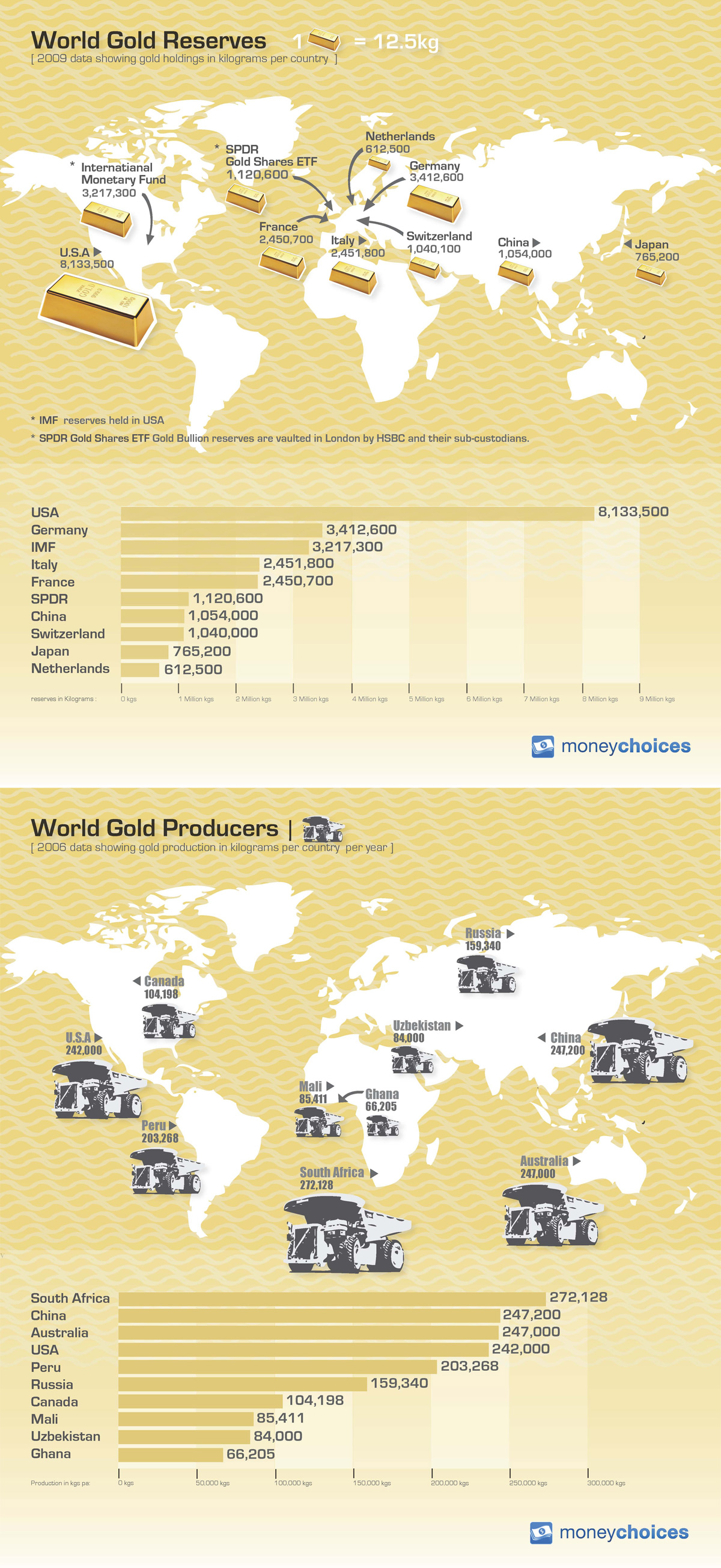

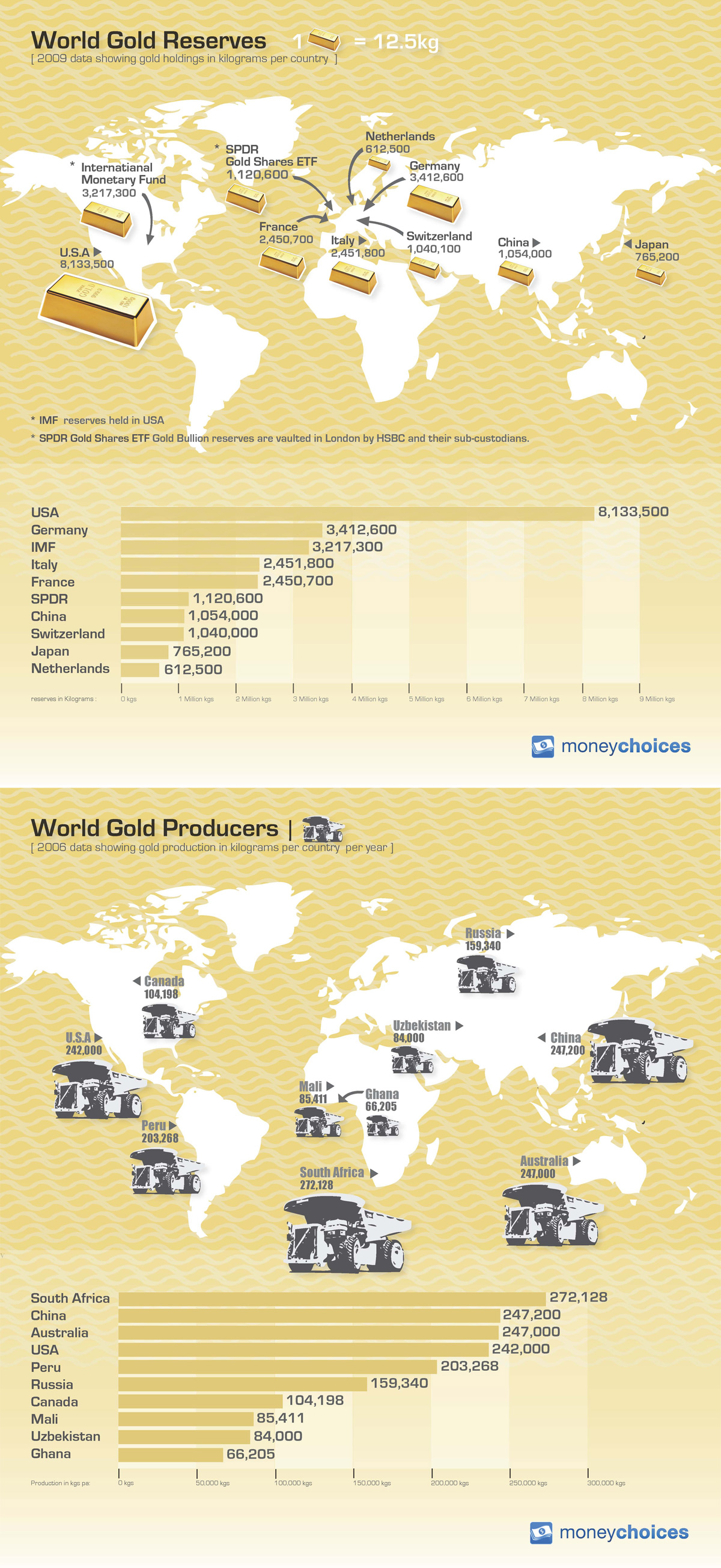

Ever wonder which countries have the biggest gold reserves? Which countries produced the most gold? Now, via Money Hacker, you know...

Ever wonder which countries have the biggest gold reserves? Which countries produced the most gold? Now, via Money Hacker, you know...

Read More

George Mobus teaches computer science to undergraduate and graduate students at the Institute of Technology, Computing & Software...

George Mobus teaches computer science to undergraduate and graduate students at the Institute of Technology, Computing & Software...

Read More

I did a few Yahoo Tech Ticker videos with Henry Blodget on Wednesday (9/1/10), Readers have asked to be updated when these appear, so...

Read More

How Wall Street Made The Crisis Worse” by NPR’s Planet Money in collaboration with ProPublica This song, fondly entitled...

Read More

> Source: Bear Days of August Might be Over, Says Barry Ritholtz Stacy Curtin Yahoo Tech Ticker Sep 02,...

Read More

> The Palm Beach Post reference was to this group of realtors back in March 2007: Quote of the day: Realtors Get Real. Classic stuff ....

Read More

We are looking forward to a possible cooling of Employment in August — slower economic growth, weaker auto sales, softer than hoped...

Read More

Yesterday, we discussed Infrastructure spending, following the WSJ article on more tax cuts as a stimulus. We know from history that...

Read More

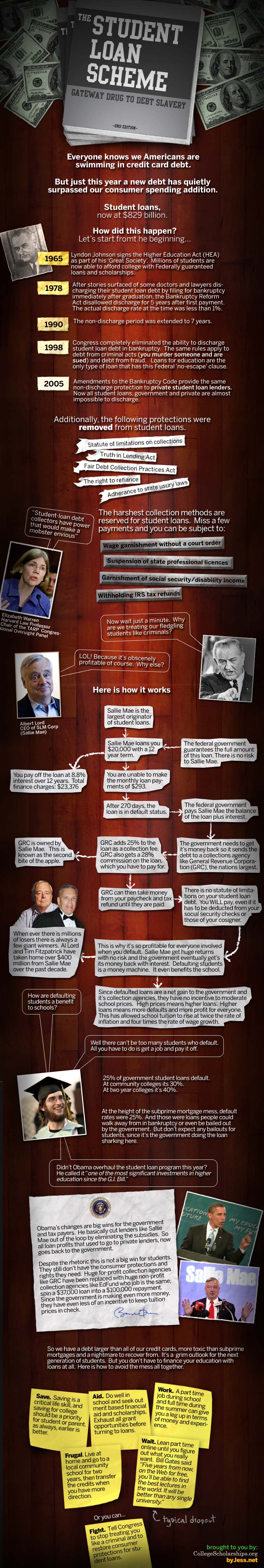

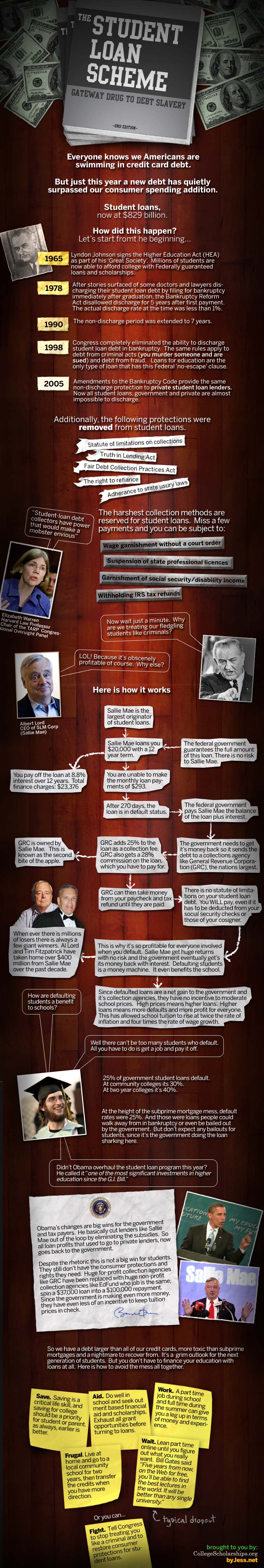

Do Student Loans Make Eduction Affordable ? You just assumed they did. It turns out to be a far seedier picture, if you ask College...

Do Student Loans Make Eduction Affordable ? You just assumed they did. It turns out to be a far seedier picture, if you ask College...

Read More