The Emperor, the Gladiator & the Lion

David R. Kotok Chairman and Chief Investment Officer The Emperor, the Gladiator & the Lion August 30, 2010 > The last surviving...

I’ve been kicking around an idea in my head and I finally decided to act on it. There are all these issues that I find interesting....

I’ve been kicking around an idea in my head and I finally decided to act on it. There are all these issues that I find interesting....

The EPA and the National Highway Traffic Safety Administration (NHTSA) are revising the fuel economy label that is required on all new...

The EPA and the National Highway Traffic Safety Administration (NHTSA) are revising the fuel economy label that is required on all new...

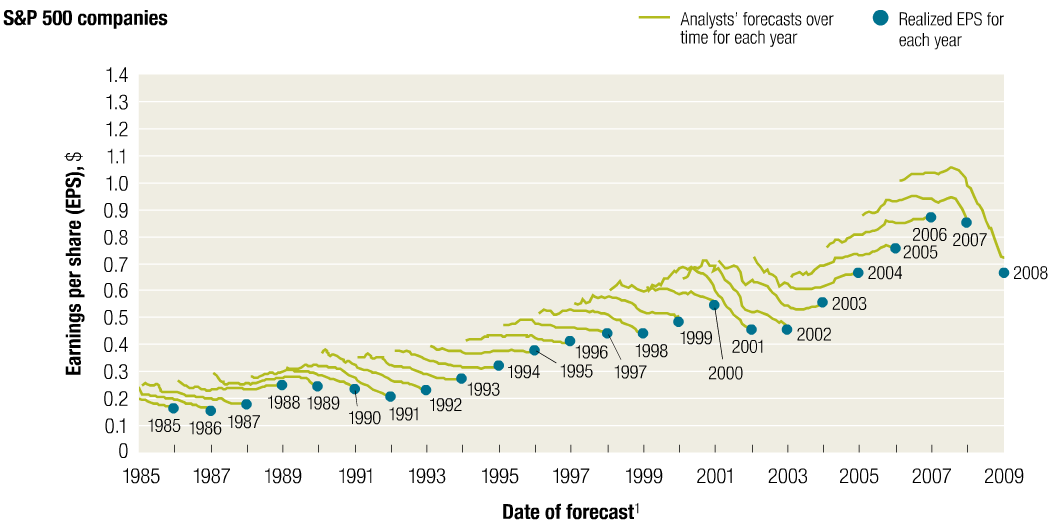

‘Boy these companies look pretty good, earnings are OK, they have plenty of cash. What if there’s a double dip?’ ‘I’m no...

‘Boy these companies look pretty good, earnings are OK, they have plenty of cash. What if there’s a double dip?’ ‘I’m no...

Get subscriber-only insights and news delivered by Barry every two weeks.