The Political Chemistry of Oil

In the Gulf oil spill’s aftermath, Lisa Margonelli says drilling moratoriums and executive ousters make for good theater, but...

On Friday, I mentioned an oddity on Amazon that I thought was weird: I could not complete the buying process until I agreed to sign up...

On Friday, I mentioned an oddity on Amazon that I thought was weird: I could not complete the buying process until I agreed to sign up...

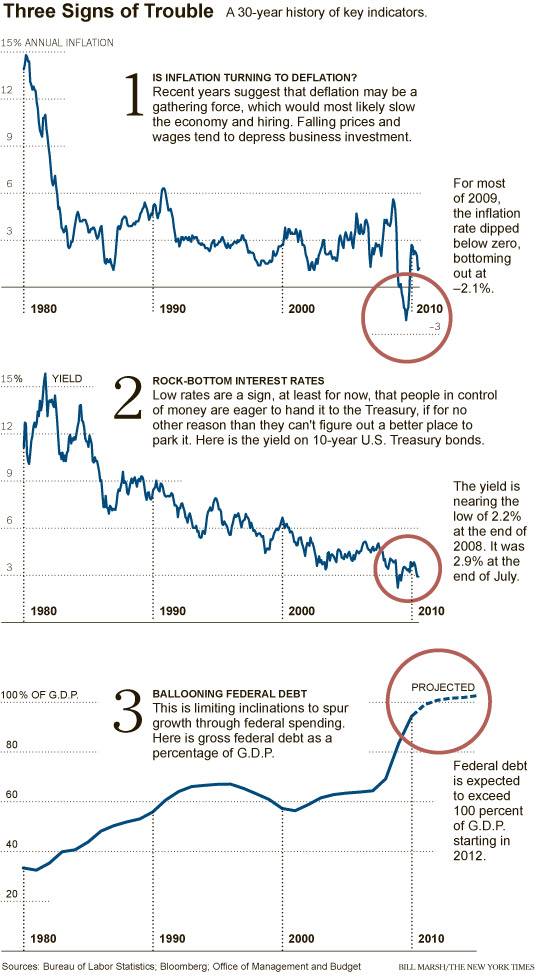

“Now I’m looking at the political system turning itself into a paralyzed beast. A lost decade now looms as a much bigger risk. The...

“Now I’m looking at the political system turning itself into a paralyzed beast. A lost decade now looms as a much bigger risk. The...

The Dark Side of Deficits August 27, 2010 By John Mauldin > Secular Bull and Bear Markets It’s Not the (Stupid) Economy The...

The Dark Side of Deficits August 27, 2010 By John Mauldin > Secular Bull and Bear Markets It’s Not the (Stupid) Economy The...

This is perfect for a Friday afternoon: An amusing romp thru Wall Street: > click for ginormous graphic > Via William Banzai7

This is perfect for a Friday afternoon: An amusing romp thru Wall Street: > click for ginormous graphic > Via William Banzai7

Get subscriber-only insights and news delivered by Barry every two weeks.