Inflation, Not Deflation, Mr. Bernanke

Inflation, Not Deflation, Mr. Bernanke Andy Xie 08.16.2010 18:12 > The global economy seems to be bifurcating into the ice-cold...

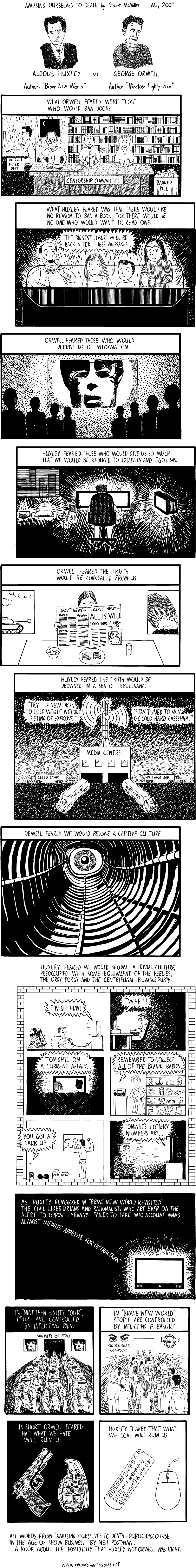

Fascinating graphic art looking into our title question over at Recombinant Records — an oddly intriguing series of cartoons by...

Fascinating graphic art looking into our title question over at Recombinant Records — an oddly intriguing series of cartoons by...

~~~ A Guide to Federal Reserve Monetary Policy, the Economy, and Financial Markets By James Welsh, Registered Investment...

~~~ A Guide to Federal Reserve Monetary Policy, the Economy, and Financial Markets By James Welsh, Registered Investment...

Get subscriber-only insights and news delivered by Barry every two weeks.