Seeking the Truth — Or Obscuring It?

Over the past few weeks, I have posted on an eclectic assortment of items. That is keeping with the blog’s sub-title: Macro...

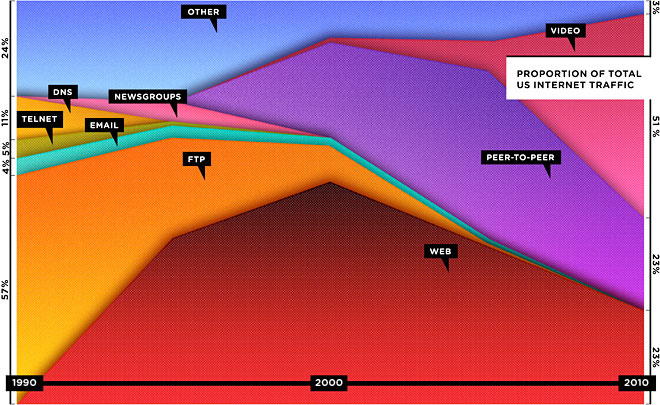

Wired has an odd little feature Web is Dead (Long Live the Internet) about their forecast from 1997 (Push!). They claimed way back then...

Wired has an odd little feature Web is Dead (Long Live the Internet) about their forecast from 1997 (Push!). They claimed way back then...

> Stephen J. Dubner, NYT journalist and co-author of the book Freakonomics, asks the following question at the Freakonomics/Times...

> Stephen J. Dubner, NYT journalist and co-author of the book Freakonomics, asks the following question at the Freakonomics/Times...

The 56 year cycle mentioned yesterday (“Periods When to Make Money” (© 1883) was picked up by FT Alphaville; we hear it caused some...

The 56 year cycle mentioned yesterday (“Periods When to Make Money” (© 1883) was picked up by FT Alphaville; we hear it caused some...

Get subscriber-only insights and news delivered by Barry every two weeks.