Felix Zulauf: Up Close And Personal (Transcript)

Earlier this month, I interviewed famed investor Felix Zulauf on his professional background and investment outlook (Audio here). As per...

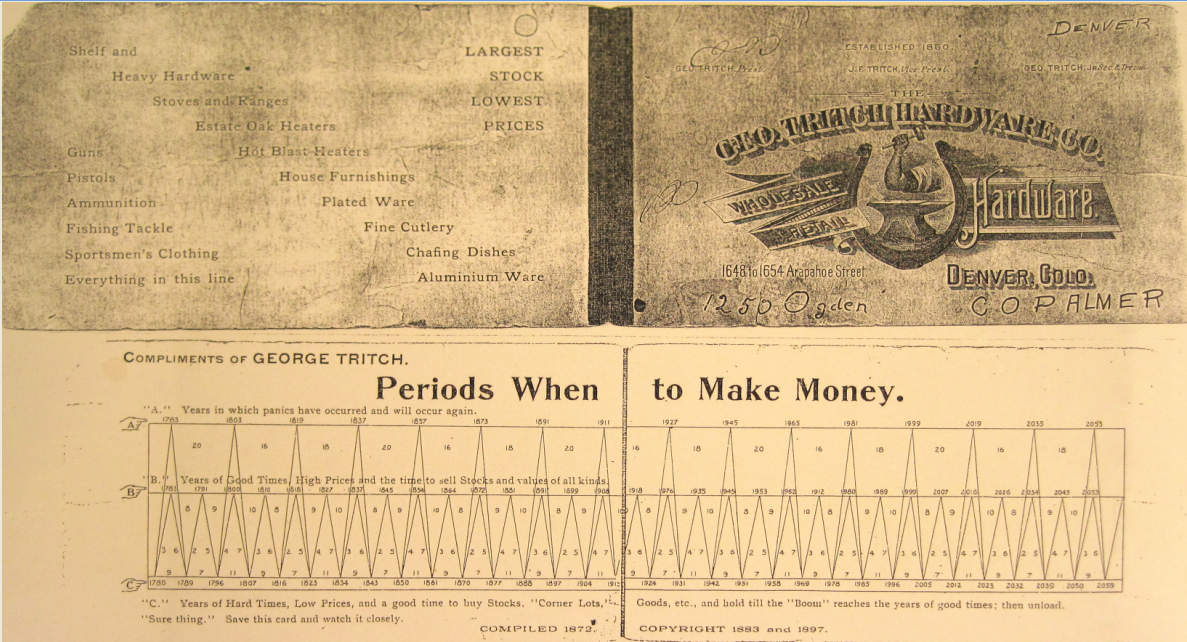

Yesterday, we looked at Long Term Market Cycles dating back to 1927; Today, lets have a look at periodicity dating back to 1763. The...

Yesterday, we looked at Long Term Market Cycles dating back to 1927; Today, lets have a look at periodicity dating back to 1763. The...

I am off to the Bloomberg Radio studios for an early segment with Keith McCullough of Hedge eye — he is substituting for the...

I am off to the Bloomberg Radio studios for an early segment with Keith McCullough of Hedge eye — he is substituting for the...

Via the Economist, we see this intriguing histogram of Global GDP (below) The Economist notes: “Data compiled by Angus Maddison, an...

Via the Economist, we see this intriguing histogram of Global GDP (below) The Economist notes: “Data compiled by Angus Maddison, an...

Ron Griess (The Chart Store) looks at the longer term market cycles of the last century. He divides them into 5 sections, 3 bears and 2...

Ron Griess (The Chart Store) looks at the longer term market cycles of the last century. He divides them into 5 sections, 3 bears and 2...

Get subscriber-only insights and news delivered by Barry every two weeks.