I bet these t shirts won’t age well . . . > Quit your Job with Style: Steven Slater Shirt

I bet these t shirts won’t age well . . . > Quit your Job with Style: Steven Slater Shirt

The Scientific Debate on Climate Change: Part 9, 10

9. Climate Change – Meet the Scientists In response to several requests, I’ll put references in the video description rather...

Succinct summation of the week’s events

Succinct summation of the week’s events: Positives: 1)UoM and ABC confidence bounce a touch off multi month lows 2)Chinese economic...

Succinct summation of the week’s events

Succinct summation of the week’s events: Positives 1)UoM and ABC confidence bounce a touch off multi month lows 2)Chinese economic...

Just Like Heaven

To counteract our Friday the 13th post, here is a lovely cover of The Cure’s Just Like Heaven from Katie Melua Some songs totally...

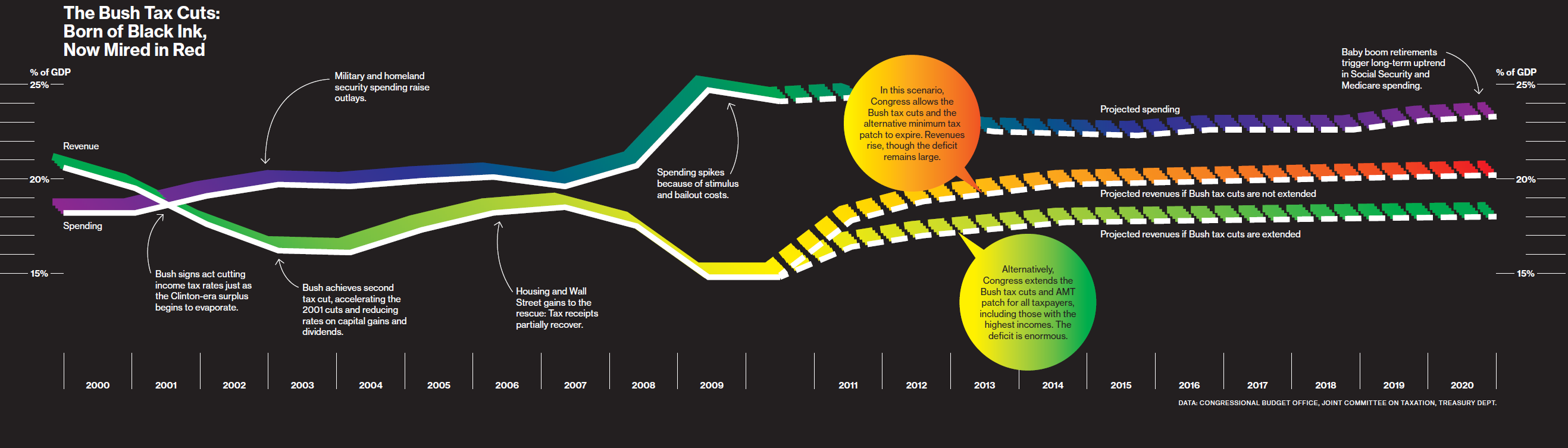

A Closer Look at the Bush Tax Cuts

The Bush Tax cuts seem to be dominating the debate about deficits and stimulus. I found two recent MSM articles (with graphics!) quite...

The Bush Tax cuts seem to be dominating the debate about deficits and stimulus. I found two recent MSM articles (with graphics!) quite...

The ‘Flations

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

David Rosenberg: Economic Cycle of Uncertainty

Discussing what’s next for the economy with David Rosenberg, of Gluskin Sheff; Richard Hoey, of BNY Mellon, and Sean Clark, of...

The Future of Finance

Did you know that the London School of Economics has a “Paul Woolley Centre for the Study of Capital Market...

Did you know that the London School of Economics has a “Paul Woolley Centre for the Study of Capital Market...