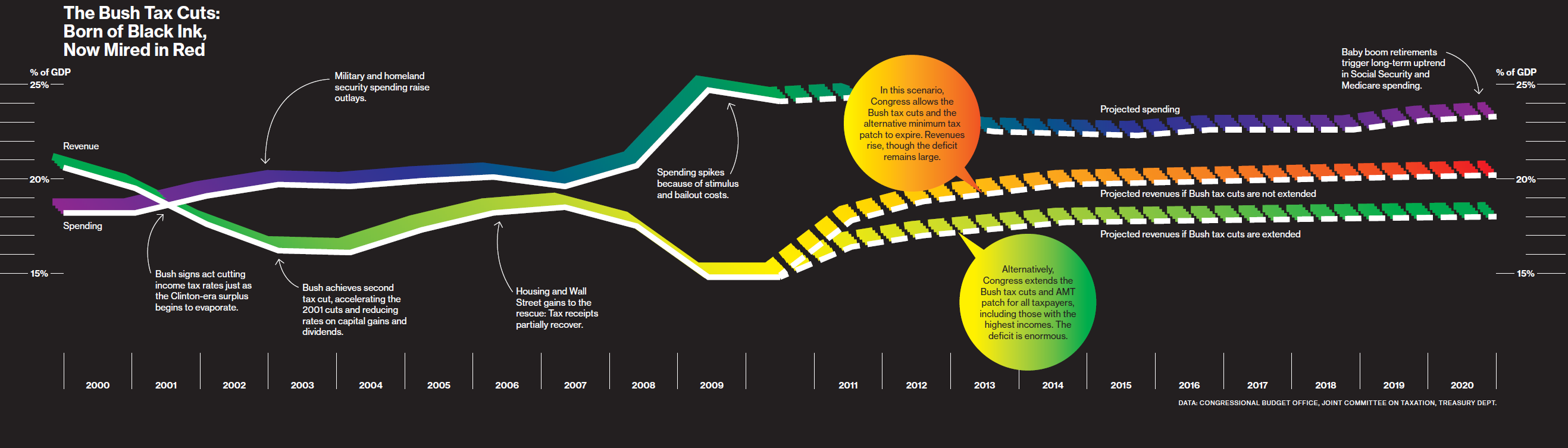

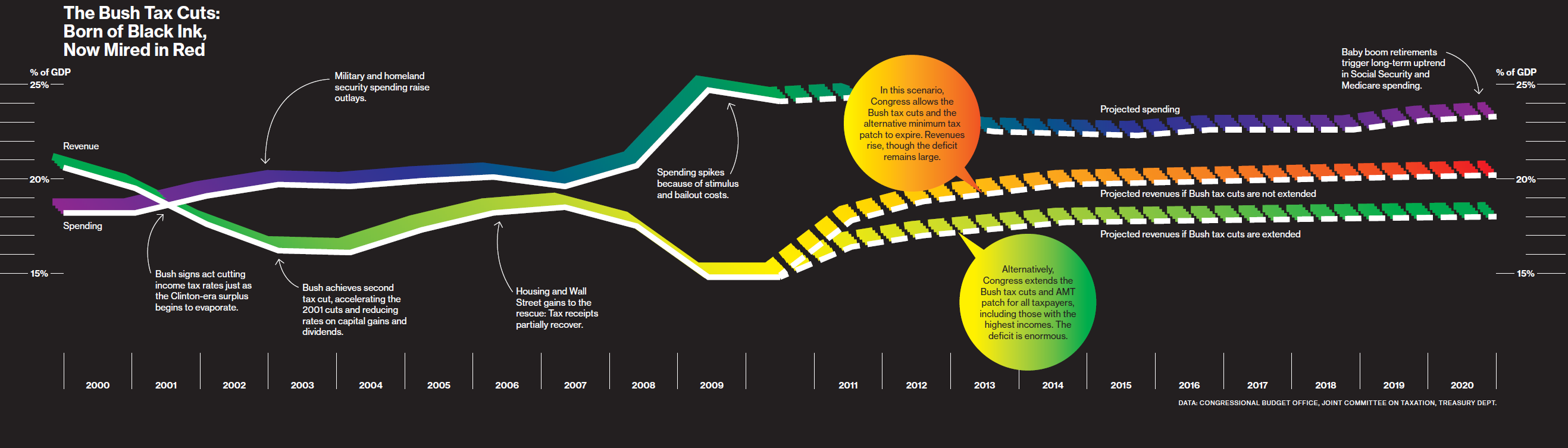

The Bush Tax cuts seem to be dominating the debate about deficits and stimulus. I found two recent MSM articles (with graphics!) quite...

The Bush Tax cuts seem to be dominating the debate about deficits and stimulus. I found two recent MSM articles (with graphics!) quite...

A Closer Look at the Bush Tax Cuts

The Bush Tax cuts seem to be dominating the debate about deficits and stimulus. I found two recent MSM articles (with graphics!) quite...

The Bush Tax cuts seem to be dominating the debate about deficits and stimulus. I found two recent MSM articles (with graphics!) quite...