“Something has to happen for this product to be marketable. I just find the whole thing ironic that FHA is providing financing for...

Read More

Some decidedly odd reading today, from (mostly) unusual sources: • The great false choice, stimulus or austerity (FT.com) • Themis...

Read More

The 30 yr bond auction, the part of the curve one can define as the leap of faith maturity in my opinion, was mixed. The yield was a...

Read More

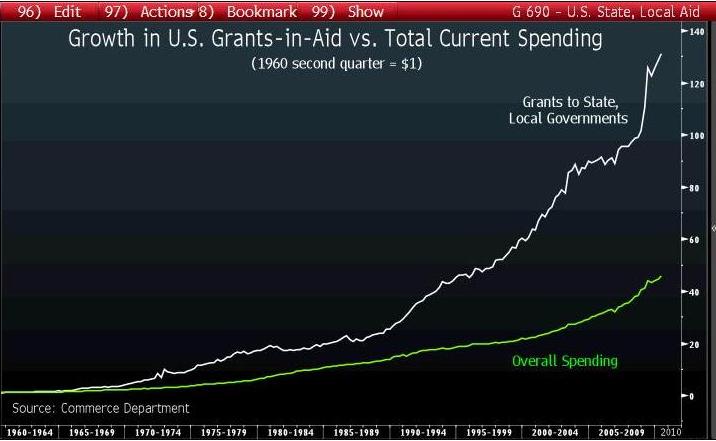

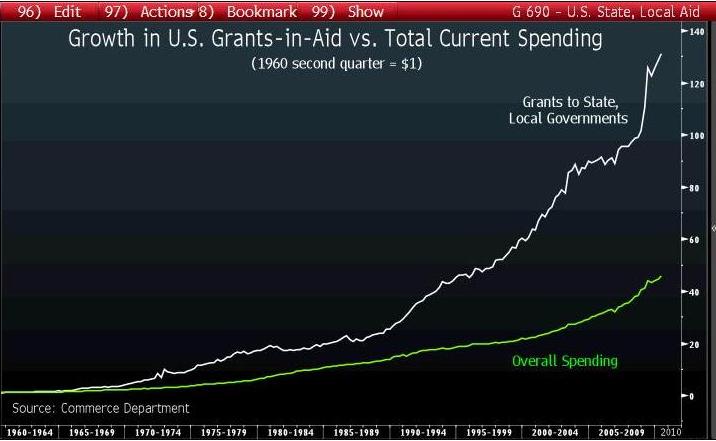

> Bloomberg’s Chart of the Day shows the growth in federal payouts to state and local governments, also known as grants-in-aid,...

> Bloomberg’s Chart of the Day shows the growth in federal payouts to state and local governments, also known as grants-in-aid,...

Read More

There are two OpEds in today’s New York Times regarding the GSEs. One of them is full of insight and intelligence and rationality....

Read More

Initial Jobless Claims totaled a disappointing 484k, 19k higher than expected and up from 482k last week. To smooth out the seasonal...

Read More

Following the July 21st comment from Bernanke that “the economic outlook remains unusually uncertain,” John Chambers of CSCO...

Read More

A few weeks ago, I mentioned we were 50% long, 50% cash (up from 100% cash in May), and were planning on selling into any rallies. Since...

Read More

Here is last night’s CNBC appearance: Starting at the 4 minute mark Airtime: Wed. Aug. 11 2010 | 7:05:0 10 ET Discussing...

Read More

> Bloomberg’s Chart of the Day shows the growth in federal payouts to state and local governments, also known as grants-in-aid,...

> Bloomberg’s Chart of the Day shows the growth in federal payouts to state and local governments, also known as grants-in-aid,...