The day after

If one of the Fed’s goals in yesterday’s statement was to instill confidence in the market that they will do anything to make...

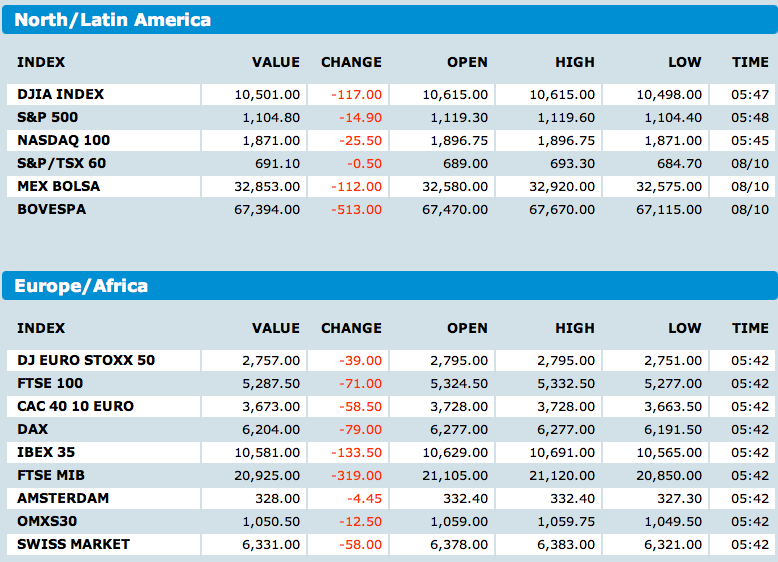

Futures are off on QE1.5, slowing US economic growth, and a slowdown in China. The Nikkei Dow fell -2.70%, while most European Bourses...

Futures are off on QE1.5, slowing US economic growth, and a slowdown in China. The Nikkei Dow fell -2.70%, while most European Bourses...

Here are a few (lower res) shots from Leen’s Lodge, Grand Lake Stream, and Big Lake: Soaring Eagle 19 Inch Freshwater Salmon Sunset...

Here are a few (lower res) shots from Leen’s Lodge, Grand Lake Stream, and Big Lake: Soaring Eagle 19 Inch Freshwater Salmon Sunset...

I try to find people to read who a) I disagree with 2) respect their methodology. It refines my arguments, and clarifies my thinking....

I try to find people to read who a) I disagree with 2) respect their methodology. It refines my arguments, and clarifies my thinking....

Get subscriber-only insights and news delivered by Barry every two weeks.