Versus Underdog Commercial

Versus: Here’s the thing that makes life so interesting. The theory of evolution claims that only the strong shall survive. Maybe...

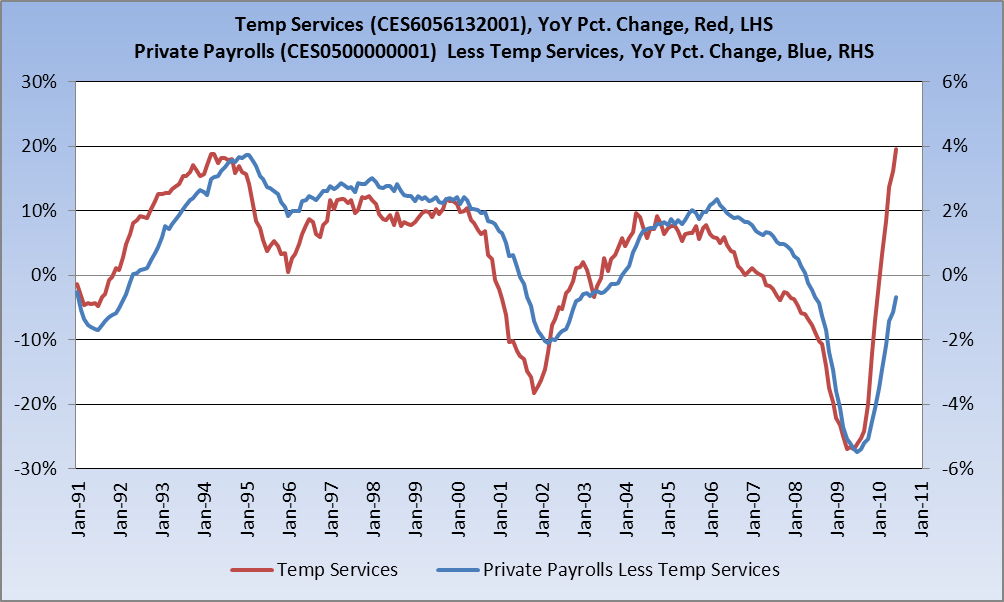

You may recall that last month we picked up on a troubling signpost in the divergence between temporary hiring and private sector...

You may recall that last month we picked up on a troubling signpost in the divergence between temporary hiring and private sector...

The Problem with Pensions August 6, 2010 By John Mauldin August Surprise from Obama? The Problem with Pensions Whither China? Sadly, I...

The Problem with Pensions August 6, 2010 By John Mauldin August Surprise from Obama? The Problem with Pensions Whither China? Sadly, I...

This really struck me as a fascinating piece of science news: A University of Delaware researcher reports that an “ice island” four...

This really struck me as a fascinating piece of science news: A University of Delaware researcher reports that an “ice island” four...

Get subscriber-only insights and news delivered by Barry every two weeks.