> Bloomberg’s chart of the day looks at the S&P500 valuation, based on a price/earnings ratio compiled by Yale University...

> Bloomberg’s chart of the day looks at the S&P500 valuation, based on a price/earnings ratio compiled by Yale University...

Read More

A few weeks ago, I mentioned I took Mrs. BP to the Jack Johnson concert at Madison Square Garden for her B-day (concert was July 14,...

A few weeks ago, I mentioned I took Mrs. BP to the Jack Johnson concert at Madison Square Garden for her B-day (concert was July 14,...

Read More

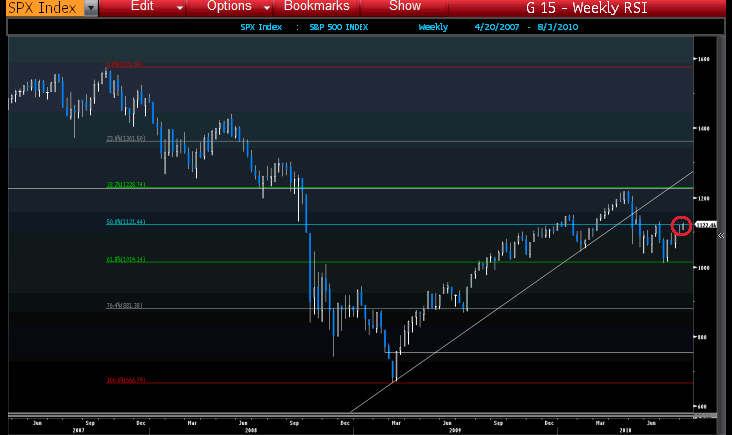

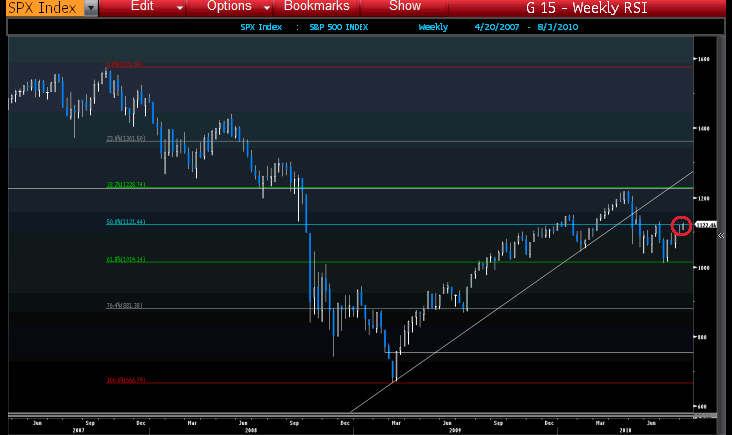

> I was speaking to our head trader earlier this week, and he pointed out that for the 5th time since the market bottomed, we have hit...

> I was speaking to our head trader earlier this week, and he pointed out that for the 5th time since the market bottomed, we have hit...

Read More

After dropping a whopping 30% m/o/m in May after the expiration of the tax credit, Pending Home Sales unexpectedly fell by 2.6% in June...

Read More

The debate over the expiring Bush tax cuts is heating up in Washington, with David Stockman, former Reagan budget director. Mon. Aug. 2...

Read More

Today’s must read MSM piece is a NYT OpEd by Treasury Secretary Tim Geithner, Welcome to the Recovery. I have been critical of...

Read More

The June income and spending data just released was included in Friday’s GDP report but the data relative to the estimate will lead...

Read More

David R. Kotok Chairman and Chief Investment Officer Three Fish Tales August 2, 2010 > Three fish tales fit this weekend’s brief...

Read More

Wikipedia defines the term Business Cycle (or economic cycle) as “economy wide fluctuations in production or economic activity over...

Read More

Whenever a company’s executives get caught doing something stupid/illegal, and are forced to pony up a hefty fine, a hue and cry go...

Read More

> Bloomberg’s chart of the day looks at the S&P500 valuation, based on a price/earnings ratio compiled by Yale University...

> Bloomberg’s chart of the day looks at the S&P500 valuation, based on a price/earnings ratio compiled by Yale University...

> Bloomberg’s chart of the day looks at the S&P500 valuation, based on a price/earnings ratio compiled by Yale University...

> Bloomberg’s chart of the day looks at the S&P500 valuation, based on a price/earnings ratio compiled by Yale University...