The Case-Shiller Index printed this morning, so a bit of chart/table porn is in order. Below is a 20-in-1 look at the Composite 20 (both...

The Case-Shiller Index printed this morning, so a bit of chart/table porn is in order. Below is a 20-in-1 look at the Composite 20 (both...

Read More

The July Consumer Confidence # was a touch below expectations at 50.4 vs 51, down from 54.3 in June and at a 5 week low. Most of the drop...

Read More

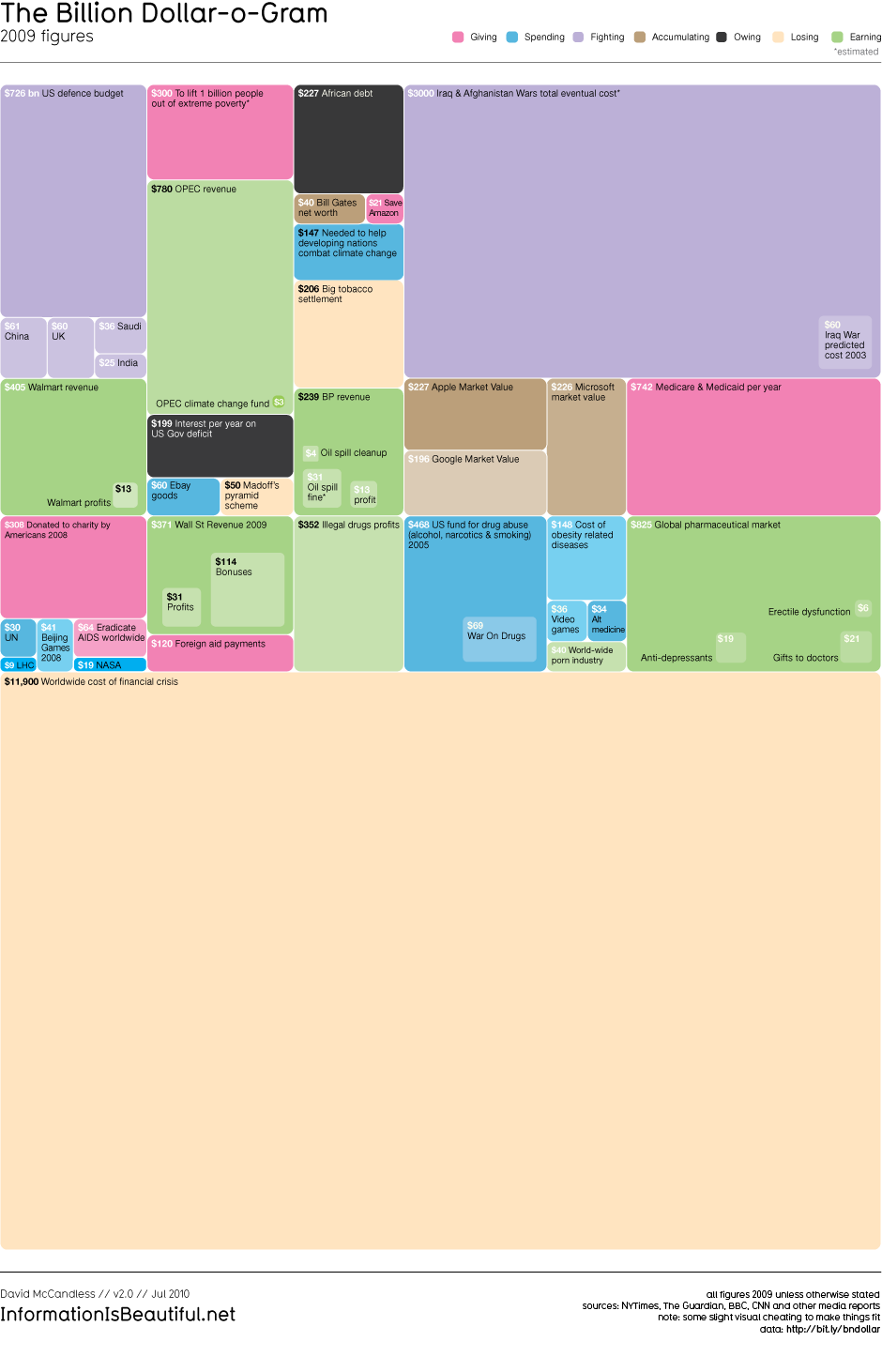

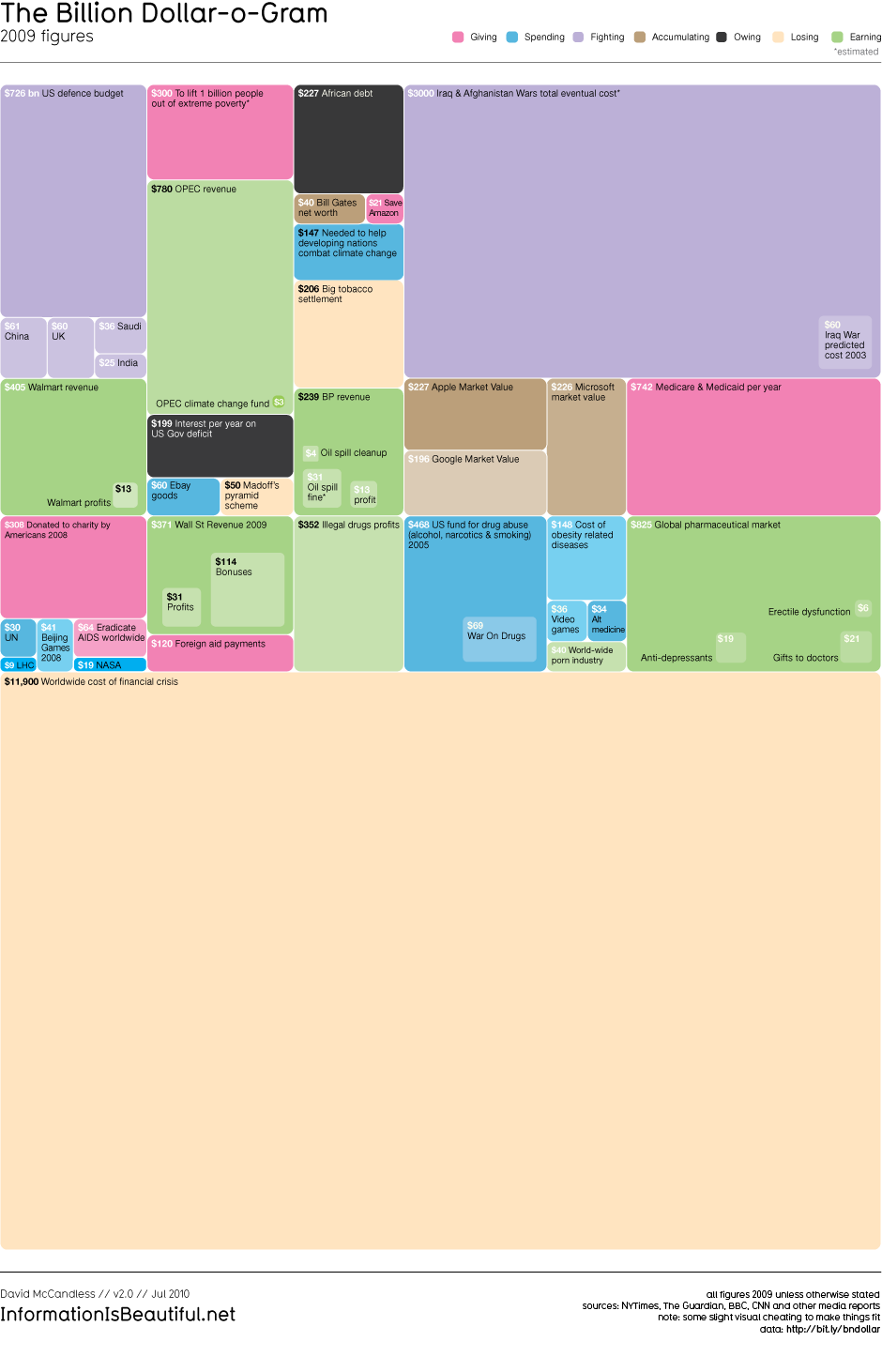

Terrific visualization from Information is Beautiful showing a treemap of different government spending that helps contextualize what $1B...

Terrific visualization from Information is Beautiful showing a treemap of different government spending that helps contextualize what $1B...

Read More

European markets continue to show their comfort with the results of the bank stress test. Spain sold 3 month and 6 month bills at yields...

Read More

We interrupt the George Bush reputation rehabilitation tour for this brief reminder: “For most of the past 70 years, the U.S....

We interrupt the George Bush reputation rehabilitation tour for this brief reminder: “For most of the past 70 years, the U.S....

Read More

This past year or so, I have been in several dozen airports: Austin TX Bangor, ME Boston, MA Chicago Midway, IL Chicago O’Hare, IL...

Read More

Ahhh, good to be back in the saddle after a week away. Quite a few very worthwhile reads crossed my desk today: • Treasuries at Odds...

Read More

The Case-Shiller Index printed this morning, so a bit of chart/table porn is in order. Below is a 20-in-1 look at the Composite 20 (both...

The Case-Shiller Index printed this morning, so a bit of chart/table porn is in order. Below is a 20-in-1 look at the Composite 20 (both...

The Case-Shiller Index printed this morning, so a bit of chart/table porn is in order. Below is a 20-in-1 look at the Composite 20 (both...

The Case-Shiller Index printed this morning, so a bit of chart/table porn is in order. Below is a 20-in-1 look at the Composite 20 (both...