You’ve Got the Love, London

During the final days studying abroad, Alex Silver took 7,757 individual photographs and created this time lapse-video as a tribute to...

Some Thoughts on Deflation July 24, 2010 By John Mauldin Some Thoughts on Deflation The Super-Trend Puzzle The Elements of Deflation...

Some Thoughts on Deflation July 24, 2010 By John Mauldin Some Thoughts on Deflation The Super-Trend Puzzle The Elements of Deflation...

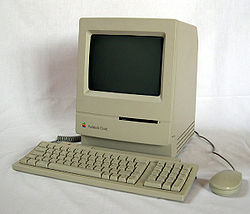

As a long time Apple fanboy going back to my 1990 Mac Classic, I find this brilliant: 1. a creation myth highlighting the...

As a long time Apple fanboy going back to my 1990 Mac Classic, I find this brilliant: 1. a creation myth highlighting the...

Whenever I travel, I always accumulate a list of things to read. Its good for airplane entertainment, and is the reason I will likely get...

Whenever I travel, I always accumulate a list of things to read. Its good for airplane entertainment, and is the reason I will likely get...

Get subscriber-only insights and news delivered by Barry every two weeks.