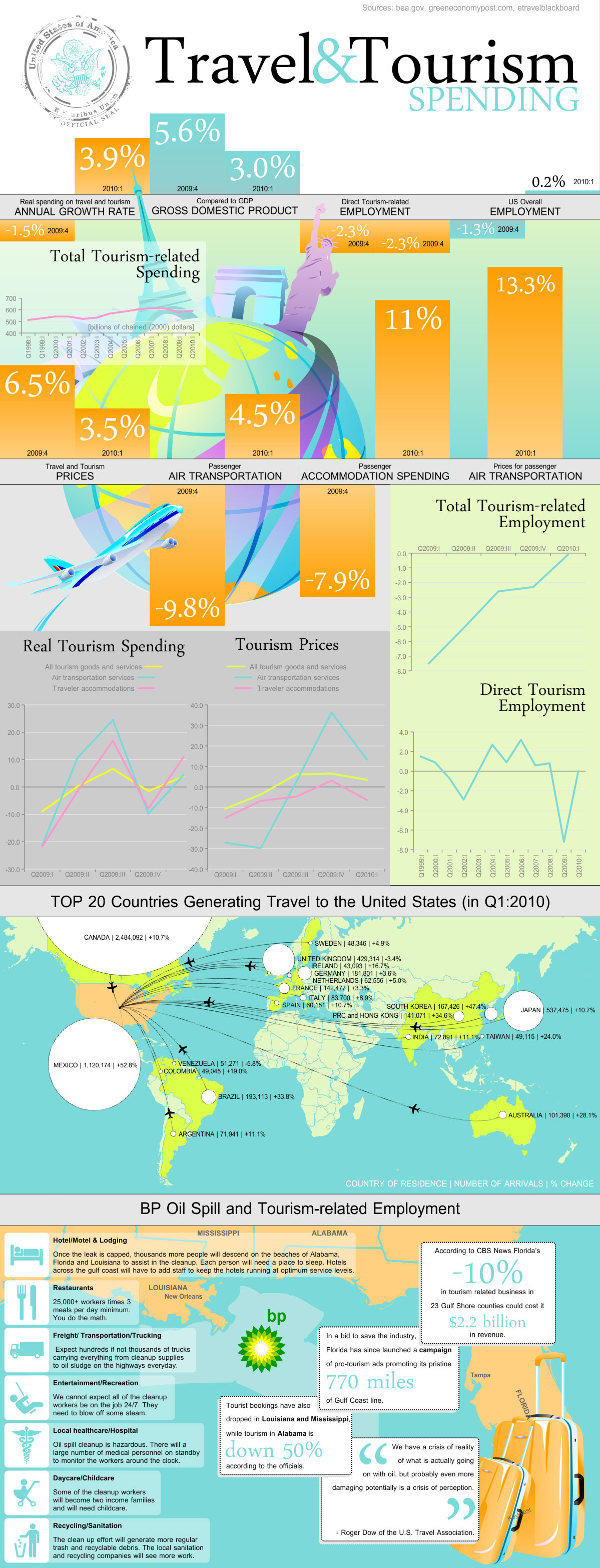

How is this for a comprehensive and colorful graphic? > click for ginormous graphic

How is this for a comprehensive and colorful graphic? > click for ginormous graphic

Floating Point (Tokyo)

Samuel Cockedey’s wicked cool time lapse: floating point from Samuel Cockedey on Vimeo.

GM IPO Coming in October

NYT headline: G.M. Spends $3.5 Billion for Lender to Subprime. The purchase of Americredit is the last step GM needs before it can take...

Taxes and the Stock Market

David R. Kotok Chairman and Chief Investment Officer Taxes and the Stock Market July 22, 2010 > ~~~ If you want less of something, tax...

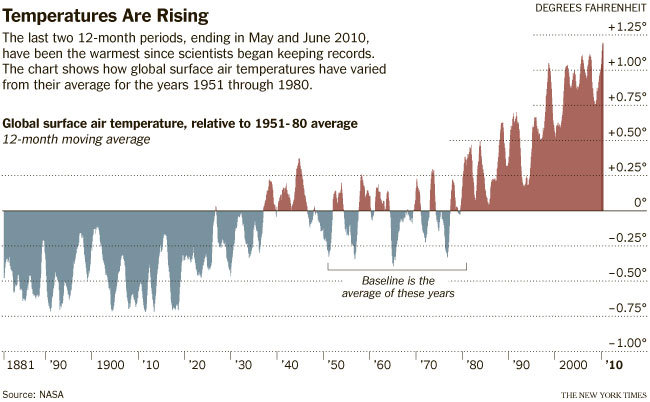

Grantham: Everything You Need to Know About Global Warming in 5...

Jeremy Grantham, who has long had investments in Timber and Natural Resources, puts a surprising smackdown on the Global Warming...

Global Warming Denial, Part 96

> I have been speaking with a number of the other presenters here in private. One of the speakers here claimed that there is no such...

> I have been speaking with a number of the other presenters here in private. One of the speakers here claimed that there is no such...

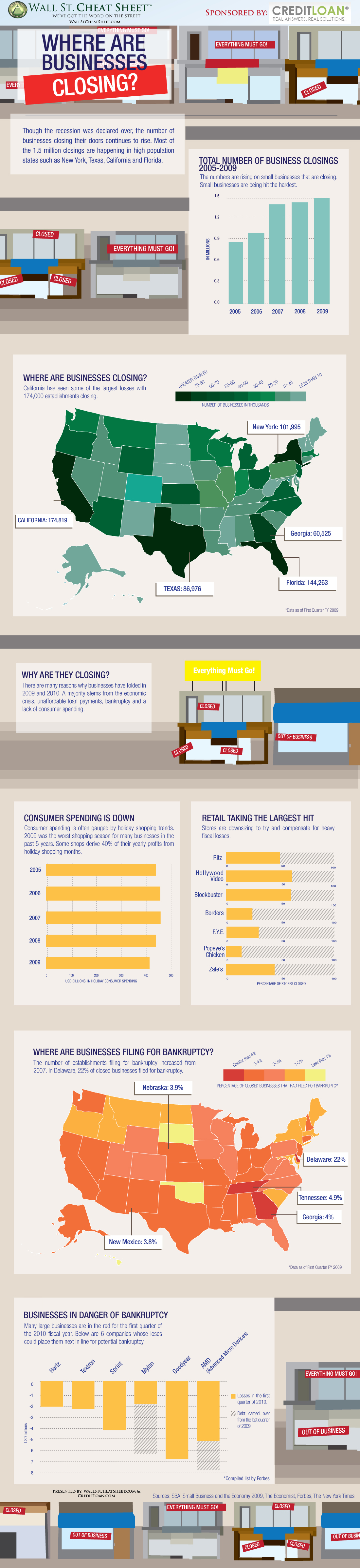

State-by-State Business Closings, Bankruptcies

Wall Street Cheat Sheet shows us where businesses are closing and filing for bankruptcies, on a state by state basis: > click for...

Wall Street Cheat Sheet shows us where businesses are closing and filing for bankruptcies, on a state by state basis: > click for...

Monetary Policy Report to the Congress

Part 1: Overview: Monetary Policy and the Economic Outlook Monetary Policy Report submitted to the Congress on July 21, 2010, pursuant to...

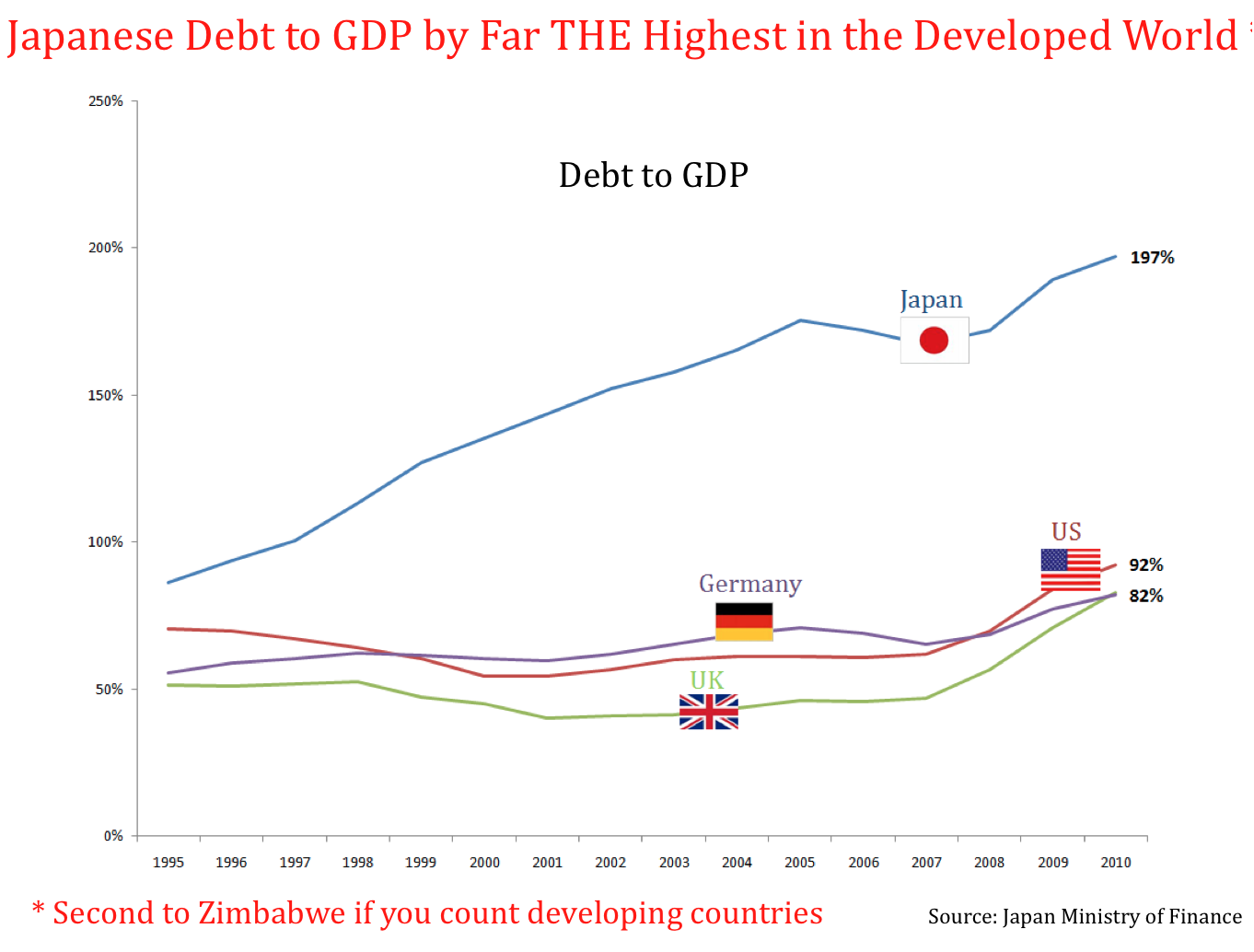

Japan – Past the Point of No Return

Vitaliy Katsenelson presented a very compelling argument that it is not Greece or Spain or Ireland or the USA that is the next major...

Vitaliy Katsenelson presented a very compelling argument that it is not Greece or Spain or Ireland or the USA that is the next major...