I did not show these slides (from The Chart Store) at the conference, as I did not want to get too deeply into a discussion on broken...

I did not show these slides (from The Chart Store) at the conference, as I did not want to get too deeply into a discussion on broken...

Read More

David R. Kotok Chairman and Chief Investment Officer Oil Slickonomics Part 10-Trouble in Muniland July 21, 2010 > Since the BP rig...

Read More

There is no doubt that a primary driver of capital markets, for better or worse, is the human ego. Depending upon which definition of...

Read More

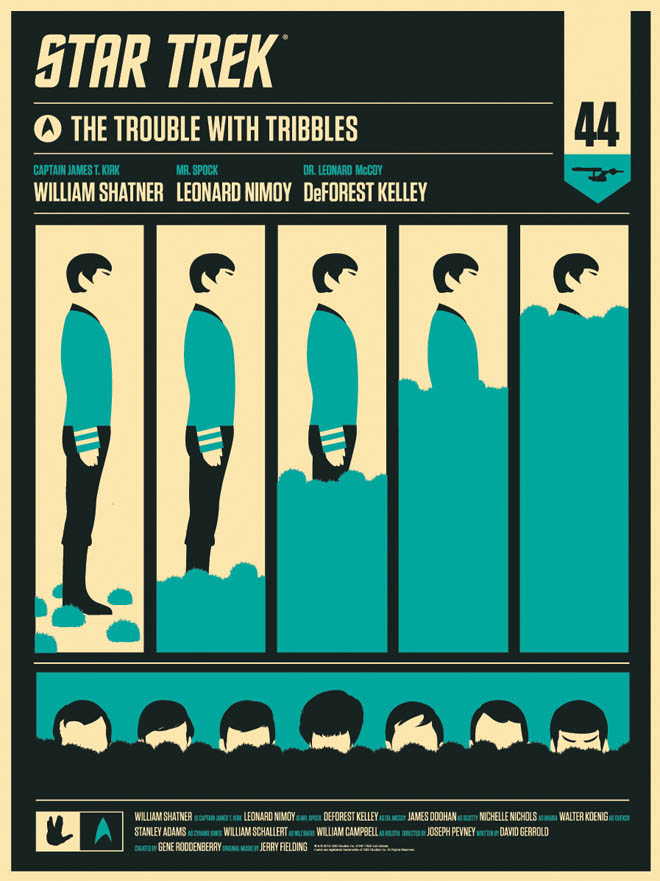

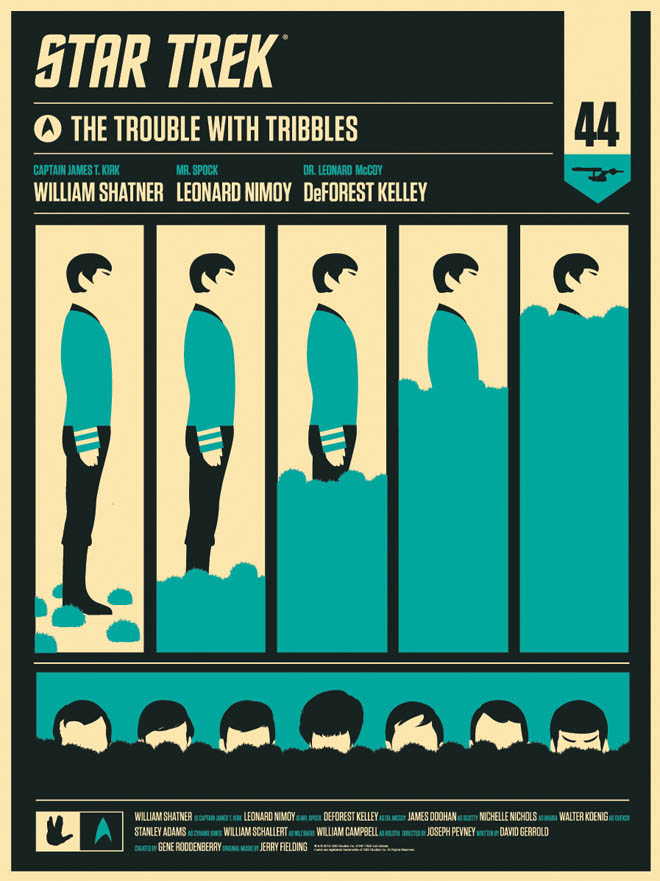

Terrific set of posters from Alamo Drafthouse Cinema in Austin, Texas: The SPock version is below; there is an Uhura version as well....

Terrific set of posters from Alamo Drafthouse Cinema in Austin, Texas: The SPock version is below; there is an Uhura version as well....

Read More

Dan Gross calls out America’s CEOs, noting “the government’s giving them everything they want, yet still they...

Read More

This is the this is the powerpoint that was part of the presentation in Canada. I discussed about half of the slides; the breakout...

Read More

David R. Kotok Chairman and Chief Investment Officer Oil Slickonomics: a bird’s eye view July 16, 2010 > There are only seven...

Read More

Now add big upside in revenue vs estimates with the earnings beat and you have the perfect formula for a higher stock price as seen with...

Read More

This is the powerpoint from the speech I gave Tuesday: Agora Vancouver 2010 Click for PDF

Read More

Whenever I travel, I always seem to find interesting stuff to read that I save for the plane. Here’s the current list of things to...

Read More

I did not show these slides (from The Chart Store) at the conference, as I did not want to get too deeply into a discussion on broken...

I did not show these slides (from The Chart Store) at the conference, as I did not want to get too deeply into a discussion on broken...

I did not show these slides (from The Chart Store) at the conference, as I did not want to get too deeply into a discussion on broken...

I did not show these slides (from The Chart Store) at the conference, as I did not want to get too deeply into a discussion on broken...