Agora Symposium Slideshow

This is the powerpoint from the speech I gave Tuesday: Agora Vancouver 2010 Click for PDF

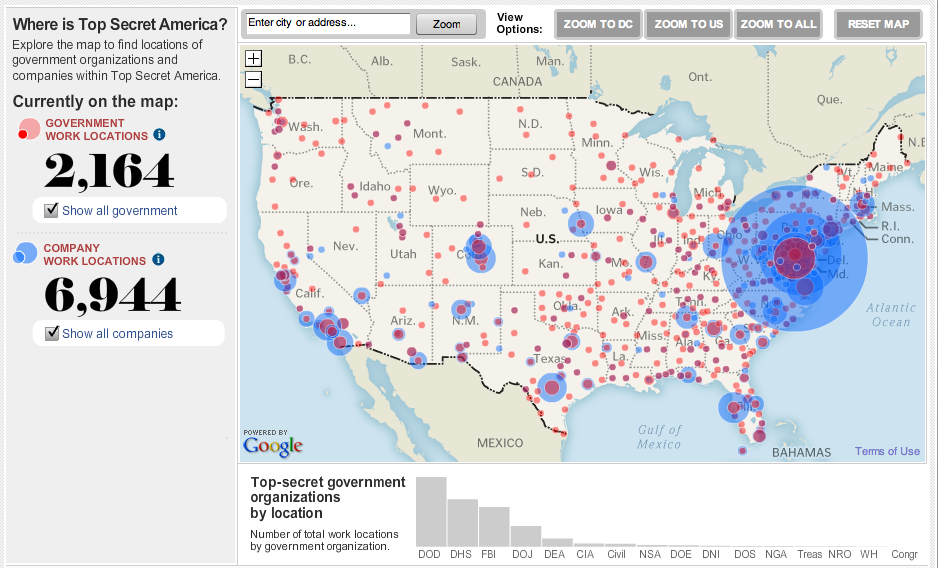

Huge investigative piece in the Washington Post into “A hidden world growing beyond control” — National Security Inc....

Huge investigative piece in the Washington Post into “A hidden world growing beyond control” — National Security Inc....

Get subscriber-only insights and news delivered by Barry every two weeks.