GS Settlement vs FinReg: Which is More Significant?

I’ll be back in a minute, but it dawns on me that the Goldman Sachs settlement may actually be the more important development than...

Way back in April 2004, I discussed why most people make bad coffee (Your Coffee Sucks!). In 2006, I got a Capresso 455...

Way back in April 2004, I discussed why most people make bad coffee (Your Coffee Sucks!). In 2006, I got a Capresso 455...

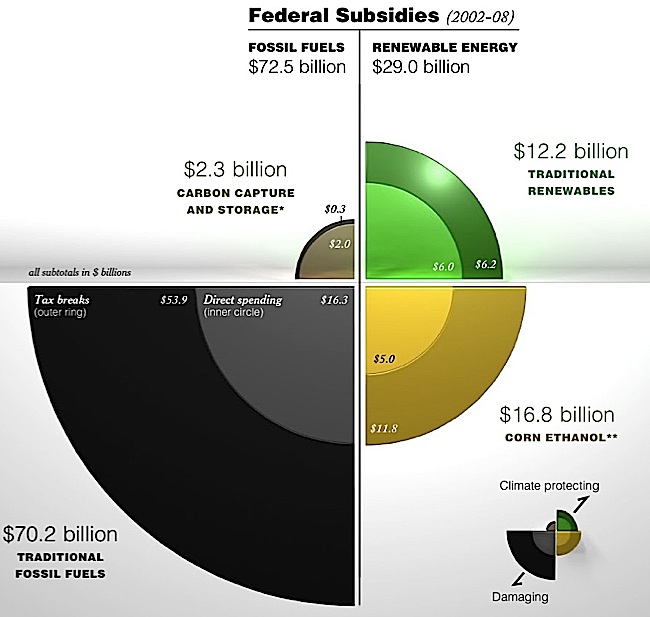

I’m a gearhead. I like the sound a V8 or V12 makes when I mash down my right foot and those pretty butterflies open up. But I am...

I’m a gearhead. I like the sound a V8 or V12 makes when I mash down my right foot and those pretty butterflies open up. But I am...

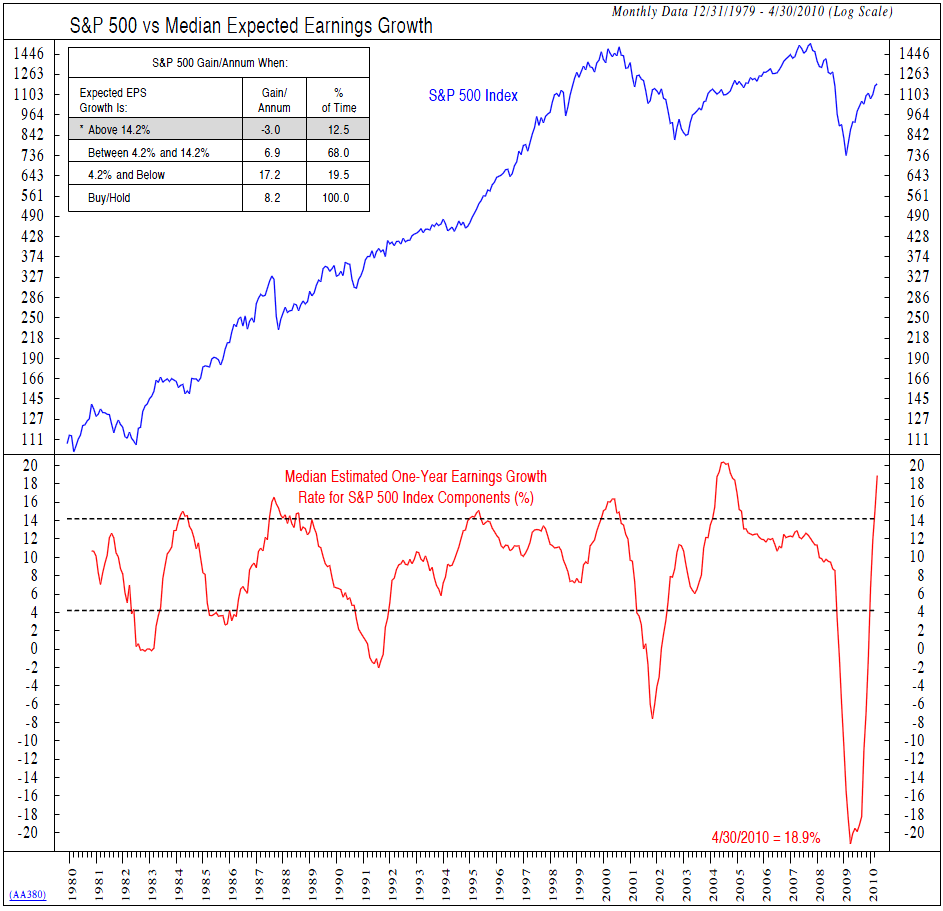

Ned Davis Research looks at the earnings picture heading into this earnings season (Note this is based upon Q1 earnings): > S&P...

Ned Davis Research looks at the earnings picture heading into this earnings season (Note this is based upon Q1 earnings): > S&P...

Get subscriber-only insights and news delivered by Barry every two weeks.