The Creators Project: ART+COM (Joachim Sauter)

Location: Berlin, Germany Profession: Artist, designer, filmmaker, professor Label: ART+COM Website: JoachimSauter.com Notables: Founder...

I want to add to Invictus’ commentary taking Newsweek’s International editor, Fareed Zakaria, to task. There are three facts...

I want to add to Invictus’ commentary taking Newsweek’s International editor, Fareed Zakaria, to task. There are three facts...

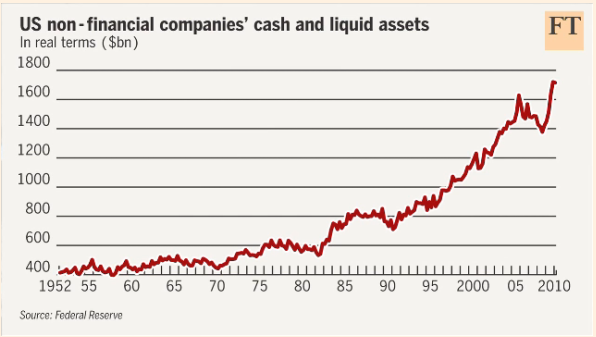

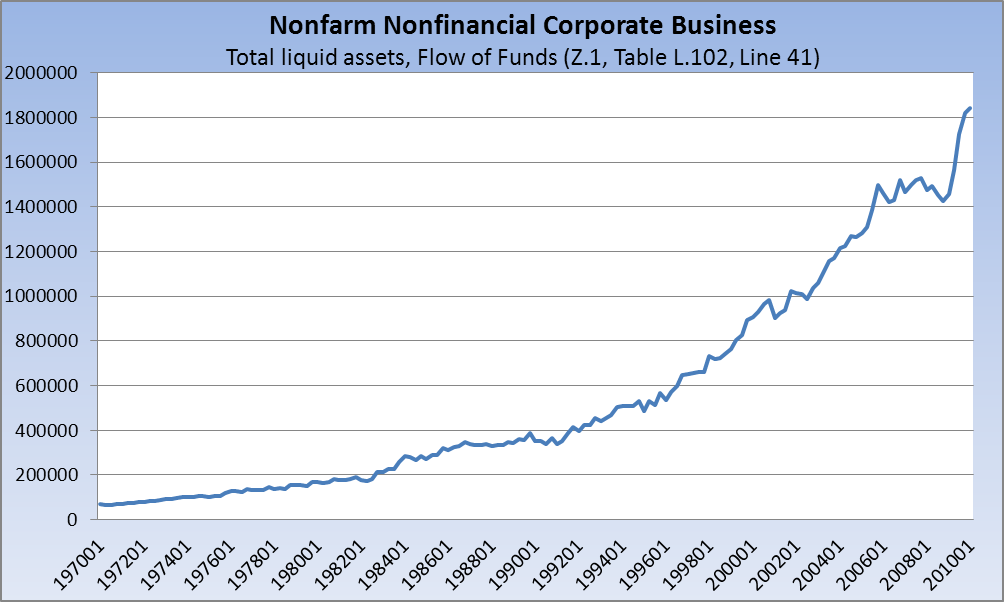

Corporate cash in the US is sitting at a record high of $1,700bn. James Mackintosh, investment editor, explains how both bulls and bears...

Corporate cash in the US is sitting at a record high of $1,700bn. James Mackintosh, investment editor, explains how both bulls and bears...

In his Washington Post column last week, Fareed Zakaria laid out the argument that Obama is anti-business (Obama’s CEO problem...

In his Washington Post column last week, Fareed Zakaria laid out the argument that Obama is anti-business (Obama’s CEO problem...

Most auto enthusiasts are watching Mercedes-Benz for the release of the nearly $200k SLS AMG Gullwing in the fall. However, Automobile...

Most auto enthusiasts are watching Mercedes-Benz for the release of the nearly $200k SLS AMG Gullwing in the fall. However, Automobile...

Get subscriber-only insights and news delivered by Barry every two weeks.